In this piece, we will take a look at the ten best semiconductor stocks to invest in according to DE Shaw. If you want to skip the details about Mr.Shaw, his hedge fund, and the top five stocks in the list, then head on over to 5 Best Semiconductor Stocks to Invest in According to DE Shaw.

D.E. Shaw is an investment firm based out of New York, United States that is named after its founder, the hedge fund billionaire Dr. David Elliot Shaw. Dr. Shaw is one of the few hedge fund executives in the financial world who has a Ph.D., and keeping in line with his academic background, he focuses mostly on research.

He created D.E. Shaw in 1988 and the hedge fund’s beginning is reminiscent of the humble origins of some of the world’s large technology firms such as the Cupertino technology giant Apple, Inc. (NASDAQ:AAPL). D.E. Shaw started out as a firm with six employees and $28 million at the top of a bookstore in New York according to its biography available on its website. Since then, the firm has grown its capital by a couple of orders of magnitude, as its portfolio was worth a staggering $120 billion as the fourth quarter of last year came to an end.

The firm has also transformed its leadership structure since its founding, and it is headed by a six person executive committee today, which is responsible for managing the hedge fund’s daily operations. Dr. Shaw’s role now involves conducting research as the chief scientist at D.E. Shaw Research, LLC. His research is focused on the field of computational biology, and he started working in the field in 2001 and set up D.E. Shaw Research a year later in 2002.

The investment firm is primarily focused on using computational tools for conducting fundamental research for its investments. However, it also takes a look at the qualitative side of things, along with providing private equity capital to new companies.

A brief look at the hedge fund’s portfolio reveals that the top holdings are concentrated in the information technology industry, and since we’re focusing on D.E. Shaw’s top semiconductor picks, the top three holdings in this subsegment of the portfolio are in QUALCOMM Incorporated (NASDAQ:QCOM), Advanced Micro Devices, Inc. (NASDAQ:AMD), and NVIDIA Corporation (NASDAQ:NVDA).

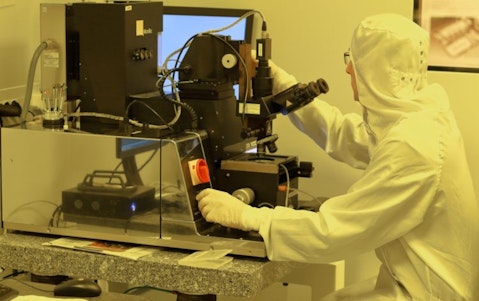

l-n-r2tVRjxzFM8-unsplash

Our Methodology

In order to narrow down D.E. Shaw’s top ten semiconductor picks from the hundreds of different companies and positions present in its investment portfolio, we took a look at the firm’s filings with the Securities and Exchange Commission for the fourth quarter of last year. After the companies were selected, we then analyzed them through their quarterly results, investor reports, analyst ratings, large investors, and overall hedge fund sentiment gathered through Insider Monkey’s survey of 924 hedge funds for Q4 2021.

10 Best Semiconductor Stocks to Invest in According to DE Shaw’s DE Shaw

10. Teradyne, Inc. (NASDAQ:TER)

D.E. Shaw’s Stake Value: $92 million

Percentage of D.E. Shaw’s 13F Portfolio: 0.07%

Number of Hedge Fund Holders: 40

Teradyne, Inc. (NASDAQ:TER) is an American testing equipment provider that enables companies to conduct quality checks on their products. Its Semiconductor Test operating segment allows chip manufacturers to test their wafers post fabrication and other companies to test their products after the chips have been cut out from the wafer and packaged for final assembly.

Teradyne, Inc. (NASDAQ:TER) earned $885 million in revenue and $1.37 in non-GAAP EPS for its fiscal Q4, beating analyst estimates for both. However, the company’s stock isn’t seeing much love from Wall Street these days due to reported manufacturing problems at the Taiwan Semiconductor Manufacturing Company (NYSE:TSM).

Dr. Shaw’s investment firm owned 564,838 Teradyne, Inc. (NASDAQ:TER) shares during the fourth quarter of last year, which translated into a $92 million stake and represented 0.07% of its portfolio. During the same time period, 40 of the 924 hedge funds polled by Insider Monkey also owned the company’s shares.

