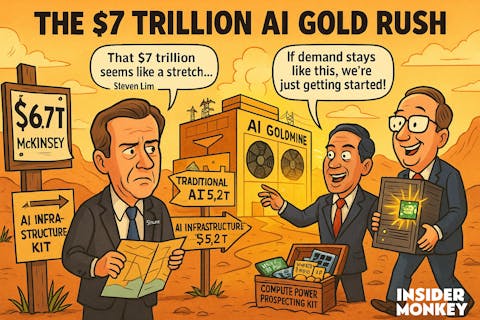

According to an analysis by global management consulting firm McKinsey & Company, data centers are projected to require $6.7 trillion in capital expenditures worldwide by 2030 to keep up with the demand for compute power.

Those data centers that are equipped to handle AI processing loads are projected to require $5.2 trillion in capital expenditures. Meanwhile, those powering traditional IT applications are projected to require $1.5 trillion, totaling up to a staggering figure close to $7 trillion.

READ NEXT: 11 AI Stocks On Wall Street’s Radar and 10 Trending AI Stocks on Wall Street Right Now

The report further claims that the companies that anticipate compute power demand and invest accordingly will win the AI-driven computing era. By proactively securing critical resources such as land, materials, energy capacity, and computing power, they would have the potential to gain a significant competitive edge.

Different analysts seem to have differing perspectives on this $7 trillion figure. Wes Cummins, CEO of Applied Digital, believes that the $7 trillion estimate appears to be “on the high end.”

“If we’re talking just the next five years, I think that’s a hard number to hit, just from the practicality of building and finding enough power.”

On the other hand, Steven Lim from NTT Global Data Centers asserted that the large figure is not that far-fetched.

“If we have an idealized situation and a consistent demand curve that we see today, then $7 trillion is not out of bounds.”

While the opinions on the feasibility of this estimate may vary, one thing that is clear is that the race to build AI-ready infrastructure is accelerating. As the demand for compute power surges to new heights, the ability to scale efficiently will determine which companies will lead the AI era and which ones will fall behind.

For this article, we selected AI stocks by going through news articles, stock analysis, and press releases. These stocks are also popular among hedge funds. The hedge fund data is as of Q4 2024.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 373.4% since May 2014, beating its benchmark by 218 percentage points (see more details here).

15. NetApp, Inc. (NASDAQ:NTAP)

Number of Hedge Fund Holders: 41

NetApp, Inc. (NASDAQ:NTAP) caters to the broader AI industry by offering data storage and management solutions important for AI workloads. On May 19, the intelligent data infrastructure company announced that it is working with NVIDIA to support the NVIDIA AI Data Platform reference design in the NetApp AIPod solution. The collaboration aims to accelerate AI agents and speed up the retrieval of relevant information. As a NVIDIA-Certified Storage partner, NetApp gives NetApp AIPod users a smart data infrastructure so that businesses can manage data efficiently and scale AI operations.

“A unified and comprehensive understanding of business data is the vehicle that will help companies drive competitive advantage in the era of intelligence, and AI inferencing is the key. We have always believed that a unified approach to data storage is essential for businesses to get the most out of their data. The rise of agentic AI has only reinforced that truly unified data storage goes beyond just multi-protocol storage. Businesses need to eliminate silos throughout their entire IT environment, whether on-premises and in the cloud, and across every business function, and we are working with NVIDIA to deliver connected storage for the unique demands of AI.”

– Sandeep Singh, Senior Vice President and General Manager of Enterprise Storage at NetApp.

14. Super Micro Computer, Inc. (NASDAQ:SMCI)

Number of Hedge Fund Holders: 45

Super Micro Computer, Inc. (NASDAQ:SMCI) designs and manufactures high-performance server and storage solutions for data centers, cloud computing. On May 19, the company announced that it is now taking orders for enterprise AI systems with NVIDIA RTX PRO 6000 Blackwell Server Edition GPUs. Offering a broad portfolio of optimized servers, Super Micro allows AI and visual computing to be deployed in almost any industry or environment. Its portfolio of over 20 systems with RTX PRO Blackwell GPUs will significantly enhance performance for enterprise AI factory workloads, including AI inference, development, generative AI, and graphics rendering. Supermicro NVIDIA-Certified Systems with RTX PRO 6000 Blackwell GPUs will allow the creation of full-stack solutions. This will, in turn, help accelerate the deployment of on-premises AI.

