Finger-licking buying opportunity?

The investment thesis behind buying Yum! is that its difficulties in China will be swiftly resolved, and the company’s sales and margins will come back strongly in the second half of the year. If you buy this argument then you must look into the causes of its problems.

Yum! Brands, Inc. (NYSE:YUM)’s issues in China started with a scare over the quality of its chicken supply, and then moved on to consumers being reluctant to eat poultry due to an outbreak of avian flu. The positive case sees these problems as being short term in nature, and the current valuation as being attractive relative to its long term prospects.

A quick look at its trailing P/E ratio:

YUM PE Ratio TTM data by YCharts.

Superficially, the above suggests the stock is currently expensive. In addition, if you assume it hits its estimate of “mid-single-digit percentage decline” for 2013, then the stock is priced at roughly 23 times forward earnings as I write.

However, Yum! Brands, Inc. (NYSE:YUM) forecasts its Chinese sales growth to turn positive in the fourth quarter, with 2014 turning into a year of stellar growth because comparables will be a lot easier. If Yum! hits analysts’ estimates of $3.79 in EPS for 2014, then the stock would be trading on a forward valuation of 18.8x earnings. This makes it look historically cheap, so should you pile in?

KFC disappoints in China

In its latest results, Yum! reported that its same-store sales for KFC in China were down 20% for the second quarter in a row. However, in its recent conference call, Yum!’s management outlined – in no uncertain terms – that its EPS forecasts were dependent on Chinese sales coming back swiftly for its KFC operations. It also served up a few indicators as to why it feels confident:

KFC same-store sales in China were down 13% in June, compared to 26% for the second quarter, indicating that the worst may be over.

KFC made low-teens sequential improvements in same-store sales in China from April to May, and then May to June.

Yum! Brands, Inc. (NYSE:YUM)’s second major restaurant chain, Pizza Hut, recorded 7% same-store sales growth in China for the quarter, suggesting that KFC’s problems are company-specific, not due to a weakening Chinese consumer market.

Overall emerging-market-same store sales grew 5% in the quarter

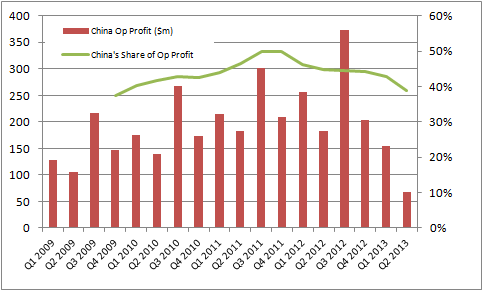

In order to demonstrate the importance of China to Yum!, here is a chart comparing its quarterly operating profit and the percentage of Yum! Brands, Inc. (NYSE:YUM)’s total operating profit that comes from the country:

Source: Yum! Brands financial statements.

In summary, all of these points suggest that Yum! can turn around performance in its key profit center. But what is the rest of its industry saying?

A twist in the tale

Unfortunately, Yum! isn’t alone in seeing weaker results in China. In fact, its biggest rival, McDonald’s Corporation (NYSE:MCD), also started to see its same-store sales growth slowing at the end of 2011. The main difference appears to be that Yum! Brands, Inc. (NYSE:YUM)’s performance notably deteriorated after the chicken supply scare had its effect. However, the downtrend was already in place by then, and it should be noted that McDonald’s Corporation (NYSE:MCD) Asia-Pacific Middle East Africa (APMEA) sales haven’t been strong this year, either. All the data in the chart is sourced from company accounts.

It’s all very well for Pizza Hut to be generating growth in China, but KFC makes up more than 74% of Yum!’s restaurants in the country.

Moreover, Burger King Worldwide Inc (NYSE:BKW) also reported some disappointing numbers in its first-quarter results to the end of March. For example, its global comparable same store sales growth fell 1.4%. In addition, its results in Asia-Pacific (APAC) weren’t much better with a paltry 2.7% systemwide comparable sales growth recorded in the region. Furthermore, Burger King Worldwide Inc (NYSE:BKW) argued that the rise in APAC was due to positive performances in Korea and Australia, thanks to a combination of value promotions and programs.

In summary, neither Burger King Worldwide Inc (NYSE:BKW) nor McDonald’s Corporation (NYSE:MCD) are reporting anything particularly positive on the global sales environment, let alone for the Far East.

The bottom line

Yum! Brands, Inc. (NYSE:YUM)’s peers are seeing difficult conditions in China, so this looks like it is more than a company-specific issue. Yum! is a compelling proposition, but cautious investors will want to take a pass. The company probably will engineer a recovery in China, but it may not be of the magnitude needed to take the stock materially higher.

The article Can This Fast Food Giant Get Back on Track? originally appeared on Fool.com and is written by Lee Samaha.

Lee Samaha has no position in any stocks mentioned. The Motley Fool recommends Burger King Worldwide (NYSE:BKW) and McDonald’s. The Motley Fool owns shares of McDonald’s. Lee is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.