Ten stocks took off on Wednesday, defying a lackluster performance on Wall Street, as investor funds continued to pour in, thanks to company-specific developments.

The stocks were notably dominated by artificial intelligence companies, boosted by increased spending in the sector. Four of the 10 soared to new all-time highs.

On the other hand, the Dow Jones was down by 0.37 percent, the tech-heavy Nasdaq decreased by 0.34 percent, and the S&P 500 index declined by 0.28 percent.

In this article, we focus on the 10 top performers on Wednesday and break down the reasons behind their gains.

To come up with the list, we focused exclusively on stocks with a $2 billion market capitalization and 5 million shares in trading volume.

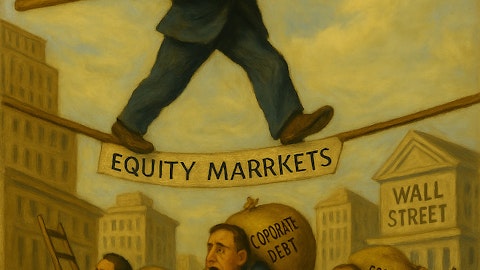

The New York Stock Exchange building. Photo by Дмитрий Трепольский on Pexels

10. GDS Holdings Ltd. (NASDAQ:GDS)

GDS Holdings saw its share prices jump by 8.08 percent on Wednesday to close at $40.67 apiece as investors loaded portfolios in Chinese artificial intelligence (AI) stocks, helped by Alibaba Group’s new $53-billion investment in the sector.

According to Alibaba, it partnered with chip giant Nvidia Corp. for the expansion of global data centers and AI products as it positions the sector as a core priority alongside its e-commerce platform.

Among the developments are physical AI capabilities such as data synthesis, model training, environmental simulation, and validation testing.

The news spilled over to Chinese companies, including GDS Holdings Ltd. (NASDAQ:GDS), an AI infrastructure company, with strong confidence that further investments in the industry would largely bolster demand for data centers.

In other developments, investor sentiment was also boosted by announcements earlier this week that China’s AI sector has grown by 24 percent year-on-year to 900 billion yuan.

According to the China Academy of Information and Communications Technology, the number of AI companies in China has already surpassed 5,300, accounting for 15 percent globally.

9. Alibaba Group Holding Ltd. (NYSE:BABA)

Alibaba Group soared to a new all-time high on Wednesday, as investors gobbled up shares after boosting its investments in artificial intelligence (AI) to 380 billion yuan ($53 billion) and partnering with Nvidia Corp. to support the program.

In intra-day trading, Alibaba Group Holding Ltd. (NYSE:BABA) climbed to its highest 52-week price of $180.16 before trimming gains to end the day just up by 8.19 percent at $176.44 apiece.

At an annual technology conference, Alibaba Group Holding Ltd. (NYSE:BABA) CEO Eddie Wu said that the company was vigorously advancing a three-year AI initiative, boosting the total investment to 380 billion yuan, in line with its strategic vision and anticipation of the artificial superintelligence era.

Alibaba Group Holding Ltd. (NYSE:BABA) said it partnered with chip giant Nvidia Corp. for the expansion of global data centers and development of new AI products as it plans to make the sector a core priority alongside e-commerce.

Wu said that companies globally are spending $4 trillion over the next five years, and that Alibaba “needs to keep up.”