“Supermicro continues to lead the development of enterprise AI infrastructure, empowering the deployment of AI across industries at ever-greater scale. Supermicro’s Data Center Building Block Solutions® is the ideal platform for collaboration with NVIDIA Enterprise AI Factory validated designs based on the Blackwell architecture. Together, we will help enterprises ramp up AI adoption by building their own Enterprise AI Factories, accelerating AI inference, AI development, simulation, and graphics workloads for faster time-to-revenue.”

-Charles Liang, president and CEO of Supermicro.

13. Palo Alto Networks, Inc. (NASDAQ:PANW)

Number of Hedge Fund Holders: 64

Palo Alto Networks, Inc. (NASDAQ:PANW) is a leader in AI-powered cybersecurity. On May 19, Piper Sandler analyst Rob Owens maintained a “Hold” rating on the stock with an associated price target of $213.07. Economic uncertainty and cautious company guidance have led Owens to maintain a cautious approach toward the stock. He noted that the challenging macroeconomic environment could limit enterprise IT investments, impacting the health of ecosystem partners that support these investments. Despite product revenue for similar companies having exceeded expectations, which implies a positive outlook for Palo Alto Networks, ongoing uncertainties keep the outlook conservative. Some key topics of interest for Palo Alto include the recent acquisition of Protect AI and the firewall refresh cycle. Regardless, these topics aren’t aggressive enough to warrant a rating upgrade.

12. Hewlett Packard Enterprise Company (NYSE:HPE)

Number of Hedge Fund Holders: 66

Hewlett Packard Enterprise Company (NYSE:HPE), an American multinational technology company, provides high-performance computing systems, AI software, and data storage solutions for running complex AI workloads. On May 19, the company announced that it has upgraded the portfolio of NVIDIA AI Computing by HPE solutions to better support the AI lifecycle for enterprises, service providers, sovereigns, and research & discovery organizations. According to Nvidia CEO Jensen Huang, businesses can now build the most advanced NVIDIA AI factories with HPE systems to prepare their IT infrastructure for the era of generative and agentic AI. The updates include deeper integrations with NVIDIA AI Enterprise, improved support for HPE Private Cloud AI with accelerated compute, and a software development kit (SDK) for NVIDIA AI Data Platform. The company has also announced compute and software offerings with NVIDIA RTX PRO™ 6000 Blackwell Server Edition GPU and NVIDIA Enterprise AI Factory validated design.

“Our strong collaboration with NVIDIA continues to drive transformative outcomes for our shared customers. By co-engineering cutting-edge AI technologies elevated by HPE’s robust solutions, we are empowering businesses to harness the full potential of these advancements throughout their organization, no matter where they are on their AI journey. Together, we are meeting the demands of today, while paving the way for an AI-driven future.”

-Antonio Neri, president and CEO of HPE.

11. Marvell Technology, Inc. (NASDAQ:MRVL)

Number of Hedge Fund Holders: 70

Marvell Technology, Inc. (NASDAQ:MRVL) engages in the development and production of semiconductors, focusing heavily on data centers. One of the most notable analyst calls on Monday, May 19, was for Marvell Technology. UBS lowered the firm’s price target on the stock to $100 from $110 and kept a “Buy” rating on the shares. The analyst told investors in a research note how they expect Marvell to report Q1 results in line with estimates, Q2 revenue guided in the range of $2B, and AI revenue up an estimated 10% quarter over quarter. The firm further added how its management has set a low bar given Trainium2’s ramp, its continued momentum in the optical business, as well as its Blackwell rollout.

10. Intel Corporation (NASDAQ:INTC)

Number of Hedge Fund Holders: 83

Intel Corporation (NASDAQ:INTC) designs and sells computing hardware, semiconductor products, and AI-driven solutions for various industries. On May 19, the software company announced that it has launched a new group of graphics processing units and artificial-intelligence accelerators for professionals and developers. The launch was made at Computex 2025, a leading global exhibition focused on AIoT and startups. The announcements includ Intel® Arc™ Pro B60 and Intel® Arc™ Pro B50 GPUs for AI inference and professional workstations. The Gaudi 3 AI Accelerators offer open solutions for enterprise and cloud AI inferencing, while the Intel® AI Assistant Builder allows developers to create local, purpose-built AI agents designed for Intel platforms.

“The Intel Arc Pro B-Series showcases Intel’s commitment in GPU technology and ecosystem partnerships. With Xe2 architecture’s advanced capabilities and a growing software ecosystem, the new Arc Pro GPUs deliver accessibility and scalability to small and medium-sized businesses that have been looking for targeted solutions.”

-Vivian Lien, vice president and general manager of Client Graphics at Intel.

