In relation to its investors, previously, the performance of Yahoo! Inc. (NASDAQ:YHOO)’s stock price has been up and down. Let’s take a look at 5 things Yahoo investors need to know.

1. Content vs Technology

Yahoo has always been known for its media content and has long kept its main page full of interesting content. But ever since the advent of riveting mobile apps, it has staggered along with other media giants like Google Inc (NASDAQ:GOOG) and Microsoft Corporation (NASDAQ:MSFT) to cultivate technology that is clever in synchronizing itself with mobile technology.

Therefore, Yahoo! Inc. (NASDAQ:YHOO) has shifted its focus towards hiring engineers through its acquisitions in order to get talent equal to creating a boom for Yahoo in smart apps and mobile advertisements. If the new talent can generate value for Yahoo, its investors will be more than pleased to be a part of a pioneer in driving mobile technology to new levels. Moreover, Yahoo will also need to keep its core business of display advertising running to avoid further meltdown that is clearly apparent; its revenue in 2010 was $6.4 billion and registered a 21.1% drop in 2012 to $4.9 billion.

What else should Yahoo! Inc. (NASDAQ:YHOO) investors watch?

2. Revenue Estimates

Speaking about revenue; analysts were less cheery when Yahoo! Inc. (NASDAQ:YHOO) reported Q2 revenue below expected revenue estimates. Its revenue has been experiencing a downward trend since 2011, but only because Yahoo signed a Search agreement with Microsoft Corporation (NASDAQ:MSFT) and has been reporting revenue differently, as it shares its revenues with Microsoft in evolving markets.

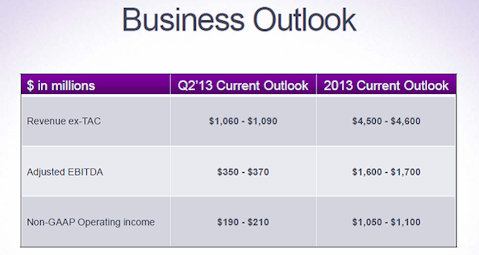

With revenue in 2011 and 2012 trailing the numbers reported in 2010, Yahoo has yet to amaze its investors after spending its money in buying an unprofitable Tumblr and trimming its stake in the Alibaba Group. Meanwhile, although Yahoo has enhanced its display ad technology and format, it is too early to say if expected revenue of $4.45 billion will be met this year.

3. Mobile Market

Creating a breakthrough in the mobile segment has not only been the strategy of Yahoo but also of Facebook and Google Inc (NASDAQ:GOOG). While Facebook is ahead of Google and Yahoo, Yahoo has not stayed behind and has currently created a photo app for iPhone users and an email app designed for smartphones. Yahoo! Inc. (NASDAQ:YHOO) plans on making around 15 apps targeted for mobile only. While Yahoo’s dedicated vision and mission to enter mobile segment is transparent, one wonders if Yahoo will bring its focus back to its Ad revenues. Yahoo’s Search segment can prove to be a growth segment along with Video and Display advertising. Merging these four segments with mobile could also bring an increase in earnings with the focus obviously on advertisements.

4. Marissa Mayer

A former employee of Google, Mayer emerged in the topmost position at Yahoo when Yahoo’s board of directors chose someone from outside its fraternity as a CEO. Marissa Mayer might have bought all those startups and given everyone free iPhones at her office to bring her to the limelight, but she would have to do a lot more than that to generate revenues for Yahoo.

Before Mayer stepped in as CEO, other executives were also on the road to bringing Yahoo! Inc. (NASDAQ:YHOO) at the forefront of mobile technology, but failed to implement, due to the short amount of time allotted to them.

5. Mergers and Acquisitions

When Yahoo purchased 17 startups, many began to wonder if there really is a strategy being employed here. The most widely discussed acquisition by Yahoo was that of Tumblr, a blogging service, which will be providing one billion users to Yahoo and not to mention a lot of traffic. This will not only help in generating ad revenues but will also, as Yahoo hopes, provide a social media that Yahoo has been missing.

However, by overpaying for a company that has only generated $13 million in revenue in 2012, Yahoo expects to generate revenue by placing advertisements in different blogs that Tumblr operates.

Disclosure: none