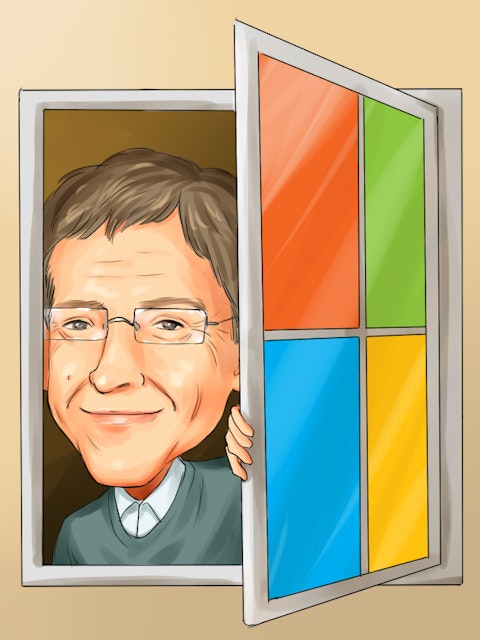

In this article, we will take a look at the 10 Stocks in Bill Gates’ Portfolio That Analysts are Watching.

The Bill & Melinda Gates Foundation Trust, based in Seattle formed by the merging of the Gates Learning Foundation and the William H. Gates Foundation, is considered the largest private foundation in the world. Bill and Melinda have donated an estimated $47.7 billion of their riches to their predecessor and foundation over the last 30 years.

With plans to raise annual distributions to $9 billion the following year, the Bill & Melinda Gates Foundation has set a record $8.74 billion budget for 2025. Notably, Bill Gates has long promised to donate the majority of his fortune to his charitable foundation.

Gates has now established a deadline for allocating his wealth: the Gates Foundation will cease operations down on December 31, 2045. Depending on variables like inflation and market performance, the Microsoft founder predicts the Foundation will be able to distribute an additional $200 billion between now and 2045.

As of the second quarter of 2025, the Bill & Melinda Gates Foundation Trust boasts about $47.78 billion in stock portfolio value. The growth and dividends earned from these investments will aid in funding future philanthropic efforts.

Our Methodology

For this list, we picked stocks from Bill & Melinda Gates Foundation Trust’s 13F portfolio as of the end of the second quarter of 2025 that analysts are keeping tabs on. These equities are also popular among elite hedge funds.

We have added the performance of each stock from the end of Q2 2025 to October 29, providing readers with insight into how the Bill & Melinda Gates Foundation Trust’s portfolio picks have played out so far.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 427.7% since May 2014, beating its benchmark by 264 percentage points (see more details here).

9 Stocks in Bill Gates’ Portfolio That Analysts are Watching

9. Crown Castle Inc. (NYSE:CCI)

Share Price Return Between July 1 and November 7: -13.67%

Bill & Melinda Gates Foundation Trust’s Q2 Stake Value: $145.8 million

Analyst Upside: 28.33%

Number of Hedge Fund Holders: 49

Crown Castle Inc. (NYSE:CCI) ranks among the stocks in Bill Gates’ portfolio that analysts are watching. Following the third-quarter 2025 results for Crown Castle Inc. (NYSE:CCI), KeyBanc reaffirmed its Overweight rating and $120 price target on the company’s shares on October 23. Crown Castle Inc. (NYSE:CCI) delivered better-than-expected results across all key measures in the quarter, leading to the company improving its expectations for site leasing, services, adjusted EBITDA, and AFFO per share.

Crown Castle Inc. (NYSE:CCI) reported $1.07 billion in revenue for the quarter, a 35.1% decrease from the same period a year earlier. Meanwhile, EPS reached $1.12, up from $0.70 in the same period last year. With the exception of Sprint Cancellations, the company announced a 5.2% organic increase in site rental billings and placed an emphasis on becoming the largest U.S. tower operator following the sale of its Fiber Business.

According to KeyBanc, Crown Castle Inc. (NYSE:CCI) is the “best positioned among Towers given its pure U.S. Tower exposure, cost takeout opportunity, and capital return.” Crown Castle Inc. (NYSE:CCI) is expected to achieve mid-20% AFFO per share growth in the first year following the completion of its fiber sale, with high single-digit to low double-digit expansion afterward.

Crown Castle Inc. (NYSE:CCI) is a major player in the real estate investment trust (REIT) sector, with a sizable portfolio that comprises over 40,000 cell towers.