VirnetX Holding Corporation (NYSEMKT:VHC)

At the end of the third quarter, just 4 hedge funds that we track were long VirnetX Holding Corporation (NYSEMKT:VHC), down from 5 funds a quarter earlier. Those 4 funds held shares of the company worth a mere $714,000 on September 30, amounting to a miniscule 0.40% of the float. In contrast, 14.63 million shares of VirnetX Holding Corporation (NYSEMKT:VHC), or 30.1% of its float, are being shorted as of November 15. The stock continues to defy the shorts however, and is up by over 26% year-to-date. The company said in October that a Texas court awarded it $302.4 million after winning its case against Apple Inc. (NASDAQ:AAPL) for infringing on four of its patents. D E Shaw is a notable stakeholder of VirnetX, owning 102,925 of its shares.

Follow Virnetx Holding Corp (NYSE:VHC)

Follow Virnetx Holding Corp (NYSE:VHC)

Receive real-time insider trading and news alerts

Stage Stores Inc (NYSE:SSI)

Stage Stores Inc (NYSE:SSI) is another stock with languishing hedge fund sentiment, as a total of just 5 funds in our database were bullish on the Texas-based department store operator at the end of September, though this was up from only 3 funds a quarter earlier. Nonetheless, those 5 funds owned just 0.20% of the company’s float. Meanwhile, 26% of the company’s float is being short as of November 15, equaling 6.53 million Stage Stores Inc (NYSE:SSI) shares. The stock has lost over 50% year-to-date. Last week, investment firm Northcoast Research lowered its rating for Stage Stores (NYSE:SSI) to ‘Sell’ from ‘Neutral’. As of the end of the third quarter, Mark Coe’s Coe Capital Management owns 242,025 shares of the company.

Follow Stage Stores Inc (NYSE:SSI)

Follow Stage Stores Inc (NYSE:SSI)

Receive real-time insider trading and news alerts

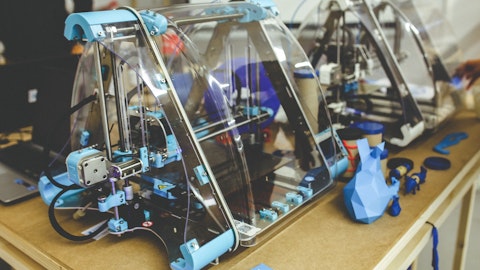

3D Systems Corporation (NYSE:DDD)

As of the end of the third quarter, 12 hedge funds tracked by Insider Monkey were long 3D Systems Corporation (NYSE:DDD), compared to 11 funds a quarter earlier. These funds owned about 2.8% of the company’s float, compared to 25.7% of the company’s stock being shorted. In the third quarter, 3D Systems earned $0.14 a share on $156.36 million revenue, above the forecasts of $0.09 per share in earnings, but missing the expected $160.16 million in revenue. The stock has gained over 73% year-to-date. Jim Simons’ Renaissance Technologies had amassed 1.19 million shares of 3D Systems Corporation (NYSE:DDD) as of the end of the third quarter.

Follow 3D Systems Corp (NYSE:DDD)

Follow 3D Systems Corp (NYSE:DDD)

Receive real-time insider trading and news alerts

Disclosure: None