More than two years ago we prepared the following list of the 10 best hospitality stocks to buy according to hedge funds. In this article we are going to take a look at the performance of these stocks over the last 28 months. The top 5 stocks listed in the article returned 9.6% whereas the remaining 5 articles lost an average of 20%. This shows that consensus hedge fund sentiment on the most promising hospitality stocks was a pretty accurate tool to identify the winners in the hospitality sector.

Every cloud has a silver lining. The COVID-19 pandemic rocked the industries in general and the hospitality industry in particular. Hotels have seen a rapid drop in occupancy rates, dropping to unprecedented slumps due to the coronavirus (COVID-19) pandemic. With the implementation of travel restrictions to curb the spread of the disease, international and domestic tourism came to a halt.

According to the American Hotels and Lodging Association (AHLA). This sharp downturn is unprecedented within the industry and has led to extreme layoffs and declines in profit.

Since humans are a social animal, their quest for better options and exploring the world would never allow them to sit back at home. Things are getting better for once again at the landscapes in Post pandemic zone. Most US leisure travelers want additional health and safety steps when asked what it would take to get them to fly again, according to the McKinsey Market Leisure Travel Report, which surveyed 3,498 travelers from five countries in April 2020. Travel demand will bounce back in 2021-22. Though figures are not satisfactory, there is a significant improvement to Q2 2020.

Another excellent and encouraging news for the investors and industry is, one of the world’s most valuable start-ups, Airbnb (NASDAQ: ABNB) went public. The company did well amid the pandemic to sustain a healthy revenue base. According to NASDAQ “Given its well-known brand, and compelling growth story, it’s no shock investors have been chomping at the bit to buy this stock. But, with shares getting ahead of themselves, it hard not to be concerned about valuation.”

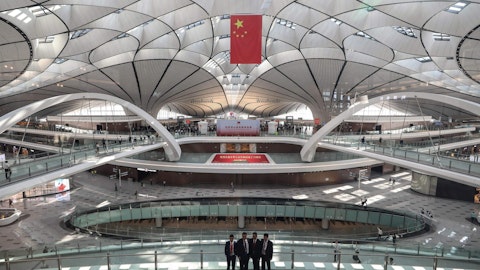

Kaspars Grinvalds/Shutterstock.com

I have ranked these stocks by using our hedge fund sentiment data to come with the list of the 10-best hotel and hospitality stocks to buy now.

1o. Service Properties Trust (NASDAQ: SVC)

No of HFs: 15

Return: -27%

Total Value of HF Holdings: $79 Million

Service Properties Trust is in the business of leasing properties and hotels. The hotels range from midscale to upscale select service and extended stay hotels and upscale to luxury full-service hotels and convenient for business travelers. The company has 329 hotels, 804 net leases with total properties of 1,133, 149 brands in 47 states.

After the opening of the hotels in 2020 September, the net loss that occurred was 173.6 million. The company has paid a $400 million term loan on 5th November 2020 to build trust and faith in the market and to their shareholders.

Adjusted EBITDA For nine months ended September 2020 was 450.9 million US dollars, such revenue after during Wuhan Virus pandemic proves that the company has a business model to help their shareholders to earn in form of returns and dividends. We hope to see more acquisitions in properties and contracts with brands in the foreseeable future.

John Murray, President and Chief Executive Officer of SVC, made the following statement:

“Our financial results during the third quarter reflect the impact of the COVID-19 pandemic on the economy generally and the hospitality industry specifically. The failure of IHG and Marriott to pay our minimum returns led us to terminate these hotel management agreements and move towards rebranding the hotels to Sonesta brands and management.”

9. RLJ Lodging Trust (NYSE: RLJ)

No of HFs: 15

Return: -35.4%

Total Value of HF Holdings: $79 Million

RLJ Lodging Trust is a hotel investment business and believes in generating more cash flow by improving its portfolio by owning premium-branded, disciplined employees and services hotels. The portfolio consists of 103 hotels with approximately 22,570 rooms located in 23 states.

The company is improving their services in leisure and business transient and small group demand. The company’s prime strategy is to invest in focused-service and compact full-service hotels, which normally generate most of their profits from room rentals.

RLJ Lodging Trust has generated positive gross and maintains total liquidity of $1.2 billion as of the third quarter of 2020. The portfolio has achieved total revenue of $ 83.9, opened 96 hotels, decrease in revenue reflects 0% occupancy during the pandemic.

RLJ Lodging Trust maintained 1 billion US dollars of unrestricted cash. The improvement in total unrestricted cash proves that the company has made its stand against the hit from the recession and the Wuhan virus pandemic.

