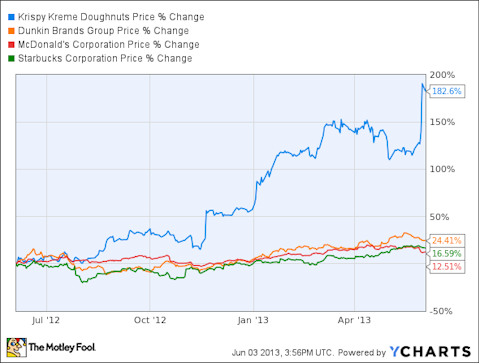

This past year has been a sweet one for Krispy Kreme Doughnuts (NYSE:KKD). Shares of the doughnut chain, which investors had once left for dead, have risen nearly 190% over the past twelve months after the company staged a dramatic comeback fueled by double-digit growth in profit, revenue, and same-store sales. With the stock now trading near an eight-year high, is it too late for investors to sweeten up their portfolios with Krispy Kreme’s glazed goodness, or is there still room for future growth?

A little history

A decade ago, Krispy Kreme Doughnuts (NYSE:KKD) traded at $50. Most of Wall Street was convinced that the doughnut maker was a great growth stock, with solid top and bottom line growth fueled by rapid nationwide expansion. By 2005, however, market sentiment shifted dramatically, after the company reported several sequential earnings declines that sank it deep into the red. Krispy Kreme over-expanded and saturated areas so heavily that franchises were forced to compete with each other. As a result, same-store sales growth came to a grinding halt.

To make matters worse, a massive accounting scandal in 2005 tarnished the company’s credibility, and investors fled. The subsequent financial crisis swept away what growth was left in Krispy Kreme Doughnuts (NYSE:KKD), and the stock fell to nearly $1 per share in March 2009. The bears proclaimed that its then privately held rival, Dunkin Brands Group Inc (NASDAQ:DNKN), had won, and that Krispy Kreme was doomed to slowly fade into obscurity.

A fattening first quarter

However, Krispy Kreme Doughnuts (NYSE:KKD)’s recent first-quarter results showed that the company had learned from the mistakes of the past. The company’s earnings rose 43% year-on-year to $0.20 per share, topping the consensus estimate of $0.17. Company-wide revenue climbed 11% to $120.6 million, also topping the $116.3 million that analysts had forecast. Same-store sales surged 11.4% from the prior year quarter.

By comparison, Dunkin Brands Group Inc (NASDAQ:DNKN) reported that is adjusted earnings rose 16% to $0.29 per share as revenue climbed 6.2% to $161.9 million. Same-store sales at its Dunkin’ Donuts stores rose 1.7% in the United States and 1.3% internationally. Its ice cream brand, Baskin Robbins, reported 4.4% and 4.2% same-store sales growth in domestic and international markets, respectively.

Although Dunkin Brands Group Inc (NASDAQ:DNKN) blamed the weather for throttling its growth during the first quarter, one thing is clear — at this rate, Krispy Kreme could soon overtake Dunkin’ Donuts in terms of total sales growth.

Battling across the globe

Dunkin’ Donuts appeared to struggle in Asia during the quarter, when it terminated its franchise agreement in Taiwan and closed all 19 of its locations on the island. This coincided with Krispy Kreme Doughnuts (NYSE:KKD)’s decision to open 10 stores in Taiwan through a similar joint venture with local conglomerate Huan Hsin. Taiwan is often considered a microcosm of the Greater Chinese market, which includes the mainland, Hong Kong, and Macau, so Dunkin’ Donuts’ retreat and Krispy Kreme’s expansion should be considered hints for future growth in the area.

However, Krispy Kreme’s international operations are still weak, with its international franchise stores reporting a same-store sales decline of 7.3% last quarter. Last year’s agreement with Star360 Group to expand into Singapore could help boost its global sales growth, especially in Asia.

Krispy Kreme Doughnuts (NYSE:KKD) currently operates 700 stores in 22 countries, which is still dwarfed by Dunkin Brands Group Inc (NASDAQ:DNKN)’ 10,500 Dunkin’ Donuts locations. Across Asia, Krispy Kreme has a presence in China, India, Indonesia, Malaysia, Thailand, the Philippines, South Korea, and Japan. Dunkin’ Donuts is present in all of these markets as well.

Krispy Kreme Doughnuts (NYSE:KKD) plans to increase its store count to 1,300 locations by 2017, which indicates that it plans to follow Dunkin’ Donuts across the world, albeit with fewer stores per country.

Coffees or doughnuts?

While Krispy Kreme appears to be outperforming Dunkin’ Donuts at the moment, there are two other competitors investors should worry about — Starbucks Corporation (NASDAQ:SBUX) and McDonald’s Corporation (NYSE:MCD).

Up until the early 1990s, Dunkin’ Donuts continuously lost business to these two giants, which also offered coffee and desserts. Dunkin’ Donuts was able to bounce back by emphasizing its coffee offerings over its doughnuts. This change can be seen in Dunkin’ Donuts’ logo, which features a coffee cup instead of a doughnut. This subtle change made Dunkin’ Donuts a place to go to sit down with a cup of coffee and hang out with friends, rather than a simple “grab and go” doughnut shop. Today, Krispy Kreme Doughnuts (NYSE:KKD) is facing the same dilemma.