In this article, we discuss the 10 stocks US politicians are buying. If you want to read about some more stocks that US politicians are buying, go directly to 5 Stocks US Politicians Are Buying.

Politicians in the United States are required to submit periodic reports of their stock trading activities to regulators for transparency purposes. Although these reports are required within 45 days of stock transactions, many lawmakers across both sides of the aisle are routinely late with these disclosures. According to a comprehensive assessment of the reports so far submitted by lawmakers, at least 216 politicians, out of 535 who presently serve in the US Congress, are involved in stock trading of some sort.

These lawmakers have so far disclosed over 45,000 stock trades worth more than $2.2 billion in volume. Nearly 4,000 different companies have been traded by US politicians through these transactions. The Republicans lead the Democrats in total trades, volume, and the number of personnel making the trades. These trading activities have come under increased scrutiny in recent weeks amid social media outcry over lawmakers trading stocks of firms that are affected by decisions of government committees comprising these lawmakers.

Investors eager to replicate the success that some of these non-professional stock traders have enjoyed at the market should closely monitor their trading activity. Some of the stocks that US politicians are buying include Meta Platforms, Inc. (NASDAQ:FB), AT&T Inc. (NYSE:T), and Apple Inc. (NASDAQ:AAPL), among others discussed in detail below.

Our Methodology

The companies listed below were picked from the Periodic Transaction Report(s) that US politicians who trade stocks are obliged to file. It is important to clarify that the companies listed below were picked from the public record of investments US politicians and their families have made in the past few months. The purchases may not have been made by the politicians themselves but only disclosed on behalf of their families.

Data from around 900 elite hedge funds tracked by Insider Monkey was used to identify the number of hedge funds that hold stakes in each firm.

Stocks US Politicians Are Buying

10. Tesla, Inc. (NASDAQ:TSLA)

Number of Hedge Fund Holders: 91

Tesla, Inc. (NASDAQ:TSLA) makes and sells electric vehicles and clean energy solutions. Hedge funds have been loading up on the stock in recent months. At the end of the fourth quarter of 2021, 91 hedge funds in the database of Insider Monkey held stakes worth $12.9 billion in Tesla, Inc. (NASDAQ:TSLA), compared to 60 in the previous quarter worth $10.6 billion.

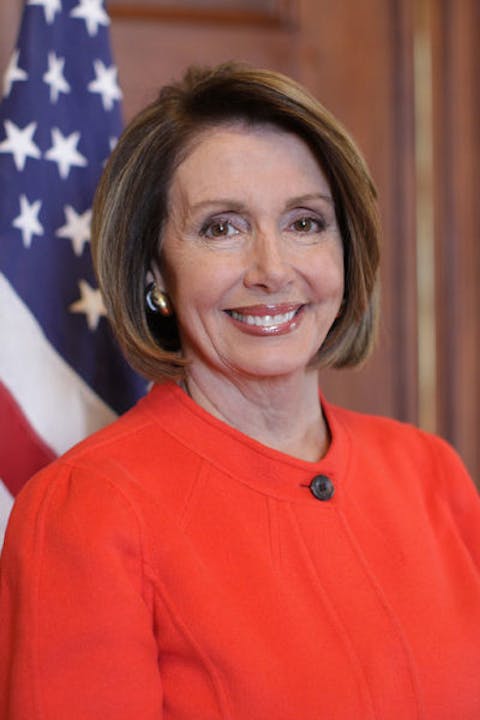

US politician Nancy Pelosi on March 22 revealed a purchase of Tesla, Inc. (NASDAQ:TSLA) shares worth somewhere between $1 million and $5 million. In the filing, disclosed four days after the transaction, Pelosi detailed that she had exercised 25 CALL options on nearly 2,500 shares of the EV maker at a strike price of $500 per share.

Just like Meta Platforms, Inc. (NASDAQ:FB), AT&T Inc. (NYSE:T), and Apple Inc. (NASDAQ:AAPL), Tesla, Inc. (NASDAQ:TSLA) is one of the stocks that elite hedge funds are flocking to.

Here is what Baron Partners Fund has to say about Tesla, Inc. (NASDAQ:TSLA) in its Q1 2021 investor letter:

“Tesla, Inc. (NASDAQ:TSLA) designs, manufactures, and sells fully electric vehicles, solar products, energy storage solutions, and battery cells. Tesla, Inc. (NASDAQ:TSLA) stock fell during the quarter as a result of general market dynamics and a potential production slowdown due to parts shortages. A refreshed S/X and China Model Y ramp could also have a negative impact on margins in early 2021. We anticipate strong growth and improved margins driven by new production capacity, manufacturing efficiencies, localization of its manufacturing and supply chain, and maturation of Tesla’s full self-driving technology.”