8. Sunstone Hotel Investors, Inc. (NYSE: SHO)

No of HFs: 17

Return: -22.5%

Total Value of HF Holdings: $191 Million

Having focused on achieving high returns to their shareholders and building strong faith and trust by improving their business model portfolio. The company has 17 hotels with 9,017 rooms in an upper-upscale segment that is being managed and operated by brands such as Marriott, Hilton, and Hyatt.

Till last quarter, the company generated $ 503.6 million revenue and Net loss of $340 million, decrease in revenue reflects 0% occupancy during the pandemic.

Sunstone Hotel Investors, Inc. moving forward with more investment as of 2.6 billion US dollars in hotel properties. The company sold out Renaissance Los Angeles Airport at an alluring valuation to further strengthen its portfolio into Long-Term Relevant Real Estate and increases considerable liquidity. The company is well placed to navigate the current environment and debt to free cashflow suggesting that the company is doing well can be able to pay off long-term debt in few years.

Here’s what John Arabia, President and CEO of Sunstone, stated:

“We are pleased to announce the second amendment of our unsecured debt agreements, extending the covenant relief period through the first quarter 2022, which will offer increased flexibility and provide the Company with the necessary near-term covenant relief and the ability to invest in acquisition opportunities that arise.”

7. Marriott Vacations Worldwide Corporation (NYSE: VAC)

No of HFs: 17

Return: -18.4%

Total Value of HF Holdings: $375 Million

2019, the great year for Marriott Vacations Worldwide Corporation worldwide implemented the technology to compete in the market, the company has adopted the digital world and partnered with PlacePass, an online marketplace where customers around the globe can visit and experience the vast possibilities and services provided by Marriott Vacations Worldwide Corporation and personalize their experiences.

The company has made huge contract sales in vacation ownership which was around 1.5 billion US dollars in the year 2019, with overall revenue of 4.355 billion US dollars. The good faith shown by the company has built trust long-lasting and created an opportunity to the mindset for new shareholders and new investors, proving that Marriott Vacations Worldwide Corporation has what it takes to compete in the market.

For the 3Q ended on 30 September 2020, Marriott Vacations Worldwide Corp revenues decreased 32% to $2.14B. Net loss of $238M. The company has also secured 25% increase in vacation ownership contract sales to $178 million in the prior quarter.

On Jan. 26, 2021, Company announced that it has entered into a definitive agreement to acquire Welk Resorts, one of the largest independent timeshare companies in North America for approximately $430 million.

Here’s what Stephen P. Weisz, Chief Executive Officer of Marriott, has to say about the acquisition:

“The acquisition will expand Hyatt Residence Club’s geographic presence while providing substantial future growth opportunities.”

6. Host Hotels & Resorts, Inc. (NASDAQ: HST)

No of HFs: 21

Return: 3.8%

Total Value of HF Holdings: $212 Million

A team of highly skilled employees in the lodging industry such as Host Hotels & Resorts, Inc. provides services which are to renovate and develop luxury and upper-scale hotels, sometimes acquiring and selling them. Monetizing their well-disciplined employee are the major focus for Host Hotels & Resorts, Inc. to stand in the competitive market and build the business and create a high risk-adjusted return for their shareholders and new coming customer around the globe.

There are 79 hotels and 46,100 luxury and upper-upscale rooms worldwide, Companies’ total Enterprise Value is $11 Billion. Till the previous quarter, Host Hotels and Resorts Inc revenues decreased 67% to $1.35B. Net loss totalled $668M Revenue owing to declining Occupancy rate during the pandemic.

The Company achieved a place on the global environmental impact non-profit CDP’s prestigious A List, By being named to the Climate A List, Host has been distinguished for its actions to mitigate climate risks and manage its environmental impacts, based on the Company’s climate disclosure in 2020.

5. Ryman Hospitality Properties, Inc. (NYSE: RHP)

No of HFs: 24

Return: 20.2%

Total Value of HF Holdings: $405 Million

Specialized in group-oriented, destination hotel assets Ryman Hospitality Properties Inc is a leading lodging and hospitality company. The company is also indulged in the music segment through a vibrant collection of entertainment venues.

”The Company is the sole owner of Gaylord Opryland Resort & Convention Centre; Gaylord Palms Resort & Convention Center; Gaylord Texan Resort & Convention Center; and Gaylord National Resort & Convention Center. It is the majority owner and managing member of the joint venture that owns Gaylord Rockies Resort & Convention Center.”

As business is going back on right track, hospitality portfolio is getting profitable Successful holiday programs drove transient demand, with over 1 million event tickets sold in Q4.

The hospitality business is getting back on track in Q4 there was 19.6% of occupancy rate. The company collected $16 million of cancellation fees, Rebooked approximately 58% of canceled room nights from March 2020 through January 21, 2021.

