#3 Baker Hughes Incorporated (NYSE:BHI)

– Number of Billionaire Shareholders at the End of September: 5

– Change From the Number of Billionaire Shareholders at the End of June: -5

Although a net total of 5 billionaires sold out of Baker Hughes Incorporated (NYSE:BHI) in the third quarter, shares of the oil service giant have continued to rally. In spite of the fact that its previous merger with Halliburton was nixed, shares of Baker Hughes have surged by 34.68% year-to-date, aided by the recent General Electric Company (NYSE:GE) deal to merge the conglomerate’s oil and gas segment with Baker Hughes. GE’s management expects the deal to yield $100 million in revenue synergies and $600 million in cost synergies. Shares of Baker Hughes could have additional upside if OPEC irons out a meaningful and specific production cut at the end of this month.

Follow Baker Hughes A Ge Co Llc (NYSE:BHI)

Follow Baker Hughes A Ge Co Llc (NYSE:BHI)

Receive real-time insider trading and news alerts

#2 AmerisourceBergen Corp. (NYSE:ABC)

– Number of Billionaire Shareholders at the End of September: 5

– Change From the Number of Billionaire Shareholders at the End of June: -5

According to our data, 5 billionaires owned stakes in AmerisourceBergen Corp. (NYSE:ABC) on September 30, down by five from June 30. Some billionaires may have sold due to the perception that Hillary Clinton was likely to win the election. If Clinton had won, there would likely have been more regulatory scrutiny concerning drug prices, which would have been a negative for AmerisourceBergen. Seeing as Donald Trump won instead, analysts have become more optimistic on the stock. Ricky Goldwasser of Morgan Stanley has an ‘Overweight’ rating and $89 price target on it, citing increased confidence in the company’s earnings stream given the Republican victories in both the legislative and executive branches.

Follow Cencora Inc. (NYSE:COR)

Follow Cencora Inc. (NYSE:COR)

Receive real-time insider trading and news alerts

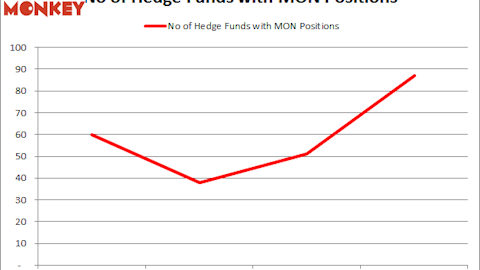

#1 Monsanto Company (NYSE:MON)

– Number of Billionaire Shareholders at the End of September: 10

– Change From the Number of Billionaire Shareholders at the End of June: -6

In terms of the net number of billionaire shareholders leaving the stock in Q3, Monsanto Company (NYSE:MON) takes the cake. Six billionaire fund managers, including Bruce Kovner of Caxton Associates, exited out of Monsanto from June 30 to September 30, leaving just 10 billionaires holding down the fort. Although Bayer agreed to buy Monsanto for $128 in cash per share, Monsanto trades for $26 per share less due to regulatory uncertainty. Given the overlap between the two companies, there is a significant probability that the deal won’t get the regulatory thumbs up that it needs.

Follow Monsanto Co W (NASDAQ:MON)

Follow Monsanto Co W (NASDAQ:MON)

Receive real-time insider trading and news alerts

Disclosure: None