In this piece, we discuss the 10 Best Debt Free Small Cap Stocks to Buy Now.

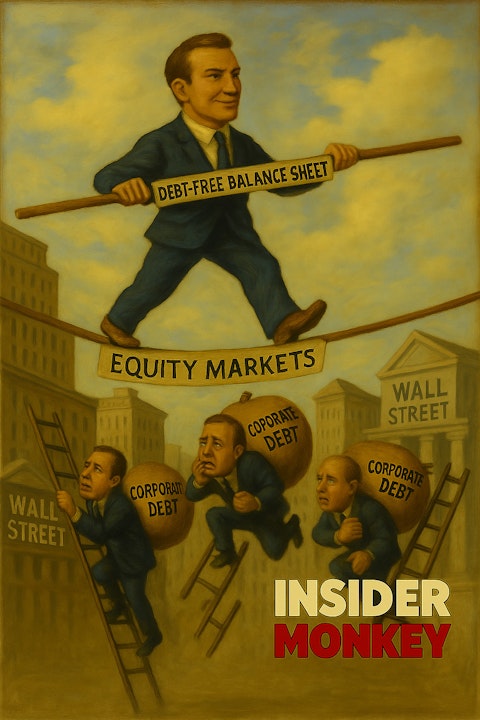

High leverage can be both an advantage and a liability. While on one hand, borrowing may reduce taxable income and increase returns in good times, on the other hand, it can also create fixed obligations that linger when profits shrink.

For small-cap companies, which are often characterized by uneven cash flows, high leverage can quickly turn into a liability. On the other hand, debt-free or low-debt companies enjoy the flexibility to reinvest in operations, carry out acquisitions, or return capital to shareholders. These debt-free or low-debt companies pose a competitive edge that grows more valuable when the economy softens. This is increasingly relevant today, as S&P Global Market Intelligence notes that U.S. corporate bankruptcy filings are estimated to hit their highest first-half total since 2010, with 371 filings year-to-date. Balance sheets across sectors are under pressure due to elevated interest rates, tighter credit conditions, and pressure from persistent inflation and tariff policies.

Still, broader equity markets remain on their upward trajectory. On Monday, September 23, 2025, the S&P 500, Nasdaq, and Dow all closed the day at record highs, thanks to a 3.9% surge in Nvidia following its $100 billion investment in OpenAI to scale data centers. Additionally, Oracle and Apple also closed the day higher, while the Russell 2000 small-cap index hit its first record close since 2021, driven by the Federal Reserve’s recent rate cut.

With this backdrop in mind, let’s move to our list of the 10 Best Debt Free Small Cap Stocks to Buy Now.

Our Methodology

To curate our list of the 10 Best Debt Free Small Cap Stocks to Buy Now, we used the Finviz screener to curate a list of stocks with a market capitalization of under $2 billion. For these stocks, we compared their enterprise value (EV) to their market capitalization (EV to market cap ratio) to gauge which ones are debt-free. These companies may not be entirely debt-free, but they maintain a solid financial standing with low net debt and substantial cash reserves. Finally, we ranked these stocks in ascending order based on the number of hedge funds holding stakes in respective stocks, as of Q2 2025.

Why are we interested in the stocks that hedge funds pile into? The reason is simple: our research has shown that we can outperform the market by imitating the top stock picks of the best hedge funds. Our quarterly newsletter’s strategy selects 14 small-cap and large-cap stocks every quarter and has returned 373.4% since May 2014, beating its benchmark by 218 percentage points (see more details here).

10. Anavex Life Sciences Corp. (NASDAQ:AVXL)

EV to Market Cap: 0.86

Number of Hedge Fund Holders: 9

Anavex Life Sciences Corp. (NASDAQ:AVXL) is one of the 10 Best Debt Free Small Cap Stocks to Buy Now.

On September 11, 2025, H.C. Wainwright reiterated its ‘Buy’ rating on Anavex Life Sciences Corp. (NASDAQ:AVXL) with a $42 price target. This bullish stance follows new Phase 2b/3 Alzheimer’s data.

Anavex Life Sciences Corp. (NASDAQ:AVXL)’s shares are currently trading well below this target, indicating significant upside potential. Meanwhile, the company announced on September 9, 2025, that its oral therapy blarcamesine noted reduced cognitive decline across key measures in early Alzheimer’s patients. This bolsters confidence in the company’s precision medicine approach.

Anavex Life Sciences Corp. (NASDAQ:AVXL), a biopharmaceutical company, develops novel therapeutics for neurodegenerative, neurodevelopmental, and neuropsychiatric disorders. It is one of the Best Debt Free Stocks.

9. Daqo New Energy Corp. (NYSE:DQ)

EV to Market Cap: 0.08

Number of Hedge Fund Holders: 10

With significant upside potential, Daqo New Energy Corp. (NYSE:DQ) secures a spot on our list of the 10 Best Debt Free Small Cap Stocks to Buy Now.

On September 11, 2025, under a retrial verdict, Daqo New Energy Corp. (NYSE:DQ)’s subsidiary Xinjiang Daqo was ordered to pay roughly $453,000 in compensation and attorneys’ fees to two companies that had provided silicon core processing services.

Furthermore, the court also affirmed the termination of the cooperation agreement between the parties. Meanwhile, the plaintiff’s claims for consequential damages were rejected by the court. Daqo New Energy Corp. (NYSE:DQ) stated that the litigation’s impact on its subsidiary will be contingent upon the final verdict.

Daqo New Energy Corp. (NYSE:DQ) manufactures and sells high-purity polysilicon to photovoltaic product manufacturers in China. It is one of the Best Debt Free Stocks.

8. MasterCraft Boat Holdings, Inc. (NASDAQ:MCFT)

EV to Market Cap: 0.78

Number of Hedge Fund Holders: 11

MasterCraft Boat Holdings, Inc. (NASDAQ:MCFT) is one of the 10 Best Debt Free Small Cap Stocks to Buy Now.

On September 17, 2025, MasterCraft Boat Holdings, Inc. (NASDAQ:MCFT) announced that it had added five new dealerships across Mexico and Germany. These additions are part of the company’s international expansion strategy. Two of the five dealerships are in Mexico City and Valle de Bravo, while three are located in Germany.

These new dealerships were selected based on track record, product expertise, and commitment to customer care standards, MasterCraft Boat Holdings, Inc. (NASDAQ:MCFT) stated. This expansion is expected to strengthen the company’s market presence in key international regions.

MasterCraft Boat Holdings, Inc. (NASDAQ:MCFT) designs, manufactures, and markets recreational powerboats. It is one of the Best Debt Free Stocks.