We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC. The 13F filings show the funds’ and investors’ portfolio positions as of September 30. In this article we look at what those investors think of A. O. Smith Corporation (NYSE:AOS).

Hedge fund interest in A. O. Smith Corporation (NYSE:AOS) shares was flat during the latest quarter. This is usually a negative indicator. At the end of this article we will also compare AOS to other stocks including Broadridge Financial Solutions, Inc. (NYSE:BR), Camden Property Trust (NYSE:CPT), and Alexandria Real Estate Equities Inc (NYSE:ARE) to get a better sense of its popularity.

Follow Smith A O Corp (NYSE:AOS)

Follow Smith A O Corp (NYSE:AOS)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

How are hedge funds trading A. O. Smith Corporation (NYSE:AOS)?

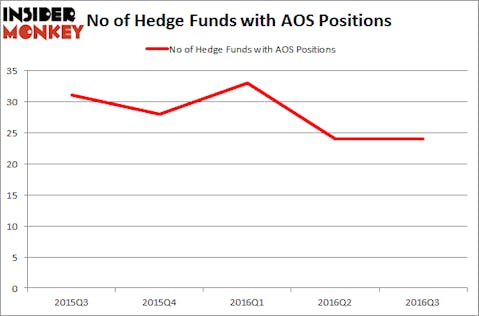

Heading into the fourth quarter of 2016, a total of 24 of the hedge funds tracked by Insider Monkey were long this stock, unchanged from the previous quarter. The flat showing followed a quarter in which hedge fund ownership fell sharply, by nearly 30%. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Cliff Asness’ AQR Capital Management has the biggest position in A. O. Smith Corporation (NYSE:AOS), worth close to $143.1 million. The second largest stake is held by Impax Asset Management, led by Ian Simm, holding a $66.8 million position; the fund has 3.1% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that hold long positions comprise John Overdeck and David Siegel’s Two Sigma Advisors, Bernard Lambilliotte’s Ecofin Ltd and Chuck Royce’s Royce & Associates.