We came across a bullish thesis on ACM Research, Inc. on FluentInQuality’s Substack. In this article, we will summarize the bulls’ thesis on ACMR. ACM Research, Inc.’s share was trading at $33 recently. ACMR’s trailing and forward P/E were 19 and 17 respectively according to Yahoo Finance.

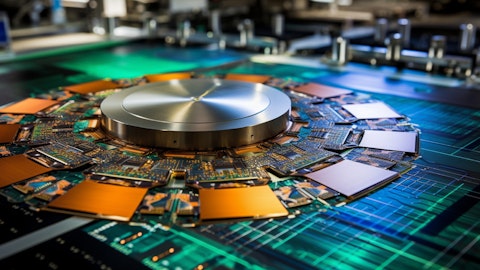

ACM Research, Inc. develops and manufactures advanced wafer-cleaning and surface-preparation equipment critical to semiconductor fabrication. Its proprietary technologies such as Space Alternated Phase Shift (SAPS), Tahoe, and TEBO—enable chipmakers to achieve higher yields, lower defect densities, and tighter process control as geometries shrink and complexity rises. ACM’s single-wafer cleaning tools are deployed across front-end, middle, and back-end steps, including photoresist removal, wet etching, and post-CMP cleaning, directly influencing wafer reliability and performance.

With a modular architecture that allows fast adaptation to new wafer sizes, materials, and device nodes, ACM minimizes customer retooling costs while maintaining high switching barriers. Once qualified in a fab line, its systems typically remain embedded for multiple generations, fostering long-term customer retention and recurring demand. The company’s expanding base across China, Korea, and the U.S. benefits from rising chip complexity, 3D architectures, and advanced packaging trends that increase cleaning intensity per wafer.

ACM’s strong localization in China aligns with the country’s semiconductor self-sufficiency push, while continuous R&D investment extends its reach into adjacent markets like wet bench and electrochemical plating tools. A growing mix of service contracts, spare parts, and upgrades complements new tool shipments, generating stable recurring cash flow.

Its proprietary process control platforms deliver nanoscale uniformity and defect reduction, while unified software architecture ensures consistent qualification across fabs. By combining precision engineering, localized innovation, and capital-efficient scaling, ACM strengthens regional supply chains and sustainability through reduced chemical consumption—serving as an indispensable enabler of the next generation of semiconductor manufacturing.

Previously we covered a bullish thesis on ACM Research, Inc. (ACMR) by thexcapitalist in April 2025, which highlighted its strong revenue growth and China-focused semiconductor positioning. The stock has appreciated approximately by 125.32% since our coverage as the thesis played out with accelerating growth. The thesis still stands as ACMR’s technology edge endures. FluentInQuality shares a similar view but stresses its proprietary platforms and diversification.

ACM Research, Inc. is not on our list of the 30 Most Popular Stocks Among Hedge Funds. As per our database, 33 hedge fund portfolios held ACMR at the end of the second quarter which was 32 in the previous quarter. While we acknowledge the risk and potential of ACMR as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and doing so within a shorter time frame. If you are looking for an AI stock that is more promising than ACMR and that has 10,000% upside potential, check out our report about this cheapest AI stock.

READ NEXT: 30 Stocks That Should Double in 3 Years and 11 Hidden AI Stocks to Buy NOW

Disclosure: None.