In this article we discuss the 5 best spring stocks to buy now. If you want to read our detailed analysis of these companies, go directly to the 10 Best Spring Stocks to Buy Now.

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best hydrogen fuel cell stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. Keeping this in mind, let’s take a look at the best spring stocks to buy now:

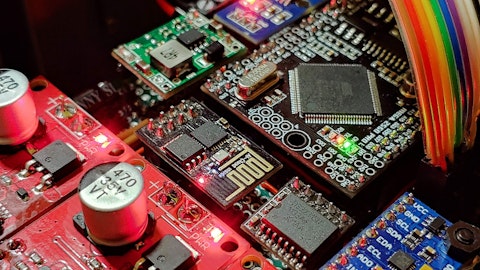

5. NXP Semiconductors N.V. (NASDAQ: NXPI)

Number of Hedge Fund Holders: 53

NXP Semiconductors N.V. (NASDAQ: NXPI) is a Netherlands-based company that makes and sells several semiconductor products. It was founded in 1953 and is placed fifth on our list of 10 best spring stocks to buy now. The company’s shares have returned more than 77% to investors over the course of the past year. NXP is one of the leading semiconductor manufacturers in the world and is uniquely poised to take advantage of a semiconductor shortage in the market in recent months that has increased chip prices drastically.

NXP Semiconductors N.V. (NASDAQ: NXPI) is a good option for income investors as the firm pays a regular and sizable dividend. On May 27, the firm declared a quarterly dividend of $0.5625 per share, in line with previous. The forward yield was 1.07%.

Out of the hedge funds being tracked by Insider Monkey, Washington-based investment firm Fisher Asset Management is a leading shareholder in NXP Semiconductors N.V. (NASDAQ: NXPI) with 1 million shares worth more than $211 million.

In its Q1 2021 investor letter, Alger, an asset management firm, highlighted a few stocks and NXP Semiconductors N.V. (NASDAQ: NXPI) was one of them. Here is what the fund said:

“NXP Semi conductors was among the top contributors to performance during the quarter. NXP Semiconductors provides high performance semiconductor solutions for a wide variety of applications, including automotive, mobile communications, consumer technology, computing, wireless infrastructure, lighting and industry. We believe NXP has an attractive cyclical tailwind with the economic reopening due to its exposure to the automotive industry and the growth of the Internet of Things. NXP’s shares performed strongly after the company said it has generated revenue growth and provided healthy forward guidance driven by an improving global macro that is evident in decreasing channel inventory levels and solid pricing.”