Here’s what Colin Reed, Chairman and Chief Executive Officer of the company stated:

“The successful extension of our covenant waiver period, along with the additional financial and operational flexibility provided by the second amendment, will assist us in our efforts to recover from the COVID-19 pandemic and to quickly begin serving our group customers once the COVID-19 vaccine becomes widely available and groups are once again able to travel,”

4. Hyatt Hotels Corporation (NYSE: H)

No of HFs: 26

Return: 34.3%

Total Value of HF Holdings: $574 Million

Hyatt Hotels Corporation a leading global hospitality company, offering 20 premier brands operating more than 950 hotels, in 67 countries globally. The Company’s prime growth strategy is aimed to build long term relationships with customers and create value for investors.

Hyatt Hotels Corporation has an extremely lucrative plan in near future. There is an expansion of the exclusive 68-room adults-only retreat luxury lifestyle Alila brand in the United States. The Hyatt Hotel Corporation also announced about the 368-room luxury hotel including 54 residential units in the commercial and retail center of Al Khobar with a connecting bridge to Al Rashid Mall, another 319-room hotel of Hyatt Regency Ningbo Hangzhou Bay in Ningbo, China.

For the third quarter of 2020 Hyatt Hotels Corporation revenues decreased 56% to $1.64B, Net income decreased 154.2% to a net loss of $161 million. Adjusted EBITDA decreased 129.9% to $48 million owing to the sharp decline in services and occupancy rate.

Here’s what Takuya Aoyama, vice president of development for Europe and Africa, Hyatt stated:

“We are thrilled to announce plans for the first Hyatt-branded hotel in the Baltics as we continue to prioritize thoughtful growth in locations that matter most to our guests, World of Hyatt members, customers and owners,”

3. Choice Hotels International, Inc. (NYSE: CHH)

No of HFs: 27

Return: 5.6%

Total Value of HF Holdings: $124 Million

When it comes to franchises network, the choice hotels international is the largest on global. Comprises more than 7100 hotels and manages around 600,000 rooms in more than 40 countries and regions.

For the 3Q 2020, Choice Hotels International Inc revenues decreased 31% to $580.7M. Revenues reflect Hotel Franchising segment decrease of 33% to $560.1M, Occupancy. There is no changes in financial fundamentals.

Choice Hotels and Penn National Gaming Team Up To Offer More Fun And Entertainment Through The Ascend Hotel Collection. Here’s what Robert McDowell, chief commercial officer of CHH stated:

“With these exciting Penn properties joining Choice and our Ascend Hotel Collection network, we will be able to provide guests even more upscale travel experiences and a wider variety of fun and entertainment on the road,”

2. Wyndham Destinations, Inc. / Travel + Leisure Co (NYSE: TNL)

No of HFs: 29

Return: -21.3%

Total Value of HF Holdings: $474 Million

Wyndham destinations, the largest vacation club globally is moving towards the goal to put the world on vacation, the company using technology to provide a platform to million members and owner families to rent, exchange their vacation with others and reap benefits other than steady income such as quality and valued services from Wyndham Destinations.

The company is a network of 230 resorts, global presence in 110 countries, also provides access to more than 4200 affiliated resorts around the globe. In a strategic alliance, Wyndham destination acquires Travel + Leisure Brand from Meredith Corporation. The new Travel + Leisure Co. will trade on the NYSE.

Wyndham Destinations Inc revenues decreased 51% to $1.52B sales were crushed by increased restrictions related to COVID-19, in Hawaii and California where resorts were closed in December.

Here’s what Michael D. Brown, president, and CEO of Wyndham Destinations stated:

“We were pleased to finish the year strong while adhering to important and necessary safety guidelines for the benefit of our owners, members, and associates, restrictions in California and certain other markets curtailed the momentum we had coming out of the summer.”

1. Wyndham Hotels & Resorts, Inc. (NYSE: WH)

No of HFs: 33

Return: 9.2%

Total Value of HF Holdings: $621 Million

Wyndham Hotels & Resorts is among the world’s largest network of hotels. The company has around 9000 hotels across 20 brands across 90 countries.

At a critical juncture when both travelers and hoteliers looking for advanced, digital solutions to help steer the challenges of the pandemic, Wyndham Hotels & Resorts announces the launch of its new mobile App.

In the third quarter room openings expanded sequentially both in the U.S. and globally and Company grew its pipeline by 3 % to 185,000 rooms globally. Revenues declined from $560 million in the 3Q of 2019 to $337 million in the 3Q of 2020.

Here’s what President and CEO of Wyndham, Geoffrey A. Ballotti stated:

“Importantly, we executed 152 hotel agreements, including 23 percent more domestic conversion signings than the third quarter of 2019. As always, we remain dedicated to supporting our owners around the world during these challenging times.”

You can also take a peek at George Soros’ Top 10 Stock Picks and Billionaire Lee Cooperman’s Top 10 Stock Picks.

Disclosure: None. 10 Best Hospitality Stocks to Buy Now is originally published on Insider Monkey.