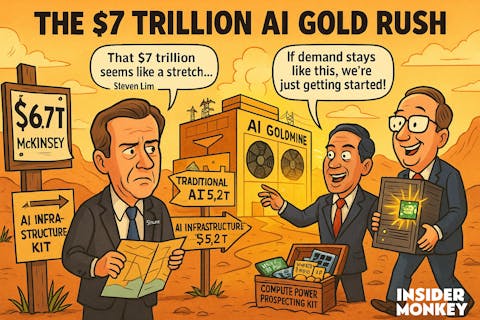

According to an analysis by global management consulting firm McKinsey & Company, data centers are projected to require $6.7 trillion in capital expenditures worldwide by 2030 to keep up with the demand for compute power.

Those data centers that are equipped to handle AI processing loads are projected to require $5.2 trillion in capital expenditures. Meanwhile, those powering traditional IT applications are projected to require $1.5 trillion, totaling up to a staggering figure close to $7 trillion.

READ NEXT: 11 AI Stocks On Wall Street’s Radar and 10 Trending AI Stocks on Wall Street Right Now

The report further claims that the companies that anticipate compute power demand and invest accordingly will win the AI-driven computing era. By proactively securing critical resources such as land, materials, energy capacity, and computing power, they would have the potential to gain a significant competitive edge.

Different analysts seem to have differing perspectives on this $7 trillion figure. Wes Cummins, CEO of Applied Digital, believes that the $7 trillion estimate appears to be “on the high end.”

“If we’re talking just the next five years, I think that’s a hard number to hit, just from the practicality of building and finding enough power.”

On the other hand, Steven Lim from NTT Global Data Centers asserted that the large figure is not that far-fetched.

“If we have an idealized situation and a consistent demand curve that we see today, then $7 trillion is not out of bounds.”

While the opinions on the feasibility of this estimate may vary, one thing that is clear is that the race to build AI-ready infrastructure is accelerating. As the demand for compute power surges to new heights, the ability to scale efficiently will determine which companies will lead the AI era and which ones will fall behind.

For this article, we selected AI stocks by going through news articles, stock analysis, and press releases. These stocks are also popular among hedge funds. The hedge fund data is as of Q4 2024.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 373.4% since May 2014, beating its benchmark by 218 percentage points (see more details here).

15. NetApp, Inc. (NASDAQ:NTAP)

Number of Hedge Fund Holders: 41

NetApp, Inc. (NASDAQ:NTAP) caters to the broader AI industry by offering data storage and management solutions important for AI workloads. On May 19, the intelligent data infrastructure company announced that it is working with NVIDIA to support the NVIDIA AI Data Platform reference design in the NetApp AIPod solution. The collaboration aims to accelerate AI agents and speed up the retrieval of relevant information. As a NVIDIA-Certified Storage partner, NetApp gives NetApp AIPod users a smart data infrastructure so that businesses can manage data efficiently and scale AI operations.

“A unified and comprehensive understanding of business data is the vehicle that will help companies drive competitive advantage in the era of intelligence, and AI inferencing is the key. We have always believed that a unified approach to data storage is essential for businesses to get the most out of their data. The rise of agentic AI has only reinforced that truly unified data storage goes beyond just multi-protocol storage. Businesses need to eliminate silos throughout their entire IT environment, whether on-premises and in the cloud, and across every business function, and we are working with NVIDIA to deliver connected storage for the unique demands of AI.”

– Sandeep Singh, Senior Vice President and General Manager of Enterprise Storage at NetApp.

14. Super Micro Computer, Inc. (NASDAQ:SMCI)

Number of Hedge Fund Holders: 45

Super Micro Computer, Inc. (NASDAQ:SMCI) designs and manufactures high-performance server and storage solutions for data centers, cloud computing. On May 19, the company announced that it is now taking orders for enterprise AI systems with NVIDIA RTX PRO 6000 Blackwell Server Edition GPUs. Offering a broad portfolio of optimized servers, Super Micro allows AI and visual computing to be deployed in almost any industry or environment. Its portfolio of over 20 systems with RTX PRO Blackwell GPUs will significantly enhance performance for enterprise AI factory workloads, including AI inference, development, generative AI, and graphics rendering. Supermicro NVIDIA-Certified Systems with RTX PRO 6000 Blackwell GPUs will allow the creation of full-stack solutions. This will, in turn, help accelerate the deployment of on-premises AI.

“Supermicro continues to lead the development of enterprise AI infrastructure, empowering the deployment of AI across industries at ever-greater scale. Supermicro’s Data Center Building Block Solutions® is the ideal platform for collaboration with NVIDIA Enterprise AI Factory validated designs based on the Blackwell architecture. Together, we will help enterprises ramp up AI adoption by building their own Enterprise AI Factories, accelerating AI inference, AI development, simulation, and graphics workloads for faster time-to-revenue.”

-Charles Liang, president and CEO of Supermicro.