In this article, we will take a look at the 5 most undervalued biotech stocks to buy according to hedge funds. To see more such companies, go directly to 11 Most Undervalued Biotech Stocks To Buy According To Hedge Funds.

5. iTeos Therapeutics, Inc. (NASDAQ:ITOS)

Number of Hedge Fund Holders: 20

PE Ratio as of February 8: 3.09

iTeos Therapeutics, Inc. (NASDAQ:ITOS) is a Massachusetts-based clinical-stage biopharmaceutical company involved in the development of immuno-oncology therapeutics for patients. iTeos Therapeutics, Inc. (NASDAQ:ITOS) has a PE ratio of 3.09 as of February 8. In November, iTeos Therapeutics, Inc. (NASDAQ:ITOS) posted its third-quarter results. GAAP EPS in the quarter came in at $0.03, while cash and cash equivalents came in at $752.2 million as of the end of the third quarter.

As of the end of the third quarter of 2022, 20 hedge funds tracked by Insider Monkey reported owning stakes in iTeos Therapeutics, Inc. (NASDAQ:ITOS). The net worth of these stakes was Peter Kolchinsky’s RA Capital Management, with an $84 million stake.

4. Dynavax Technologies Corporation (NASDAQ:DVAX)

Number of Hedge Fund Holders: 22

PE Ratio as of February 8: 5.78

California-based Dynavax Technologies Corporation (NASDAQ:DVAX) ranks 4th in our list of the most undervalued biotech stocks to buy according to hedge funds. Insider Monkey’s database shows that 22 hedge funds had stakes in Dynavax Technologies Corporation (NASDAQ:DVAX) at the end of the third quarter of last year, up from 18 hedge funds at the conclusion of the second quarter of the same year. This shows hedge fund sentiment around Dynavax Technologies Corporation (NASDAQ:DVAX) is positive. The biggest stakeholder of Dynavax Technologies Corporation (NASDAQ:DVAX) as of the end of the third quarter of 2022 was Ken Fisher’s Fisher Asset Management which owns a $44 million stake in the firm.

3. Immatics N.V. (NASDAQ:IMTX)

Number of Hedge Fund Holders: 25

PE Ratio as of February 8: 14.81

Immatics N.V. (NASDAQ:IMTX) is a German biotech company focused on the discovery and development of T cell receptor (TCR) based immunotherapies for the treatment of cancer. A total of 25 hedge funds among the 920 funds tracked by Insider Monkey reported owning stakes in Immatics N.V. (NASDAQ:IMTX) at the end of the third quarter of 2022. The net worth of these stakes was $172 million. The biggest stakeholder of Immatics N.V. (NASDAQ:IMTX) during this period was Julian Baker and Felix Baker’s Baker Bros. Advisors which owns a $44 million stake in the company.

In the third quarter, Immatics N.V. (NASDAQ:IMTX)’ revenue jumped a whopping 133% on a YoY basis. In October 2022, Immatics N.V. (NASDAQ:IMTX) shares jumped after the company posted upbeat data for Phase 1 study of its IMA203 as a potential cancer treatment.

2. AbCellera Biologics Inc. (NASDAQ:ABCL)

Number of Hedge Fund Holders: 26

PE Ratio as of February 8: 13.52

AbCellera Biologics Inc. (NASDAQ:ABCL) is a Canadian biotech company that operates in the domain of human antibodies. AbCellera Biologics Inc. (NASDAQ:ABCL) has a PE ratio of 13.52 as of February 8. In December, AbCellera Biologics Inc. (NASDAQ:ABCL) rose after the company said it entered into a partnership with AbbVie (NYSE:ABBV) to discover antibody therapies. AbCellera Biologics Inc. (NASDAQ:ABCL)’s antibody discovery and development platform will be used to deliver optimized development candidates for up to five targets selected by AbbVie across multiple indications, according to the agreement.

Julian Baker and Felix Baker’s Baker Bros. Advisors was the biggest hedge fund stakeholder of AbCellera Biologics Inc. (NASDAQ:ABCL) at the end of the September quarter. The fund reported owning over 10 million shares of AbCellera Biologics Inc. (NASDAQ:ABCL), which had a net worth of about $103 million.

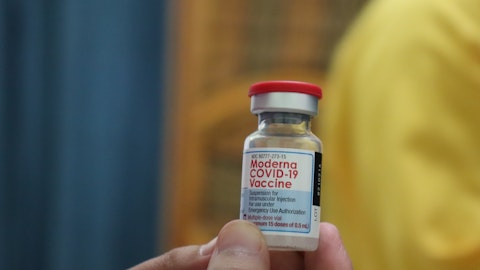

1. Moderna, Inc. (NASDAQ:MRNA)

Number of Hedge Fund Holders: 44

PE Ratio as of February 8: 6.19

Moderna, Inc. (NASDAQ:MRNA) is one of the most undervalued biotech stocks to buy according to hedge funds. Moderna, Inc. (NASDAQ:MRNA)’s PE ratio stands at about 6.19 as of February 8. Recently, the FDA gave Breakthrough Therapy Designation for Moderna, Inc. (NASDAQ:MRNA)’s mRNA vaccine candidate for seasonal pathogen respiratory syncytial virus (RSV). FDA’s decision was based on initial data from Moderna, Inc. (NASDAQ:MRNA)’s ConquerRSV Phase 3 pivotal trial.

Hedge fund sentiment for Moderna, Inc. (NASDAQ:MRNA) is strong. As of the end of the third quarter of 2022, 44 hedge funds reported owning stakes in Moderna, Inc. (NASDAQ:MRNA), according to Insider Monkey’s database of 920 funds. The net worth of these stakes was about $2 billion.

Baron Funds made the following comment about Moderna, Inc. (NASDAQ:MRNA) in its Q4 2022 investor letter:

“We added to our position in Moderna, Inc. (NASDAQ:MRNA), a market leader in medicines made of messenger RNA (mRNA). We think Moderna has a competitively advantaged platform that allows the company to develop medicines and manufacture them at scale more rapidly than other classes of medicines. We believe that as COVID transitions to an endemic phase, annual COVID booster volumes could approximate flu vaccine volumes over time. The worldwide annual flu vaccine market consists of 500 million to 600 million vaccine doses. Assuming COVID boosters are combined with flu and RSV vaccines in one shot, and depending upon assumptions for vaccine pricing and market share, we think the annual recurring revenue opportunity for respiratory vaccines is at least $5 billion to $10 billion. Beyond this base business, Moderna has a large pipeline of development programs, including vaccines against latent viruses (such as CMV, EBV, and HIV), and medicines for cancer and rare diseases. Just recently, Moderna announced that its personalized cancer vaccine in combination with Merck’s Keytruda demonstrated a statistically significant and clinically meaningful reduction in the risk of disease recurrency or death compared to Keytruda monotherapy in stage III/IV melanoma patients with high risk of recurrence following complete resection. These results are the first demonstration of efficacy for an investigational mRNA cancer treatment in a randomized clinical trial. Additionally, Moderna has roughly $18 billion of cash on its balance sheet as of December 31, 2022.”

You can also take a peek at 15 Countries that Export the Most Beef and 12 Biggest Industrial Software Companies in the World.