4. Intel Corporation (NASDAQ:INTC)

Millennium Management’s Stake Value: $110 million

Percentage of Millennium Management’s 13F Portfolio: 0.05%

Number of Hedge Fund Holders: 74

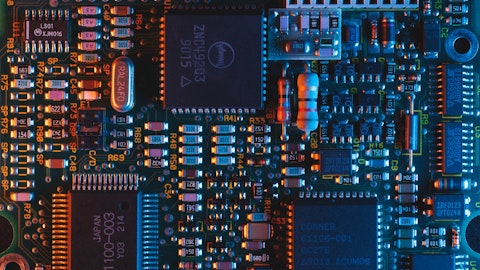

Intel Corporation (NASDAQ:INTC) is widely heralded as the pioneer of the modern day microprocessor. The company became one of the first in the world to develop and sell what would become today’s integrated circuit processor. Over the years, Intel Corporation (NASDAQ:INTC) has successfully reduced its transistor sizes and improved performance.

Intel Corporation (NASDAQ:INTC) reported $19.5 billion in revenue and $1.09 in non-GAAP EPS for its fiscal Q4, beating analyst estimates for both. The company is currently racing to mass produce chips based on the latest manufacturing processes through its facilities located in the United States.

Mr. Englander’s hedge fund owned 2.1 million Intel Corporation (NASDAQ:INTC) shares during Q4 2021, in a $110 million stake which made up 0.05% of its investment portfolio. 74 of the 924 hedge funds polled by Insider Monkey during the same time period also held the company’s shares.

Seth Klarman’s Baupost Group is Intel Corporation (NASDAQ:INTC)’s largest investor according to Insider Monkey’s research. It owns 18 million shares for a $928 million stake.

Third Point Management mentioned Intel Corporation (NASDAQ:INTC) in its fourth quarter 2021 investor letter. Here is what the fund said:

“2021 was a highly productive year for Intel‘s new CEO, Pat Gelsinger. Despite the stock’s tepid results, we see a compelling, underappreciated fundamental story. Intel’s “brain drain” – a key part of our thesis when we first sought to help the company confront its long-time underperformance – appears to be reversing. Since joining Intel, Mr. Gelsinger has not only brought back prominent Intel former employees but has also attracted talents from competitors such as Advanced Micro Devices, Inc. (NASDAQ:AMD), Nvidia, Apple, and, most recently, Micron’s stellar Chief Financial Officer, David Zinsner.

We are encouraged by Intel Corporation (NASDAQ:INTC)’s aggressive investment plan, including a recently announced fabrication plant in Ohio and acquisition of Tower Semiconductors. We knew from the start that Intel’s turnaround would be complex and lengthy, and we have been pleased to see Mr. Gelsinger sacrifice near-term earnings for long-term growth.

Finally, after a series of blunders across its PC and Server product lines, Intel is finally receiving good reviews for one of its upcoming processors: Alder Lake. Tom’s Hardware, a preeminent hardware publication, called Alder Lake “a cataclysmic shift in Intel Corporation (NASDAQ:INTC)’s battle against AMD’s potent Ryzen 5000 chips.” While this is just one product across a broad lineup, and given it will take time to achieve leadership across them all, we are encouraged by these tangible signs of progress under Mr. Gelsinger’s leadership. With talent returning, an improving product suite, and a willingness to invest for growth, we believe Intel’s prospects have turned the corner. We expect that the company’s upcoming analyst day will be an ideal time for Mr. Gelsinger to articulate the progress he has made and begin to reset expectations for the company.”