9. Lowe’s Companies, Inc. (NYSE:LOW)

Number of Hedge Fund Holders: 72

Lowe’s Companies, Inc. (NYSE:LOW) operates as a home improvement retailer. According to the latest filings, US politician Josh Gottheimer purchased shares of the company worth somewhere around $1,000 and $15,000. The transaction in this regard was disclosed almost a month after it was made.

Lowe’s Companies, Inc. (NYSE:LOW) is a favorite home improvement stock in the finance world. At the end of the fourth quarter of 2021, 72 hedge funds in the database of Insider Monkey held stakes worth $6.8 billion in Lowe’s Companies, Inc. (NYSE:LOW), up from 60 in the preceding quarter worth $5 billion.

In its Q2 2021 investor letter, Pershing Square Holdings, Ltd., an asset management firm, highlighted a few stocks and Lowe’s Companies, Inc. (NYSE:LOW) was one of them. Here is what the fund said:

“Since the onset of the COVID-19 pandemic, Lowe’s Companies, Inc. (NYSE:LOW) has experienced a significant acceleration in demand driven by consumers nesting at home, higher home asset utilization and the reallocation of discretionary spend. In the three years since Marvin Ellison became CEO, the company has executed a multi-year transformation plan to bolster Lowe’s retail fundamentals, reduce structural costs, expand distribution capabilities, and modernize systems and the company’s online capabilities. This transformation has allowed Lowe’s to meet consumers’ needs during this highly elevated period of demand, and positioned the company for continued success and accelerated earnings growth.

In the second quarter, Lowe’s Companies, Inc. (NYSE:LOW) reported U.S. same-store-sales growth of 2.2%. Growth was bolstered by strength from the critical Pro consumer, where Lowe’s reported growth of 21%, off setting moderating do-it-yourself (“DIY”) demand. While DIY demand has receded from peak-COVID-19 periods, Pro customer demand has accelerated as consumers engage Pro’s for larger renovation projects.

Notwithstanding the headline growth figure, which is impacted by comparisons to COVID-19-aff ected months from spring of 2020, demand remains extremely elevated relative to baseline 2019 levels. July same-store-sales, the most recent full month for which the company has provided disclosure, were up 31.5% on a two-year basis and management indicated August month-to-date results are substantially similar. More significantly, Lowe’s reported Pro growth of +49% on a two-year basis in Q2, evidence that Lowe’s Companies, Inc. (NYSE:LOW) focus on the Pro is bearing fruit. Share gains with the critical Pro customer will provide a tailwind to growth that should allow Lowe’s to outperform market-level growth going forward.

Even as the robust demand experienced during the height of COVID-19 stabilizes at a new base, the medium and longer-term macro environment remain very attractive for the home improvement sector and Lowe’s in particular. This favorable context for the sector is evidenced by consumers’ enhanced focus and appreciation of the importance of the home, higher home asset utilization, rising home prices, historically low mortgage rates, an aging housing stock, strong consumer balance sheets, and the general lack of new housing inventory.

Against this backdrop, Lowe’s Companies, Inc. (NYSE:LOW) is focused on taking market share and expanding margins. Pro penetration today is still only 25% of revenue as compared to Lowe’s medium-term target of 30% to 35%, providing a runway for continued above market growth. Management continues to execute against various operational initiatives (Lowe’s “Perpetual Productivity Improvement” program) designed to improve the customer experience while enhancing the company’s margins and long term earnings power. The company’s long-term outlook implies significant opportunity for continued margin expansion and earnings appreciation as it executes its business transformation.

Lowe’s currently trades at approximately 17 times forward earnings. Home Depot, its closest competitor, trades at approximately 22 times forward earnings despite Lowe’s Companies, Inc. (NYSE:LOW) superior prospective earnings growth. We find this valuation disparity to be anomalous in light of Lowe’s strong execution and potential for further operational optimization.”

8. UGI Corporation (NYSE:UGI)

Number of Hedge Fund Holders: 31

UGI Corporation (NYSE:UGI) markets energy products. It is a top energy stock on Wall Street. Among the hedge funds being tracked by Insider Monkey, New York-based investment firm First Eagle Investment Management is a leading shareholder in UGI Corporation (NYSE:UGI) with 8.6 million shares worth more than $396 million.

On March 16, US politician John Rutherford disclosed a purchase of UGI Corporation (NYSE:UGI) stock worth $1,000-$15,000. The purchase was made public more than a month after the transaction in this regard.

