Dividend growth stocks allow investors to earn progressively higher income. Moreover, high dividend growth stocks tend to outperform their peers with low dividend growth and those stocks that do not raise dividends. Investing in dividend growth stocks is a sound investment choice that can enable investors to make high total returns over long-term investment horizons.

A few dividend stocks have just raised their dividend payouts by double-digit rates. These include Cummins Inc. (NYSE:CMI), Stanley Black & Decker, Inc. (NYSE:SWK), and KLA-Tencor Corporation (NASDAQ:KLAC). These three stocks have dividend yields in excess of 2%, market caps in billions of dollars, and payout ratios between 20% and 55%. Here is a quick glance at these three dividend growth stocks:

Cummins, Inc.

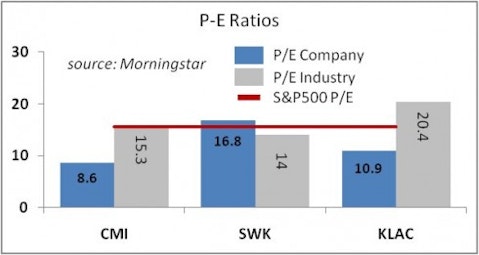

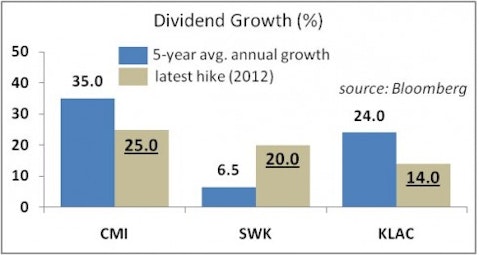

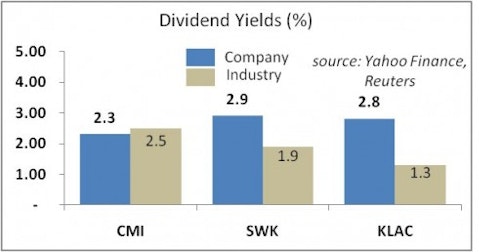

The $17 billion company manufactures and services diesel and natural gas engines, engine-related components, and electric power generation systems. It has paid dividends since 1990, boosting them 5.3 times since 2006. On average, over the past five years, Cummins bolstered its dividend at nearly 35% per year. At the same time, its EPS expanded at an average rate of 22% per year. The EPS growth is forecast to average 14% per year for the next five years. This year, the company boosted its dividend by 25%. Currently, this dividend payer boasts a yield of 2.3% on a low payout ratio of 20%. The continued robust EPS growth and the very low payout ratio suggest that large dividend hikes should continue in the future. The company’s competitor Caterpillar Inc. (CAT) pays a yield of 2.6%, while rivals Navistar International Corporation (NAV) and Westport Innovations (WPRT) do not pay regular dividends. The company’s stock has been pummeled recently, due to slowing growth in emerging markets and recessionary fears in the developed ones. The company has cut its full-year revenue guidance amid weak global sales and the strengthening dollar. The stock is trading at $87.46, down 18% over the past year. The shares are favorably priced, trading at a slight discount to the commercial vehicles and trucks industry. Among fund managers, the stock is popular with billionaires Ken Heebner, Jim Simons, and Cliff Asness.

Stanley Black & Decker

This $11 billion company manufactures and sells power and hand tools, mechanical access solutions, and security systems. It has paid a dividend for 136 consecutive years, the longest of any industrial company listed on the NYSE. The company has also raised dividends for 45 years in a row. Over the past five years, its dividend growth averaged 6.5% per year. Over the same period, the EPS grew at an average annual rate of 4.1%. The EPS growth is expected to accelerate to nearly 13% per year for the next five years, although there may be some bumps along the road. The higher forecast EPS growth bodes well for future dividend growth. This year, Stanley Black & Decker raised its dividend by a higher-than-average rate of 20%. This major boost came despite the company’s lowering of the full-year guidance and planned layoffs in a cost-cutting effort. The company has also announced the acquisition of Infastech, a Hong Kong-based fasteners maker, for $850 million in cash. This acquisition will be accretive to earnings immediately. Stanley Black & Decker currently yields 2.9% on a payout ratio of 55%. Its peers Danaher Corp. (DHR) and Snap-On Inc. (SNA) yield 0.2% and 2.0%, respectively. The stock is trading on a forward P/E well below that of its industry. The shares are changing hands at $65.00 a share, down 7.3% over the past year. Ken Heebner initiated a large position in the stock in the first quarter of 2012 (see Ken Heebner’s stock picks).

KLA-Tencor Corporation

This is an $8 billion global leader in process diagnostics and control, serving semiconductor and nanoelectronics industries. The company has paid a dividend since 2005. On average, over the past five years, the company’s dividend grew at a rate of nearly 24% per year. Since April 2005, the company has increased dividends four times. KLA-Tencor’s EPS growth averaged 20.1% per year over the past five years. Analysts forecast that in the next five years, the rate of EPS growth will be cut in half. This year, the company boosted its dividend by 14%, lower than the average growth over the past five years, but still robust. Similar dividend rate increases should continue in the future, given the good EPS growth and low payout ratio. Currently, KLA-Tencor pays a dividend yield of 2.8% on a payout ratio of 32%. The company’s peer Applied Materials (AMAT) pays a dividend yield of 3.6%, while competitor Rudolph Technologies (RTEC) does not pay any regular dividends. The semiconductor wafer fab equipment environment remains challenging, and KLA-Tencor sees its yearly bookings off by 4% this year. Gartner, an IT research firm, sees global wafer fab equipment spending down 8.9% year-over-year in 2012, but up 7.4% in 2013. On a forward P/E basis, KLA-Tencor’s stock is trading at a major discount to the semiconductor industry. The shares are changing hands at $48.23, up 9.3% over the past year. The stock is popular with Jim Simons and billionaire Ken Griffin.