You might be wondering how high the price-to-earnings ratio of Yelp Inc (NYSE:YELP) is, considering the price movements are close to insanity. The truth is that there isn’t any price-to-earnings ratio, simply because there aren’t any earnings. At least not yet. So what exactly is Yelp doing to deserve such a market valuation?

Yet another cute website?

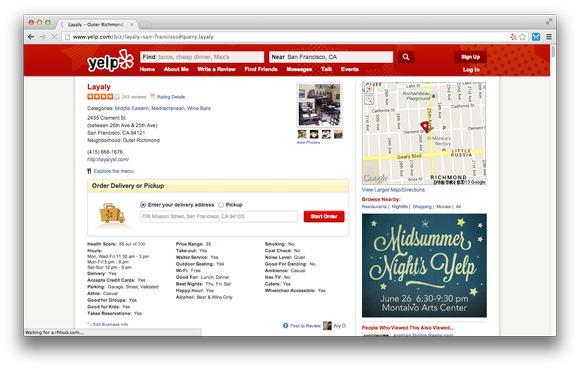

Yelp Inc (NYSE:YELP) does not manufacture cellphones or games. Yelp is a website that connects people to local businesses. It’s mainly user-generated content. About 42 million reviews of every type of local business, from restaurants to plumbers. According to the official slides, the website gets about 108 million unique visitors and the mobile application has been used on approximately 10.4 million unique devices on a monthly average basis. That’s all there is.

How about fundamentals?

Now, if there’s something that investors have learned after the 2000 dotcom crash it is that no matter how attractive the monthly average user metric or the app looks like, fundamentals do matter, regardless of the business. So, what do the fundamentals of Yelp look like?

First, I suspect revenue is highly cyclical, evidencing the fact that Yelp is an advertising company, in the sense that most of its revenue comes from ads. We can’t deny the fact that growth is happening. But is the growth rate enough to justify today’s valuation? To answer this question we need to estimate the time when Yelp Inc (NYSE:YELP) will enter profit zone. Unfortunately, every time that Yelp grows its revenue base, its operating expenses grow as well. For this reason the company has never been profitable. Just take a look at 2011: revenues grew to $83 million, but operating expenses grew even faster, reaching $99 million. And a one cent per share loss announced on the latest earnings call, which beat the street consensus, confirms that Yelp still has the same issue. Cost and revenue growth at the same time.

According to Morningstar, the average price-to-earnings ratio for this industry is 31. That’s quite high but let’s be optimistic and assume that in the long run, Yelp’s P/E will converge to this value. If that is so, to justify the current $3.36 billion market cap, Yelp would need to generate approximately $108 million in earnings per year. Now, the whole revenue for last year was $137.6 million itself. This implies that unless Yelp experiences massive revenue growth (the kind of growth it hasn’t experienced before) for the next year, it won’t be able to justify its high valuation any time soon.

Notice that the sell-side expects Yelp Inc (NYSE:YELP) to report a loss also this year, followed by earnings per share of $0.18 in 2014 and $0.54 in 2015. From this perspective, the company is quite far away from consistently high margins.

Too many acquisitions way too early

Although Yelp is not profitable at the moment, it is quite active in acquisitions.It acquired Qype, a social networking & local reviews site with strong presence in Europe for $47.6 million. The company was generating revenues of only $8 million per year, with a net loss of $4 million. Even if revenue grows 20% every year, it will take more than 10 years for Yelp to recover its premium. More recently Yelp acquired online reservation software SeatMe for about $12.7 million. While some of these acquisitions may be successful in the long run, I think the time for Yelp to acquire startups is a bit too early, considering that there are enough risks to deal with coming from the core business, which isn’t profitable yet.

Competitors

Apart from still losing money and having poor fundamentals in comparison with its current market valuation, Yelp has to deal with one more issue: low barriers to entry. It isn’t hard to come up with yet another local review app. In this way, Yelp is constantly exposed to competition coming from start-ups, some of which may become early stars in the segment.

But Yelp also needs to pay attention to some giants, including Facebook Inc (NASDAQ:FB) and Google Inc (NASDAQ:GOOG). Both companies are interested in the local reviews segment and have the resources to bring traffic almost immediately to their new apps.

Facebook Inc (NASDAQ:FB)’s Local Search is a great competitor: according to a recent comScore-15 Miles-Neustar local search study, it’s already one of the most used mobile apps for local search. With more than a billion users under its network, Facebook Inc (NASDAQ:FB) can create demand for reviews almost immediately. Yelp investors are aware of this, and that’s why when Facebook released its feature, Yelp’s stock price decreased almost 4% in less than 20 minutes back in December 2012. The stronger Facebook’s Local Search gets, the more probable it is to see negative momentum on Yelp’s stock. And since mobile isn’t growing as fast for Yelp as it is growing for Facebook Inc (NASDAQ:FB), I wouldn’t be surprised to see more growth in Facebook Inc (NASDAQ:FB)‘s Local Search at the expense of Yelp’s user base contraction in the near future.

Google Inc (NASDAQ:GOOG), on the other hand, has Google Maps, which is also a direct (yet strong) competitor: according to TechCrunch, “Google borrowed liberally from Yelp’s database of reviews to flesh out its Google Places pages.”

But Google Inc (NASDAQ:GOOG) also owns Zagat. Founded by Tim and Nina Zagat 32 years ago, Zagat operates in 13 categories (from theaters to restaurants) and more than 100 cities. And although Zagat may still be small in comparison with Yelp, the giant can promote it quite easily using Google Maps, if necessary. Even better, Zagat reviews can become an integrated application to Google Glass. This could help Google gain more market share in the local reviews segment. Remember that Google Inc (NASDAQ:GOOG) once tried to buy Yelp (in late 2009), without success. The giant is interested in this segment and that’s enough to watch correlations between Yelp and Google Inc (NASDAQ:GOOG)’s stock closely.

My investment thesis

To me, Yelp Inc (NYSE:YELP)’s fundamentals dictate a value well below the current market price, at least for now. It’s an expensive local review app, operating in a segment with low barriers to entry.

Two of the biggest IT giants are interested in stealing market share and that will make things even tougher for Yelp. Facebook Inc (NASDAQ:FB)’s Local Search enjoys the advantage of being owned by the biggest social network in the world, with its mobile exposure growing faster than Yelp. Google Inc (NASDAQ:GOOG), on the other hand, owns Google Maps and Zagat. In this context, I see little reasons to consider Yelp as a sound, long-term investment.

The article Is This Unprofitable IT Stock a Disaster in the Making? originally appeared on Fool.com and is written by Adrian Campos.

Adrian Campos has no position in any stocks mentioned. The Motley Fool recommends Facebook and Google. The Motley Fool owns shares of Facebook and Google. Adrian is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.