Thanks to an astounding growth that prompted nearly a dozen 2-for-1 splits between 1971 and 1999, your 10 shares would have gradually multiplied into 20,480 shares. With each share now worth about $75, you’d now be sitting on more than $1.5 million — not a bad return on the $165 you’d have shelled out originally.

Investors who bought in more recently have been well-rewarded, too. The stock has delivered annualized returns of 16.1% during the past three years and 12.5% for the past five years.

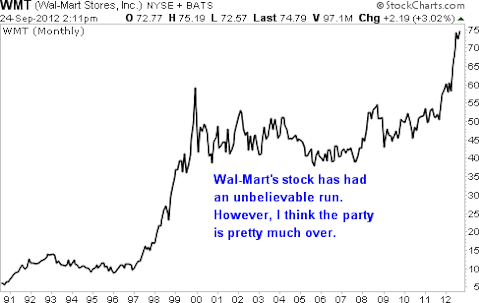

But I’m here to warn you, those days are over.

Now, I’m not saying Wal-Mart’s in trouble, or that you could lose your shirt if you invest in it now. However, I do believe the stock will have pretty mediocre performance going forward. I’m even willing to bet it’s no longer the market-trouncer many investors have come to expect.

Here are three reasons why I think Wal-Mart has seen better days…

1. Weak same-store sales

Despite extensive remodeling, more efficient inventory management and other measures to facilitate customer traffic in its U.S. stores, Wal-Mart has long seen anemic same-store sales at locations that have been open for at least a year. Indeed, this metric actually declined by 1-2% for nine straight quarters, from the second quarter of 2009 through the second quarter of 2011. It has since resumed positive growth, but at a mere 2% pace. This pales in comparison with the 6-8% expansion rate in same-store sales Wal-Mart typically posted during its heyday 10 or 15 years ago.

A similar sort of stagnation is occurring at Wal-Mart’s international locations, too. Among the company’s 5,850 foreign locations, there hasn’t been any substantial improvement in return on assets (ROA) from three-fourths of the 4,400 stores that have been operating for more than a decade. ROA, a measure of profits as a percentage of total assets, has remained in a so-so range (5-7%) in the international segment for the past 10 years (compared with a somewhat better companywide ROA just shy of 9%).

If I were a Wal-Mart shareholder, then I’d find this very discouraging. Companies that can’t generate their best rates of return internationally, particularly through emerging markets, don’t have much chance of outdoing the competition in years to come.

2. Speaking of competition…

As the world’s largest retailer, Wal-Mart has been under constant assault and is losing U.S. market sharefor the first time in its history. Main rival Target Corporation (NYSE:TGT) has done better with same-store sales, lately posting a 3.1% growth rate in that metric. Wal-Mart has also been losing revenue to e-commerce leader Amazon.com, Inc. (NASDAQ:AMZN) for non-grocery items like furniture, electronics and school supplies. Bulk retailers such as Costco Wholesale Corporation (NASDAQ:COST) and ultra-cheap discounters like Aldi and Dollar General Corp. (NYSE:DG) have become major competitors, too.

3. Customers are hurting

The poor economy has been especially tough on Wal-Mart’s predominantly low- and middle-income customer base, and the situation of these customers only seems to be getting worse. Just one indication is the recent Census Bureau data showing the median U.S. household income is actually slightly lower now than in 1989 ($50,054 vs. $50,624). Even Wal-Mart management concedes more customers are living paycheck to paycheck, in the U.S. and abroad, and has begun tightening sales and earningsforecasts.

Risks to Consider: Of course, there’s a potentially important wildcard — Wal-Mart Express, a much smaller version of the traditional “big box” Wal-Mart. Management hopes this will be a potent answer to stiff competition from Dollar General and similar discount stores.

Wal-Mart Express is very new, however, with perhaps a dozen locations open for business so far. It’ll be years before we know for sure if it can help the company resume faster growth. The fact that one location (the 10,000-square-foot West Chatham store in Chicago) closed on July 30, only a year after it opened, doesn’t bode well.

Action to Take –> Because of all this, I’m not a bit surprised analysts foresee a big slowdown in revenue growth to 3-5% annually during the next five years, compared with 10% in the past 10 years. Earnings per share, which grew 11% a year during the past decade, may rise only 6-7% annually through 2017.

Analysts also expect the dividend growth rate to slow dramatically, from 18% during the past decade to perhaps 7% for the next five years. So the dividend yield, already a mediocre 2.1 % based on a per-share dividend of $1.59, likely won’t improve in the foreseeable future.

I’m more inclined to expect Wal-Mart’s stock to trail the market for years to come, and I don’t recommend adding it to your portfolio any time soon.

This article was originally written by Tim Begany, and posted on StreetAuthority.