In this article, we discuss 10 best healthcare stocks to buy in 2022. If you want to skip our detailed analysis of these stocks, go directly to 5 Best Healthcare Stocks To Buy In 2022.

The post-COVID world has highlighted several existing and emerging healthcare trends, such as shifting consumer preferences, the collaboration of life sciences and healthcare, new digital health technologies, younger talent, and clinical innovation. Amid uncertainty and a reinvented outlook for the public health sector, healthcare companies are benefiting from and adapting to changes such as remote working, virtual doctor visits, and supply chain challenges.

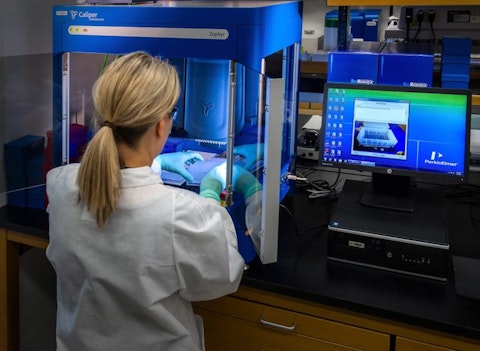

The growing transformation of the healthcare sector also includes IoT and AI-enabled algorithms and investments into technologies that will continue to enhance patient diagnosis and treatment, in addition to escalating focus on research and development.

Healthcare stocks are a huge component of the S&P 500 Index, and companies like Teladoc Health, Inc. (NYSE:TDOC), Abbott Laboratories (NYSE:ABT), and UnitedHealth Group Incorporated (NYSE:UNH) are some of the leading contenders in the sector.

Our Methodology

We selected healthcare stocks which received positive ratings from analysts in the last few weeks and were popular among the hedge funds tracked by Insider Monkey.

Data from 867 hedge funds monitored by Insider Monkey was used to assess the hedge fund sentiment around each stock.

Best Healthcare Stocks To Buy In 2022

10. Royalty Pharma plc (NASDAQ:RPRX)

Number of Hedge Fund Holders: 20

Royalty Pharma plc (NASDAQ:RPRX) is a leading American buyer of biopharmaceutical royalties, funding innovation across the biopharmaceutical industry. Royalty Pharma plc (NASDAQ:RPRX) partners with innovators from academic institutions, research hospitals and not-for-profits, small and mid-cap biotechnology companies, and pharmaceutical companies.

On January 6, Royalty Pharma plc (NASDAQ:RPRX) declared a $0.19 per share quarterly dividend, which is an 11.8% increase from its prior dividend of $0.17. The dividend is payable on March 15, to shareholders of record on February 18.

Tigress Financial analyst Ivan Feinseth on December 17 raised the price target on Royalty Pharma plc (NASDAQ:RPRX) to $52 from $50 and kept a Buy rating on the shares after the company’s “strong” Q3 results. The analyst, who sees “a long runway of investment opportunities” driving significant growth in revenue, cash flow, and dividend increases at Royalty Pharma plc (NASDAQ:RPRX), noted that his $52 price target represents a potential return of over 36% from current levels.

Among the hedge funds tracked by Insider Monkey in Q3 2021, 20 funds were bullish on Royalty Pharma plc (NASDAQ:RPRX), with stakes totaling $1.96 billion. Adage Capital Management held the leading stake in Royalty Pharma plc (NASDAQ:RPRX), with 24.6 million shares worth $892.5 million.

9. Sage Therapeutics, Inc. (NASDAQ:SAGE)

Number of Hedge Fund Holders: 22

Sage Therapeutics, Inc. (NASDAQ:SAGE) is a Massachusetts-based biopharmaceutical company providing medicines to treat central nervous system disorders.

Needham analyst Ami Fadia on January 6 raised the price target on Sage Therapeutics, Inc. (NASDAQ:SAGE) to $85 from $79 and kept a Buy rating on the shares while naming the stock Needham Top Pick for 2022 and affirming its position on Needham’s Conviction List. The analyst is positive on the stock’s “setup” this year with several pipeline catalysts.

In the third quarter of 2021, 22 hedge funds were bullish on Sage Therapeutics, Inc. (NASDAQ:SAGE), down from 27 funds in the quarter earlier. D E Shaw held the largest stake in Sage Therapeutics, Inc. (NASDAQ:SAGE), with 1.25 million shares worth $55.6 million.

In addition to Teladoc Health, Inc. (NYSE:TDOC), Abbott Laboratories (NYSE:ABT), and UnitedHealth Group Incorporated (NYSE:UNH), Sage Therapeutics, Inc. (NASDAQ:SAGE) is a notable healthcare stock heading into 2022.

8. Bio-Rad Laboratories, Inc. (NYSE:BIO)

Number of Hedge Fund Holders: 38

Bio-Rad Laboratories, Inc. (NYSE:BIO) is a California-based manufacturer of specialized technological products for the life science research, medical laboratories, and clinical diagnostics markets.

Publishing its Q4 results on February 10, Bio-Rad Laboratories, Inc. (NYSE:BIO) reported earnings per share of $3.21, exceeding estimates by $0.34. The company’s revenue over the period totaled $732.77 million, surpassing estimates by $825,500.

On February 11, Citi analyst Patrick Donnelly raised the price target on Bio-Rad Laboratories, Inc. (NYSE:BIO) to $800 from $750 and kept a Buy rating on the shares after the Q4 results. The company guided 2022 well ahead of expectations, the analyst told investors in a bullish note.