Teradyne, Inc. (NASDAQ:TER)’s largest investor is Panayotis Takis Sparaggis’ Alkeon Capital Management which owns 3.7 million shares worth $611 million.

Advanced Micro Devices, Inc. (NASDAQ:AMD), QUALCOMM Incorporated (NASDAQ:QCOM), and NVIDIA Corporation (NASDAQ:NVDA) are met by Teradyne, Inc. (NASDAQ:TER) as one of D.E. Shaw’s favorite chip stocks.

9. Qorvo, Inc. (NASDAQ:QRVO)

D.E. Shaw’s Stake Value: $95 million

Percentage of D.E. Shaw’s 13F Portfolio: 0.07%

Number of Hedge Fund Holders: 46

Qorvo, Inc. (NASDAQ:QRVO) is a semiconductor designer that provides chips tailored to the needs of communications devices. Its products are used in devices and systems such as WiFi routers, smartphones, and communications infrastructure. The company is also one of the oldest chip firms in the world, after being founded in 1957, and it is currently headquartered in North Carolina, United States.

D.E. Shaw owned 609,285 Qorvo, Inc. (NASDAQ:QRVO) shares during Q4 2021, in a $95 million stake which represented 0.07% of its investment portfolio. An Insider Monkey survey covering 924 hedge funds during the same time period listed 46 of them owning a stake in the company.

At the end of its fiscal third quarter, Qorvo, Inc. (NASDAQ:QRVO) brought in $1.1 billion in revenue and $2.98 in non-GAAP EPS, in a mixed bag of results that saw it beat EPS estimates but meet them for revenue. The company was awarded a $4.1 million contract in February 2022 by the National Institutes of Health for COVID-19 detection systems.

Seth Klarman’s Baupost Group is Qorvo, Inc. (NASDAQ:QRVO)’s largest investor. It owns 5.9 million shares that are worth $929 million.

8. Western Digital Corporation (NASDAQ:WDC)

D.E. Shaw’s Stake Value: $97 million

Percentage of D.E. Shaw’s 13F Portfolio: 0.08%

Number of Hedge Fund Holders: 51

Western Digital Corporation (NASDAQ:WDC) is a renowned storage devices manufacturer that is known for selling products such as hard disk drives (HDDs) and solid state drives (SSDs). The company’s enterprise SSD segment, which provides storage devices for corporate customers, uses metal oxide semiconductor (MOS) based integrated circuit chips that result in superior performance over traditional equipment.

Western Digital Corporation (NASDAQ:WDC) brought in $4.83 billion in revenue and $2.30 in non-GAAP EPS for its fiscal second quarter, which saw it beat analyst estimates for both. After material contamination affected the company’s flash production operations in Japan in February 2022, the company announced in March that it has resumed production as normal and the effect of the disruption will be felt later this year.

Dr. Shaw’s investment firm held 1.4 million Western Digital Corporation (NASDAQ:WDC) shares during Q4 2021. These were worth $97 million and represented 0.08% of its portfolio. During the same time period, 51 of the 924 hedge funds analyzed by Insider Monkey held a stake in the storage device company.

Western Digital Corporation (NASDAQ:WDC)’s largest investor is Andrew Wellington and Jeff Keswin’s Lyrical Asset Management through a $258 million stake via 3.9 million shares.

7. ASML Holding N.V. (NASDAQ:ASML)

D.E. Shaw’s Stake Value: $141 million

Percentage of D.E. Shaw’s 13F Portfolio: 0.11%

Number of Hedge Fund Holders: 41

ASML Holding N.V. (NASDAQ:ASML) is a Dutch company that is responsible for building machines that are capable of manufacturing semiconductors on the latest technologies present in the world. It is also the only company that can make these machines, making it crucial for the chip sector.

