Last week, the Federal Reserve released the first part of the annual banking stress test results, which examined the impact of a severe economic downturn on the largest U.S. banks. While it did not stand out as one of the strongest participants during last year’s stress tests, Capital One Financial Corp. (NYSE:COF) posted improved and fairly solid results. The results highlighted the bank’s relatively robust credit card portfolio and its ability to weather a global economic downturn.

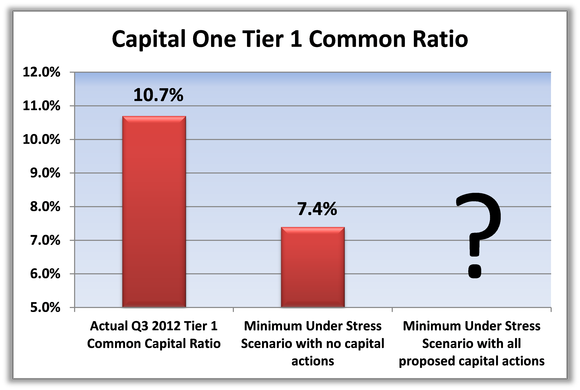

In addition to posting a higher actual Tier 1 common ratio in Q3 in 2012 compared to 2011, Capital One Financial Corp. (NYSE:COF) posted an improved minimum Tier 1 common ratio of 7.4% under the severely adverse scenario. During the previous year’s tests, Capital One Financial Corp. (NYSE:COF)’s minimum Tier 1 common in the doom-and-gloom scenario was 7.2%. One of the main drivers of Capital One Financial Corp. (NYSE:COF)’s enhanced outlook was the less-severe U.S.-based stress scenario, compared to last year’s tests.

These stronger results have driven investors to tune into the Comprehensive Capital Analysis and Review results, which will be released on Thursday afternoon. Within this release from the Fed, investors will know if the participating banks sought and received approval for any increases in dividends or share buyback programs. Investors will also get to see the impact of any new capital plans on stressed ratios.

Source: Dodd-Frank Act Stress Test 2013: Supervisory stress Test Methodology and Results.

Should Capital One Financial Corp. (NYSE:COF) finally request a bump?

Last year, Capital One Financial Corp. (NYSE:COF) did not request approval for any increase in quarterly dividend payment or initiation of any share repurchase program. The bank has not increased its quarterly dividend of $0.05 since the onset of the financial crisis. Given the marginal improvement of its capital ratios under a stressed scenario, Capital One Financial Corp. (NYSE:COF) does not seem to have ample leverage in negotiating any additional actions to return more cash to shareholders.

Will shareholders get anything?

While it seems that Capital One is on the right path to increase its dividend, I believe investors may want to temper their expectations. If the Fed and the bank cannot agree on a dividend increase, Capital One may request to ramp up share repurchases. With the bank’s shares are trading at a 20% discount to book value, initiating a share repurchase may be the preferred capital action plan to generate additional value for shareholders. Therefore, I expect Capital One to ask and receive approval for a small share buyback program.

The article Will Capital One Increase Its Dividend? originally appeared on Fool.com.

David Hanson has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.