7. Danaher Corporation (NYSE:DHR)

Number of Hedge Fund Holders: 87

Danaher Corporation (NYSE:DHR) is a conglomerate with stakes in businesses like medical, industrial, and commercial products and services. It is one of the favorite diversified stocks among elite hedge funds. At the end of the fourth quarter of 2021, 87 hedge funds in the database of Insider Monkey held stakes worth $7.3 billion in Danaher Corporation (NYSE: DHR), compared to 74 in the previous quarter worth $6.9 billion.

Regulatory filings show that US politician John Curtis, on March 9, purchased Danaher Corporation (NYSE:DHR) stock worth somewhere around $1,000 to $15,000. The transaction in this regard was made public on March 24, almost two weeks after it was made.

In its Q2 2021 investor letter, Cooper Investors, an asset management firm, highlighted a few stocks and Danaher Corporation (NYSE:DHR) was one of them. Here is what the fund said:

“During the quarter the Fund’s largest holding Danaher Corporation (NYSE:DHR) made a notable acquisition, spending US$9bn (~5% of its market cap) to buy privately held Aldevron, a leading player in the fast growing field of genomic medicine. Over the years Danaher Corporation (NYSE:DHR) has built up a unique portfolio of life science and diagnostic assets. Their key life sciences businesses involve providing the tools and services to research, develop and manufacture biotech drugs. For example, they are a key provider to over 400 COVID vaccine and therapeutic projects globally.

Aldevron expands Danaher’s capability into gene therapy. Aldevron is a supplier of key ingredients for the next generation of therapies, namely cell and gene therapy and mRNA vaccines. Aldevron is the leader in these fields and this deal puts Danaher Corporation (NYSE:DHR) in pole position to participate in the wave of innovation occurring in this space.

The acquisition multiple is high – Danaher Corporation (NYSE:DHR) are paying US$9bn for what today is a US$500m revenue business but growing 30% a year with 40% operating margins, in our view justifying the high price. Importantly, management can see an investment return in line with recent acquisitions. As a reminder Danaher’s history and skill set is acquiring businesses, it is how the company has been successfully built over 35 years. The shares were up 4% on the news and have gained nearly 20% for the quarter. Most companies would be sold down off the back of an announcement like this but Danaher has a long multidecade track record of successful acquisitions and this fits a similar enough pattern.

The opportunity is to grow Aldevron into a multibillion dollar business given the growth in genomics and RNA innovation that’s occurring and as more of these types of therapeutics become approved. Overall as a key supplier with deep global networks across life sciences and medical research Danaher Corporation (NYSE:DHR) is very well placed to continue growing with the innovation in biotech and diagnostic markets. It remains an incredibly well run company and a high conviction investment in the Fund.”

6. Wells Fargo & Company (NYSE:WFC)

Number of Hedge Fund Holders: 94

Wells Fargo & Company (NYSE:WFC) provides financial services. As interest rates rise, the stock has seen increased interest from hedge funds. At the end of the fourth quarter of 2021, 94 hedge funds in the database of Insider Monkey held stakes worth $6.11 billion in Wells Fargo & Company (NYSE:WFC), compared to 88 the preceding quarter worth $6.18 billion.

On March 21, US politician disclosed a purchase of Wells Fargo & Company (NYSE:WFC) stock worth somewhere between $1,000 to $15,000. The transaction in this regard took place in early March.

Along with Meta Platforms, Inc. (NASDAQ:FB), AT&T Inc. (NYSE:T), and Apple Inc. (NASDAQ:AAPL), Wells Fargo & Company (NYSE:WFC) is one of the stocks on the radar of institutional investors.

In its Q4 2020 investor letter, Davis Funds, an asset management firm, highlighted a few stocks and Wells Fargo & Company (NYSE:WFC) was one of them. Here is what the fund said:

“Detractors to performance relative to the index include financial services holdings such as Wells Fargo. While banks in general have suffered due to the recession and experienced credit losses, Wells Fargo & Company (NYSE:WFC) also suffered from operational missteps. It is our expectation, however, that our bank holdings in general will benefit from stronger economic growth as the pandemic recedes; and we believe Wells Fargo & Company (NYSE:WFC) in particular, will, over time, lower their costs and successfully grow their businesses.”

Click to continue reading and see 5 Stocks US Politicians Are Buying.

Suggested Articles:

- 15 Best Gambling Companies to Buy Now

- 10 Best Growth Companies Under $10

- 10 Best Companies for Animal Lovers

Disclosure. None. 10 Stocks US Politicians Are Buying is originally published on Insider Monkey.