Warren Buffett likes special businesses. For many of the businesses he owns, the uniqueness is obvious; anyone can see that The Coca-Cola Company (NYSE:KO), The Procter & Gamble Company (NYSE:PG), and American Express Company (NYSE:AXP) are not replicable and enjoy significant competitive advantages. However, for one Buffett favorite —Wells Fargo & Co (NYSE:WFC) — the word ‘special’ may not jump out at the average investor.

Wells Fargo is the second-largest U.S. bank by deposits, but it is not just any megabank. Wells Fargo is a truly wonderful bank with a long history of strong management and a unique culture that enables it to routinely be more profitable than its peers, even while taking fewer risks.

Financial evidence of superiority

According to Morningstar, Wells Fargo & Co (NYSE:WFC) has funded its assets (interest paid on deposits and similar liabilities is the bank’s cost of funding) at an average cost of 1.3% over the last decade — 20% lower than the nearest competitor. Since banks generate profits based on the spread between cost of funding and return on investments (loans, trading, etc), a low cost of funding is critical to a bank’s success.

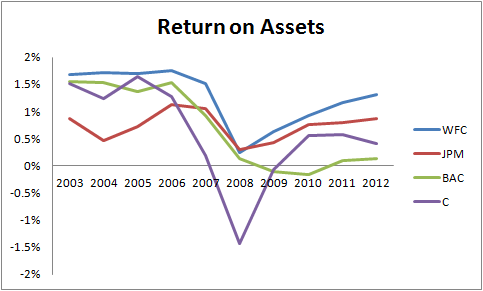

Over the last decade, Wells Fargo has earned a consistently higher return on assets and return on equity than JPMorgan Chase & Co. (NYSE:JPM), Bank of America Corp (NYSE:BAC), and Citigroup Inc. (NYSE:C). Since return on assets and return on equity are key measures of a bank’s profitability, Wells Fargo’s superiority on these metrics should set off an immediate signal that there is something special about its operations.

Old-fashioned business

Wells Fargo has a simple business model. Plain vanilla bank services, like loan origination and servicing, make up the majority of Wells Fargo & Co (NYSE:WFC)’s activities, while its trading and derivatives operations are minuscule compared to other megabanks.

But what really sets the bank apart from the likes of Chase, Bank of America, and Citigroup is its devotion to customer service and cross-selling. It wants to earn 100% of each customers’ finance-related business. While it is true that all banks would like to have all of its customers’ business, no other bank has the deeply-ingrained culture that allows Wells Fargo & Co (NYSE:WFC) to cross-sell its customers on so many products.

Cross-selling has a number of benefits. For one, it is more cost-efficient to sign up a customer that already has a checking account at Wells Fargo for asset management services than it is to go out and convince an entirely new customer to sign up for Wells Fargo’s asset management services; the company estimates the cost of cross-selling to be just 10% of what it would cost to acquire a completely new customer.

In addition, the more services a customer uses at the bank, the more loyal that customer is likely to be. Transferring all of one’s accounts to a new bank is no simple matter, and Wells Fargo’s focus on customer retention makes this an even more remote possibility. As a result, Wells Fargo & Co (NYSE:WFC) retains a large share of its customers for many years.

Competition does not stack up

It is clear to most investors that Wells Fargo is a better bank than Bank of America and Citigroup. Both of the latter banks suffered mightily during the financial crisis and likely would have been insolvent without government support. Bank of America still suffers from enormous legal risks in connection with its activities leading up to and during the financial crisis, many of which cannot yet be quantified.

Citigroup, on the other hand, suffers from a culture of trading long-term viability for short-term profits — a culture that is not easily changed. The bank is now an enormous international financial services firm, with a presence in nearly every product market in finance. It will be difficult to manage risk at an institution that is more complicated than many of its peers. In addition, the bank’s large bet on emerging market credit may prove unwise; if the Chinese economy slows down, Citigroup could suffer substantial losses while its peers continue to improve.

Many investors hold Wells Fargo & Co (NYSE:WFC) in the same regard as Chase bank. Although Chase has a great leader in Jamie Dimon, it does not have a “Jamie Dimon culture” that will survive after his departure; at least nothing compared to Wells Fargo’s deeply-ingrained customer service culture. When Dimon leaves, so will much of Chase’s special-ness. But when John Stumpf leaves, someone on Wells Fargo’s deep bench of long-time executives will step in and continue operating in according with the bank’s culture and values.

In addition, Chase is a much more complicated bank than Wells Fargo. Even Jamie Dimon could not stop a poor decision by a trader in London from costing the bank billions along with an enormous hit to its reputation. Although Wells Fargo executives cannot know what is going on in every aspect of its business at all times, its simpler business model makes a London Whale-like event much less likely to occur.

Bottom line

Buffett did not make an exception to his history of owning special businesses when he bought Wells Fargo. Although most banks can be lumped together, Wells Fargo stands apart from the crowd. Its unique culture enables it to earn the highest return on assets in its peer group and it will continue to generate above-average returns for years to come.

Ted Cooper has no position in any stocks mentioned. The Motley Fool recommends Wells Fargo. The Motley Fool owns shares of Bank of America, Citigroup Inc (NYSE:C) , JPMorgan Chase & Co (NYSE:JPM)., and Wells Fargo.

The article What Makes Wells Fargo a Special Business? originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.