The dividend increase resulted in an approximate 3% yield on the underlying stock price: admirable, respectable, but not earth-shaking. There are many 3% yielding stocks that have better near-term earnings growth potential.

The buyback plan is somewhat impressive if for no other reason than its sheer magnitude. However, it’s spread out until the end of 2015. This diluted its effect.

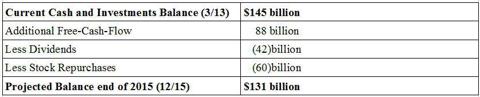

Let’s assume that Apple generates an average of $8 billion in Free-Cash-Flow (FCF) per quarter, or $88 billion through the 11 quarters of the 2013 to 2015 period. FCF is defined as operating cash flow less capital expenditures. This is an important metric since it represents what cash the company has left over after all expenses and routine capital requirements have been made.

Here’s a chart of Apple Inc. (NASDAQ:AAPL)’s FCF over the past five years, outlining why I suggest this figure is defensible:

courtesy of ycharts.com

Now let’s premise that the 2014 and 2015 annual dividend is raised by 10% each year. Therefore, the total cash dividends paid will be approximately $42 billion between now and the end of 2015.

Here’s the all-in math:

Apple Balance Sheet Cash / Investments 2013 – 2015

While a step in the right direction, Apple management appears intent on retaining the bulk of the current cash hoard. The company compounded this perception by recently borrowing $17 billion in debt with the stated intent of using much of it for future dividend payments. Indeed, it should be noted that while Apple holds a majority of its cash overseas, over $42.4 billion is here in the U.S.; equivalent to pay all the projected dividends through 2015. Of course, more than a third of Apple Inc. (NASDAQ:AAPL)’s ongoing operating cash is expected to be generated here, too.

Indeed, Apple investors understand there are tax consequences if the overseas fund are repatriated. Nonetheless, Apple management needs to explain what they plan to do with it. And while the stock buyback will retire up to 4 or 5% a year of shares outstanding, additional shares will be issued to management and employees in the form of options and restricted stock, thereby diluting the effort.

While corporate leadership has begun to address the issue of excess cash, I do not believe it’s a closed case.

In addition, Apple management could do itself a favor by taking a page from the Intel Corporation (NASDAQ:INTC) playbook: invest the cash in a way that provides a better return. Apple FY2012 10-K filings indicated an annual return on cash and investments of only 1.03 percent.

On the other hand, Intel 2012 10-K filings provide detail showing cash and marketable investments have generated three-year, average annualized capital and income returns of $332 million, or approximately 2%; plus marketable investments recorded a 2012 gross unrealized gain of over $1 billion, or 7%. Intel Corporation (NASDAQ:INTC) outlines a breakdown of cash equivalents, fixed income, and marketable securities within the SEC filings. Management line-items “gains and losses on equity investments,” as well as “interest” on their income statement. Apple management rolls it all up into “other income (expense).

The bottom line

Apple management faces four key investor issues: margin compression, declining comparable earnings, an innovation vacuum, and excessive balance sheet cash / investments. These issues underpin underlying business performance. I suggest that until these items show improvement, the share price will remain range-bound.

The article What Apple Management Must Do To Levitate Your Shares originally appeared on Fool.com and is written by Raymond Merola.

Author is long AAPL and INTC. Raymond is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.