Woodford Investment Management is a London-based hedge fund founded in 2016 by Neil Woodford. At the end of the June quarter, Woodford managed a public equity portfolio valued at $2.13 billion. Woodford Investment Management’s 6 long positions in companies which had a market cap of at least $1 billion on June 30 returned 17.36% in the third quarter. We’ll take a look at four of those stocks in this article, AbbVie Inc (NYSE:ABBV), Reynolds American, Inc. (NYSE:RAI), Prothena Corporation PLC (NASDAQ:PRTA), and Alkermes PLC (NASDAQ:ALKS). It should be noted that our calculations may be different from the fund’s actual returns, as they do not factor in changes to positions during the quarter, or positions that don’t get reported on Form 13Fs, like short positions.

Hedge funds on average underperform the market in bull markets because they are hedged. In our rankings, we consider only their long non-microcap positions. This way when we can compare these returns to the returns of the S&P 500 ETFs, which are basically 100% long portfolios of large-cap stocks. Woodford Investment Management is one of 627 funds in our database which returned positive gains in the third quarter.

Now then, let’s find out how Woodford’s important picks performed during the third quarter.

Woodford Investment Management increased its holding in AbbVie Inc (NYSE:ABBV) by 5% in the second quarter, ending the period with a total of 11.66 million shares of the company, which had a net worth of over $721.67 million at that time. The stock returned 2.8% during the third quarter but has dipped slightly in the fourth quarter, as fears about the sector continue to grip investors.

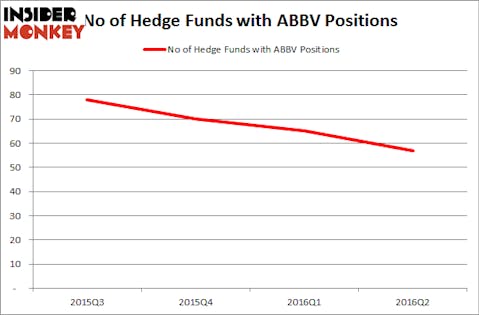

The best stock pickers in our system were also becoming less confident on the company. The number of long hedge fund bets dropped by eight in the second quarter and has fallen by over 20 in the past year. ABBV was in 57 hedge funds’ portfolios at the end of June. There were 65 hedge funds in our database with ABBV positions at the end of the previous quarter. Among these funds, Baker Bros. Advisors held the most valuable stake in AbbVie Inc (NYSE:ABBV), which was worth $889.9 million at the end of the second quarter. On the second spot was Glenview Capital which amassed $771.1 million worth of shares. Moreover, Highfields Capital Management and OrbiMed Advisors were also bullish on AbbVie Inc (NYSE:ABBV).

Follow Abbvie Inc. (NYSE:ABBV)

Follow Abbvie Inc. (NYSE:ABBV)

Receive real-time insider trading and news alerts

Woodford Investment Management slashed its position in Reynolds American, Inc. (NYSE:RAI) by 38% in the second quarter, ending the period with a total of 9.33 million shares of the company with a total value of $502.76 million. The fund’s picks had a strong Q3 despite this particular stock losing 11.8% during the period. However, shares skyrocketed in the middle of October following the company’s latest quarterly results, and are up by over 10% in Q4. The number of bullish hedge fund bets on Reynolds American rose by one during the June quarter to 40. Arrowstreet Capital with a $236.6 million position in the company stands out in our database of investors. Other investors bullish on the company included Wintergreen Advisers, Citadel Investment Group, and Renaissance Technologies.

Follow Reynolds American Inc (NYSE:RAI)

Follow Reynolds American Inc (NYSE:RAI)

Receive real-time insider trading and news alerts

Woodford Investment Management upped its position in Prothena Corporation PLC (NASDAQ:PRTA) by 10% in the June quarter. According to the 13F filing issued by the fund for the June quarter, it had over 10.30 million shares of the company in its portfolio at the end of the second quarter. The total value of the investment was about $360.25 million, and that was set to increase greatly, as the stock returned 71.5% during the third quarter.

At the end of the second quarter, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 13% decline from one quarter earlier. Palo Alto Investors, led by William Leland Edwards, held a $27.6 million position in the stock on June 30. Some other hedge funds and institutional investors that held long positions comprise Jeremy Green’s Redmile Group, Kris Jenner, Gordon Bussard, and Graham McPhail’s Rock Springs Capital Management, and Jerome Pfund and Michael Sjostrom’s Sectoral Asset Management.

Lastly, Woodford Investment Management increased its position in Alkermes PLC (NASDAQ:ALKS) by 5% in the second quarter, ending the period with over 7.53 million shares of the company. The position was valued at $325.68 million at the end of June. The stock returned 8.8% during the third quarter and has done even better in the fourth quarter, topping gains of 20% so far. At the end of the second quarter, a total of 25 of the hedge funds in our system were long Alkermes, a 4% dip from the previous quarter. Trailing Woodford Investment Management was D E Shaw, which amassed a stake valued at $60.6 million. Camber Capital Management, Citadel Investment Group, and Marshall Wace LLP also held valuable positions in the company.

Follow Alkermes Plc. (NASDAQ:ALKS)

Follow Alkermes Plc. (NASDAQ:ALKS)

Receive real-time insider trading and news alerts

Disclosure: None