9. Snowflake Inc. (NYSE:SNOW)

Number of Hedge Fund Holders: 85

Snowflake Inc. (NYSE:SNOW) is a cloud-based data storage company providing a data analysis, storage, and sharing platform. One of the most notable analyst calls on Monday, May 19, was for Snowflake Inc. Goldman Sachs reiterates Snowflake as “Buy.” The firm said it is bullish on the stock heading into earnings on Wednesday.

“We continue viewing Snowflake as a high-quality asset capable of scaling to $10bn+ with durable mid-20′s topline growth and 25%+ FCFM [free cash flow model].”

On the same day, Snowflake also received a Buy rating and a $240.00 price target from Needham analyst Mike Cikos.

8. Reddit, Inc. (NYSE:RDDT)

Number of Hedge Fund Holders: 87

Reddit, Inc. (NYSE:RDDT) is a social media platform that leverages AI to strengthen search functionality and improve user engagement. On May 19, Wells Fargo analyst Ken Gawrelski downgraded the stock to “Equal Weight” from Overweight with a price target of $115, down from $168. With Google likely to fully integrate artificial intelligence search capabilities in search soon, the firm believes that Reddit’s recent user drop may be permanent. The analyst told investors in a research note how these threats don’t only apply to Reddit, but to all companies dependent on search traffic. With Google more aggressively implementing AI features in search, Wells Fargo sees logged-out user declines for Reddit. The firm also expects Reddit’s stock to remain under pressure because of user disruption.

7. Vertiv Holdings Co (NYSE:VRT)

Number of Hedge Fund Holders: 91

Vertiv Holdings Co (NYSE:VRT) offers digital infrastructure technology and services for data centers, communication networks, and commercial and industrial facilities. On May 19, the critical digital infrastructure provider confirmed its strategic alignment with NVIDIA’s announcement of 800 VDC power architectures for future AI-centric data centers. The 800 VDC power portfolio by Vertiv is planned for release in the second half of 2026, ahead of NVIDIA Kyber and NVIDIA Rubin Ultra platform rollouts.

The goal of this strategic alignment is to enable customers to deploy their power and cooling infrastructure in alignment with NVIDIA’s next-generation compute platforms. A major advantage of the 800 VDC is that it enables more efficient and centralized power delivery through reducing copper usage, current, and thermal losses. This is particularly useful now that rack power requirements in AI environments are scaling beyond 300 kilowatts.

“As GPUs evolve to support increasingly complex AI applications at giga-watt scale, power and cooling providers need to be equally innovative to provide energy-efficient and high-density solutions for the AI factories. While the 800 VDC portfolio is new, DC power isn’t a new direction for us, it’s a continuation of what we’ve already done at scale. We’ve spent decades deploying higher-voltage DC architectures across global telecom, industrial, and data center applications. We’re entering this transition from a position of strength and bringing real-world experience to meet the demands of the AI factory.”

-Scott Armul, executive vice president of global portfolio and business units at Vertiv.

6. Tesla, Inc. (NASDAQ:TSLA)

Number of Hedge Fund Holders: 126

Tesla, Inc. (NASDAQ:TSLA) is an automotive and clean energy company that leverages advanced artificial intelligence in its autonomous driving technology and robotics initiatives. On May 19, the stock was revisited by a Wall Street analyst, Adam Jonas from Morgan Stanley. Jones has maintained a “Buy” rating on the stock and has a $410.00 price target. He believes that Tesla has the potential to move beyond its traditional core automotive business, noting how investors focus solely on Tesla’s car sales, even though its future value lies in its ability to leverage its installed base of vehicles for additional revenue streams.

The analyst also pointed out the growth and high margins of Tesla’s energy storage business, valuing it at $67 per share. He further said that Tesla’s humanoid robots have the potential to transform the labor market and also add significant value to the company. Even though valuing Tesla’s diverse portfolio of emerging businesses remains a challenge, the above factors have enabled a positive outlook toward the stock.

5. Salesforce, Inc. (NYSE:CRM)

Number of Hedge Fund Holders: 162

Salesforce Inc (NYSE:CRM) is a cloud-based CRM company that has gained popularity after it unveiled its AI-powered platform called Agentforce. On May 19, the company announced that Takeda, a multinational pharmaceutical company, has selected Salesforce Life Sciences Cloud for Customer Engagement to streamline interactions with healthcare professionals. Takeda will be leveraging Salesforce’s deeply unified platform, including Agentforce and Data Cloud, to deploy personalized AI agents. These agents will allow it to support numerous operations, from medical to commercial and patient support functions.