Among the hedge funds tracked by Insider Monkey, 38 funds held long positions in Bio-Rad Laboratories, Inc. (NYSE:BIO) in the third quarter of 2021, down from 41 funds in the quarter earlier. Marshall Wace LLP held the biggest stake in Bio-Rad Laboratories, Inc. (NYSE:BIO) in Q3 2021, with 439,344 shares worth $327.7 million.

7. Teladoc Health, Inc. (NYSE:TDOC)

Number of Hedge Fund Holders: 40

Teladoc Health, Inc. (NYSE:TDOC) creates virtual healthcare services on a B2B basis in the United States and internationally, offering medical opinions, AI and analytics, and telehealth devices.

Goldman Sachs analyst Cindy Motz on February 11 initiated coverage of Teladoc Health, Inc. (NYSE:TDOC) with a Buy rating and a $121 price target. As the global leader in the virtual healthcare space, Teladoc Health, Inc. (NYSE:TDOC) is “uniquely positioned” to advance the overall integration of digital into healthcare, “paving the way for the healthcare technology sector to become more disruptive,” the analyst told investors in a research note.

On December 16, Teladoc Health, Inc. (NYSE:TDOC) announced an expanded partnership with the National Labor Alliance of Health Care Coalitions, the largest alliance of labor unions and labor management coalitions, to offer its full suite of virtual care products and services.

In Q3 2021, ARK Investment Management was the biggest stakeholder of Teladoc Health, Inc. (NYSE:TDOC), with 16.4 million shares worth more than $2 billion. Overall, 40 hedge funds were bullish on the stock in the third quarter of 2021, down from 43 funds in the quarter earlier.

Here is what Greenhaven Road Capital has to say about Teladoc Health, Inc (NYSE:TDOC) in its Q4 2021 investor letter:

“Teladoc Health (TDOC) – I agree with the common sentiment that we have seen the end of the tailwinds many companies enjoyed due to the massive customer behavior changes necessitated by staying home. Shares of “Covid beneficiaries” have sold off dramatically as a result. The share price of Teladoc Health (TDOC) is down >75% and instead of selling for 20X revenues, they are trading for less than 5X revenues.

What do we get at this reduced price? For starters, unlike many other “Covid beneficiaries,” Teladoc still expects to grow 25-30% per year for the next three years, regardless of progress to a more normalized environment. Is this plausible? For starters, management pre-announced revenues and reaffirmed their projections at the JPMorgan healthcare conference after their big selling season was complete, so there are indications that the company continues to believe. More importantly, the path to continued growth is primarily from selling additional products to existing customers. Over the past ten years,

Teladoc Health (TDOC) has evolved from being a Zoom solution for doctors to a much broader swath of comprehensive service offerings, including the delivery of mental healthcare, the monitoring of chronic conditions, lab testing, and specialist referrals. Teladoc is a telehealth provider that benefits from a large number of offerings as well as a broad geographic footprint in the U.S. and internationally. This scale enables it to provide a comprehensive solution for a health plan or a company making selections for large groups of patients. The benefits of scale are also realized on the development/product front, where there is a large base of 76M end customers to spread investments across. The net result of their product breadth and technology investments is that the company can provide “whole person care” on a purpose-built technology platform…” (Click here to see the full text)

6. Seagen Inc. (NASDAQ:SGEN)

Number of Hedge Fund Holders: 40

Seagen Inc. (NASDAQ:SGEN) is a Washington-based biotechnology company that creates antibody-based therapies for treating cancer. Among the hedge funds tracked by Insider Monkey, 40 funds were bullish on Seagen Inc. (NASDAQ:SGEN) in Q3 2021, up from 37 funds in the preceding quarter.

Publishing its Q4 earnings report on February 9, Seagen Inc. (NASDAQ:SGEN) posted a loss per share of $0.95, missing estimates by $0.08. Revenue over the period came in at roughly $430 million, surpassing estimates by $28.18 million.

Oppenheimer analyst Jay Olson lowered the price target on Seagen Inc. (NASDAQ:SGEN) on February 11 to $162 from $198 but kept an Outperform rating on the shares. While Seagen Inc. (NASDAQ:SGEN) delivered “solid” Q4 financial results overall with $176 million in Adcetris sales, management forecast negative growth for Tukysa in 2022, the analyst told investors in a research note. While the guidance may be disappointing, he remains optimistic on the long-term growth with continued label and geographical expansions in the near-term.

Seagen Inc. (NASDAQ:SGEN) is a popular healthcare stock among smart investors, just like Teladoc Health, Inc. (NYSE:TDOC), Abbott Laboratories (NYSE:ABT), and UnitedHealth Group Incorporated (NYSE:UNH).

Here is what Carillon Tower Advisers has to say about Seagen Inc. (NASDAQ:SGEN) in their Q4 2020 investor letter:

“Seagen Inc. (NASDAQ:SGEN) is a biotechnology company engaged in the development and commercialization of monoclonal antibody-based therapies for the treatment of cancer. The stock slumped a bit in the quarter after the firm announced it was lowering guidance for its drug Adcetris, which is an antibody medication used to treat lymphoma. We remain optimistic on the stock, primarily due to the company’s appealing pipeline of new products as well as the continued growth of Padcev (for metastatic urothelial cancer) and Tucatinib (for breast cancer).”

Click to continue reading and see 5 Best Healthcare Stocks To Buy In 2022.

Suggested articles:

- 10 High Dividend Stocks with Over 12% Yield

- 13 Uranium Stocks Popular on Reddit

- 10 Best Solar Energy Stocks to Buy for 2022

Disclosure: None. 10 Best Healthcare Stocks To Buy In 2022 is originally published on Insider Monkey.