Warren Buffett likes special businesses. For many of the businesses he owns, the uniqueness is obvious; anyone can see that The Coca-Cola Company (NYSE:KO), The Procter & Gamble Company (NYSE:PG), and American Express Company (NYSE:AXP) are not replicable and enjoy significant competitive advantages. However, for one Buffett favorite —Wells Fargo & Co (NYSE:WFC) — the word ‘special’ may not jump out at the average investor.

Wells Fargo is the second-largest U.S. bank by deposits, but it is not just any megabank. Wells Fargo is a truly wonderful bank with a long history of strong management and a unique culture that enables it to routinely be more profitable than its peers, even while taking fewer risks.

Financial evidence of superiority

According to Morningstar, Wells Fargo & Co (NYSE:WFC) has funded its assets (interest paid on deposits and similar liabilities is the bank’s cost of funding) at an average cost of 1.3% over the last decade — 20% lower than the nearest competitor. Since banks generate profits based on the spread between cost of funding and return on investments (loans, trading, etc), a low cost of funding is critical to a bank’s success.

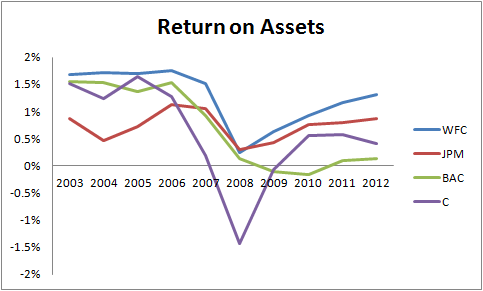

Over the last decade, Wells Fargo has earned a consistently higher return on assets and return on equity than JPMorgan Chase & Co. (NYSE:JPM), Bank of America Corp (NYSE:BAC), and Citigroup Inc. (NYSE:C). Since return on assets and return on equity are key measures of a bank’s profitability, Wells Fargo’s superiority on these metrics should set off an immediate signal that there is something special about its operations.

Old-fashioned business

Wells Fargo has a simple business model. Plain vanilla bank services, like loan origination and servicing, make up the majority of Wells Fargo & Co (NYSE:WFC)’s activities, while its trading and derivatives operations are minuscule compared to other megabanks.

But what really sets the bank apart from the likes of Chase, Bank of America, and Citigroup is its devotion to customer service and cross-selling. It wants to earn 100% of each customers’ finance-related business. While it is true that all banks would like to have all of its customers’ business, no other bank has the deeply-ingrained culture that allows Wells Fargo & Co (NYSE:WFC) to cross-sell its customers on so many products.

Cross-selling has a number of benefits. For one, it is more cost-efficient to sign up a customer that already has a checking account at Wells Fargo for asset management services than it is to go out and convince an entirely new customer to sign up for Wells Fargo’s asset management services; the company estimates the cost of cross-selling to be just 10% of what it would cost to acquire a completely new customer.

In addition, the more services a customer uses at the bank, the more loyal that customer is likely to be. Transferring all of one’s accounts to a new bank is no simple matter, and Wells Fargo’s focus on customer retention makes this an even more remote possibility. As a result, Wells Fargo & Co (NYSE:WFC) retains a large share of its customers for many years.