“Takeda is an outstanding leader in the industry, aspiring to create better health for people and a brighter future for the world. Now, with Life Sciences Cloud for Customer Engagement, we’ll help Takeda improve provider and patient engagement and scale the impact of every team member.”

-Frank Defesche, SVP & GM, Life Sciences at Salesforce.

4. Apple Inc. (NASDAQ:AAPL)

Number of Hedge Fund Holders: 166

Apple Inc. (NASDAQ:AAPL) is a technology company known for its consumer electronics, like the iPhones and MacBooks. On May 19, Morgan Stanley reiterated the stock as “Overweight,” maintaining a price target of $235. The firm stated that Apple remains under-owned.

Despite a modest narrowing in under-ownership across the sector, “AAPL remains the most under-owned mega cap tech stock we track.”

They further noted that the gap between the company’s institutional ownership and its S&P 500 weighting is said to have narrowed by 17 basis points in the first quarter to -2.06%. Moreover, Apple’s active institutional portfolio weighting fell to 4.86%. Meanwhile, its S&P 500 weighting declined more steeply to 6.9%.

“New form factors for the iPhone in the coming years should lead to meaningful upgrades… and replacement cycles that have never been as extended.”

3. NVIDIA Corporation (NASDAQ:NVDA)

Number of Hedge Fund Holders: 223

NVIDIA Corporation (NASDAQ:NVDA) specializes in AI-driven solutions, offering platforms for data centers, self-driving cars, robotics, and cloud services. On May 19, the company revealed that it plans to sell a technology that will tie chips together, accelerating the chip-to-chip communication needed to build and deploy artificial intelligence tools.

On the same day, it launched a new version of its NVLink tech called NVLink Fusion. Nvidia will sell the NVLink Fusion to other chip designers to help build powerful custom AI systems with multiple chips linked together. Companies looking to adopt the NVLink Tech called Fusion for their custom chip efforts include Marvell Technology and MediaTek.

In other news, CEO Jensen Huang has also announced the company’s plan to build a Taiwan headquarters in the northern suburbs of Taipei.

2. Microsoft Corporation (NASDAQ:MSFT)

Number of Hedge Fund Holders: 317

Microsoft Corporation (NASDAQ:MSFT) provides AI-powered cloud, productivity, and business solutions, focusing on efficiency, security, and AI advancements. On May 19, the company announced its Copilot artificial intelligence agent that can take on specific programming work and notify people once it has finished. After the programming work has finished, developers can then check the agent’s work from GitHub, a widely used code repository, requesting modifications in the process. They can then allow GitHub to add the source code to existing files. The launch was announced at Microsoft’s Build developer conference in Seattle today, reflecting on its motive to make artificial intelligence an integrated process of software enhancement.

“Using state-of-the-art models, the agent excels at low-to-medium complexity tasks in well-tested codebases, from adding features and fixing bugs to extending tests, refactoring code, and improving documentation.”

-Thomas Dohmke, CEO of GitHub.

1. Amazon.com, Inc. (NASDAQ:AMZN)

Number of Hedge Fund Holders: 339

Amazon.com Inc. (NASDAQ:AMZN) is an American technology company offering e-commerce, cloud computing, and other services, including digital streaming and artificial intelligence solutions. On May 19, TipRanks reported that DBS analyst Nashrullah Putra Sulaeman maintained their bullish stance on AMZN stock, giving a “Buy” rating. The firm’s buy rating stems from the profitability of its Amazon Web Services (AWS) segment and increased non-operating income, growing revenue, and a recovering retail segment.

The company’s strategic regionalization of its logistics network has lowered its delivery costs. Moreover, Amazon’s advertising segment is also gaining traction, promising growth in ad revenue and reflecting on its ability to leverage its e-commerce ecosystem effectively. Challenges, however, still exist. These include supply chain disruptions and regulatory challenges, amongst others. However, the company’s continued investment in artificial intelligence-driven cloud solutions and its dominant market position reinforce a positive outlook.

While we acknowledge the potential of AMZN as an investment, our conviction lies in the belief that some AI stocks hold greater promise for delivering higher returns and have limited downside risk. If you are looking for an AI stock that is more promising than AMZN and that has 100x upside potential, check out our report about this cheapest AI stock.

READ NEXT: 20 Best AI Stocks To Buy Now and 30 Best Stocks to Buy Now According to Billionaires.

Disclosure: None. Insider Monkey focuses on uncovering the best investment ideas of hedge funds and insiders. Please subscribe to our free daily e-newsletter to get the latest investment ideas from hedge funds’ investor letters by entering your email address below.