You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

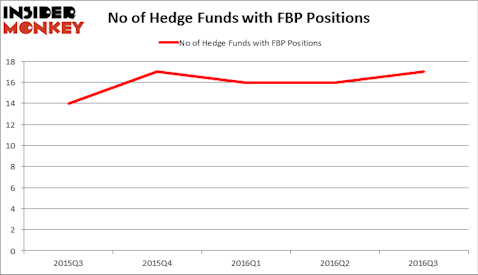

One stock that has seen an increase in activity from the world’s largest hedge funds is First Bancorp (NYSE:FBP). There were 17 hedge funds in our database with FBP holdings at the end of September, compared to 16 funds at the end of June. At the end of this article we will also compare FBP to other stocks including Installed Building Products Inc (NYSE:IBP), Amerisafe, Inc. (NASDAQ:AMSF), and Green Dot Corporation (NYSE:GDOT) to get a better sense of its popularity.

Follow First Bancorp (NYSE:FBP)

Follow First Bancorp (NYSE:FBP)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Nonwarit/Shutterstock.com

Now, we’re going to take a peek at the key action surrounding First Bancorp (NYSE:FBP).

What have hedge funds been doing with First Bancorp (NYSE:FBP)?

Heading into the fourth quarter of 2016, 17 funds tracked by Insider Monkey held long positions in First Bancorp (NYSE:FBP), a change of 6% from the second quarter of 2016. By comparison, 17 hedge funds held shares or bullish call options in FBP heading into 2016. With the smart money’s sentiment swirling, there exists a few key hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Howard Marks’ Oaktree Capital Management holds the number one position in First Bancorp (NYSE:FBP). Oaktree Capital Management has a $217.6 million position in the stock, comprising 2.8% of its 13F portfolio. On Oaktree’s heels is Castine Capital Management, led by Paul Magidson, Jonathan Cohen and Ostrom Enders, holding an $8 million position; the fund has 4% of its 13F portfolio invested in the stock. Some other peers with similar optimism include Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Cliff Asness’ AQR Capital Management, and Israel Englander’s Millennium Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

With a general bullishness amongst the heavyweights, some big names were leading the bulls’ herd. Ellington, led by Mike Vranos, created the most outsized position in First Bancorp (NYSE:FBP). Ellington had $0.3 million invested in the company at the end of the quarter. Thomas Bailard’s Bailard Inc also initiated a $0.3 million position during the quarter. The other funds with new positions in the stock are Michael Platt and William Reeves’s BlueCrest Capital Mgmt., and David E. Shaw’s D E Shaw.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as First Bancorp (NYSE:FBP) but similarly valued. These stocks are Installed Building Products Inc (NYSE:IBP), Amerisafe, Inc. (NASDAQ:AMSF), Green Dot Corporation (NYSE:GDOT), and Genesco Inc. (NYSE:GCO). This group of stocks’ market values match FBP’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| IBP | 13 | 53809 | -3 |

| AMSF | 8 | 17850 | -3 |

| GDOT | 17 | 180354 | -2 |

| GCO | 13 | 64533 | 2 |

As you can see these stocks had an average of 13 funds with bullish positions and the average amount invested in these stocks was $79 million. That figure was $245 million in FBP’s case. Green Dot Corporation (NYSE:GDOT) is the most popular stock in this table, while Amerisafe, Inc. (NASDAQ:AMSF) is the least popular one with only eight investors holding long positions. First Bancorp (NYSE:FBP) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard Green Dot Corporation (NYSE:GDOT) might be a better candidate to consider taking a long position in.

Disclosure: none