After a lengthy stretch of outperformance, small-cap stocks suffered from July 2015 through June 2016, as heightened global economic fears led investors to flee to the safe havens of large-cap stocks and other instruments. Those stocks outperformed small-caps by about 10 percentage points during that time, with small-cap healthcare stocks being particularly hard hit. However, the tide has since turned in a big way, as evidenced by small-caps toppling their large-cap peers by 6 percentage points in the third quarter, and by another 4 percentage points in the first seven weeks of the fourth quarter. In this article, we’ll analyze how this shift affected hedge funds’ Q3 trading of Yahoo! Inc. (NASDAQ:YHOO) and see how the stock is affected by the recent hedge fund activity.

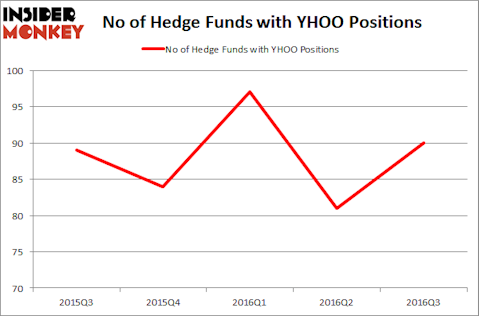

Is Yahoo! Inc. (NASDAQ:YHOO) ready to rally soon? Prominent investors are in an optimistic mood. The number of bullish hedge fund positions went up by 9 in recent months. YHOO was in 90 hedge funds’ portfolios at the end of the third quarter of 2016. There were 81 hedge funds in our database with YHOO positions at the end of the previous quarter. At the end of this article we will also compare YHOO to other stocks including T MOBILE US INC (NYSE:TMUS), Mizuho Financial Group Inc. (ADR) (NYSE:MFG), and The Kroger Co. (NYSE:KR) to get a better sense of its popularity.

Follow Altaba Inc. (NASDAQ:AABA)

Follow Altaba Inc. (NASDAQ:AABA)

Receive real-time insider trading and news alerts

Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

nevodka / Shutterstock.com

Keeping this in mind, let’s review the new action encompassing Yahoo! Inc. (NASDAQ:YHOO).

How are hedge funds trading Yahoo! Inc. (NASDAQ:YHOO)?

At the end of September, 90 funds tracked by Insider Monkey were bullish on this stock, a change of 11% from the second quarter of 2016. With hedgies’ sentiment swirling, there exists a few key hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Canyon Capital Advisors, managed by Joshua Friedman and Mitchell Julis, holds the most valuable position in Yahoo! Inc. (NASDAQ:YHOO). Canyon Capital Advisors has a $896.6 million position in the stock, comprising 32.6% of its 13F portfolio. The second largest stake is held by Owl Creek Asset Management, led by Jeffrey Altman, holding a $679.7 million position; the fund has 29.4% of its 13F portfolio invested in the stock. Remaining peers with similar optimism encompass David Costen Haley’s HBK Investments, Jeffrey Smith’s Starboard Value LP and David Cohen and Harold Levy’s Iridian Asset Management.

As industrywide interest jumped, key hedge funds were leading the bulls’ herd. Senator Investment Group, managed by Doug Silverman and Alexander Klabin, assembled the most valuable position in Yahoo! Inc. (NASDAQ:YHOO). Senator Investment Group had $147.1 million invested in the company at the end of the quarter. Matthew Sidman’s Three Bays Capital also initiated a $104.6 million position during the quarter. The following funds were also among the new YHOO investors: Richard Gerson and Navroz D. Udwadia’s Falcon Edge Capital, David Tepper’s Appaloosa Management LP, and Ken Griffin’s Citadel Investment Group.

Let’s now review hedge fund activity in other stocks similar to Yahoo! Inc. (NASDAQ:YHOO). We will take a look at T MOBILE US INC (NYSE:TMUS), Mizuho Financial Group Inc. (ADR) (NYSE:MFG), The Kroger Co. (NYSE:KR), and Carnival plc (ADR) (NYSE:CUK). This group of stocks’ market values resemble YHOO’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TMUS | 58 | 3343677 | 6 |

| MFG | 5 | 11054 | 0 |

| KR | 40 | 946147 | 5 |

| CUK | 10 | 41201 | -1 |

As you can see, on average 28 funds held long positions in each of these stocks and the average amount invested in these stocks was $1.09 billion. That figure was $8.27 billion in Yahoo’s case. T MOBILE US INC (NYSE:TMUS) is the most popular stock in this table with six funds holding shares. On the other hand Mizuho Financial Group Inc. (ADR) (NYSE:MFG) is the least popular one with only five bullish hedge fund positions. Compared to these stocks Yahoo! Inc. (NASDAQ:YHOO) is significantly more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.