For its fourth fiscal quarter, ASML Holding N.V. (NASDAQ:ASML) earned €4.98 billion in revenue and €4.27 in GAAP EPS. The company announced in January 2022 that is partnering up with U.S. chip giant Intel Corporation for its TWINSCAN EXE:5200 system. This is a chip production machine that uses a larger lens and extreme ultraviolet light to manufacture more than 200 silicon wafers in an hour. According to the deal, Intel Corporation (NASDAQ:INTC) will be the first in the world to buy the machine from ASML Holding N.V. (NASDAQ:ASML)

D.E. Shaw owned 178,356 ASML Holding N.V. (NASDAQ:ASML) shares during Q4 2021. These were worth $141 million and represented 0.11% of its portfolio. Insider Monkey’s research during the same time period covering 924 hedge funds revealed that 41 had also owned a stake in the company.

ASML Holding N.V. (NASDAQ:ASML)’s largest investor is Ken Fisher’s Fisher Asset Management. It owns a $3.4 billion stake that comes through 4.2 million shares.

Polen Capital mentioned ASML Holding N.V. (NASDAQ:ASML) in its Q2 2021 investor letter. Here is what the firm said:

“Dutch technology company ASML is the world’s only supplier of photolithography systems to leading-edge semiconductor manufacturers. It is a gross simplification and a valid point to note that ASML’s technology enables the computing technology we use today. For years, ASML Holding N.V. (NASDAQ:ASML) engineers bent the laws of physics and enabled Moore’s Law—which states that computer chips will become faster and cost less—to progress.

Incremental innovation gains mushroomed with the rollout of Extreme Ultraviolet (EUV) technology. We were impressed by management’s recent acknowledgment that demand for ASML’s lithography systems is exceeding their prior expectations. Recent announcements by management and major customers for ASML give us even more confidence in the sustainability of growth. We believe ASML Holding N.V. (NASDAQ:ASML) could grow its earnings at a high-teens rate over the coming five years.”

6. Marvell Technology, Inc. (NASDAQ:MRVL)

D.E. Shaw’s Stake Value: $143 million

Percentage of D.E. Shaw’s 13F Portfolio: 0.11%

Number of Hedge Fund Holders: 61

Marvell Technology, Inc. (NASDAQ:MRVL) is a semiconductor firm that offers several kinds of products such as processors and signals processing devices. These products are used in technology gadgets such as printers, smartphones, and WiFi devices.

As its fiscal fourth quarter came to an end, Marvell Technology, Inc. (NASDAQ:MRVL) reported that it had earned $1.34 billion in revenue and $0.50 in non-GAAP EPS, beating analyst estimates for both and posting a whopping 68% annual revenue growth. Susquehanna raised the company’s share price target to $105 from $100 in March 2022, outlining that the company’s presence in several growing industries such as data centers and telecommunications are positive drivers.

D.E. Shaw’s stake in Marvell Technology, Inc. (NASDAQ:MRVL) was worth $143 million as Q4 2021 came to an end, as it owned 1.6 million shares. Insider Monkey’s research covering 924 funds for the same time period revealed that 61 had owned a stake in the company.

Ken Griffin’s Citadel Investment Group is Marvell Technology, Inc. (NASDAQ:MRVL)’s largest investor through owning 5.3 million shares that are worth $466 million.

Marvell Technology, Inc. (NASDAQ:MRVL) was mentioned by Carillon Tower Advisers in its fourth quarter 2021 investor letter. Here is what the fund said:

“Marvell Technology provides infrastructure semiconductor solutions. Investors have recently appreciated the particularly strong growth the company has posted, as it is winning designs in the datacenter server market as well as winning notable contracts in the upcoming 5G wireless infrastructure build-outs. Supply chain issues had hampered growth in 2021 for the company, but with some improvements there recently, we believe Marvell is set to exhibit robust growth in the upcoming year.”

Marvell Technology, Inc. (NASDAQ:MRVL) joins QUALCOMM Incorporated (NASDAQ:QCOM), Advanced Micro Devices, Inc. (NASDAQ:AMD), and NVIDIA Corporation (NASDAQ:NVDA) in the list of D.E. Shaw’s top semiconductor picks.

Click to continue reading and see 5 Best Semiconductor Stocks to Invest in According to DE Shaw.

Suggested articles:

- 15 Best Consumer Discretionary Stocks to Buy Now

- 11 Best Blue Chip Stocks To Buy Now

- 10 Best EV Startups to Watch

Disclosure: None. 10 Best Semiconductor Stocks to Invest in According to DE Shaw is originally published on Insider Monkey.