Walgreen Company (NYSE:WAG) has been one of my favorite stocks in the market for some time now, and I have recommended it several times. Since the last time I wrote about the company (early March), Walgreen Company (NYSE:WAG) is up by over 17%, so congrats to whoever listened to me and bought. This type of a gain in such a short time period produces another dilemma. It makes us ask the question: “Is Walgreen still a good buy?” While the gain is nice, it means that the company’s dividend yield has dropped from 2.62% to 2.29%, and it now trades at a P/E of 21.4 as opposed to 18.5. Should investors in Walgreen cash in, or hang on in the hopes of more upside ahead?

Walgreen in a Nutshell

Walgreen Company (NYSE:WAG) operates almost 8,400 drug stores throughout the United States which produce total revenue of about $72 billion annually. The company’s pharmacies filled almost 800 million prescriptions last year, which is about 20% of the entire U.S. prescription drug market. Over the past decade alone, revenues have more than doubled for Walgreen Company (NYSE:WAG), which has been in business since 1909 but has only been operating freestanding stores since 1992.

Express Scripts Saga

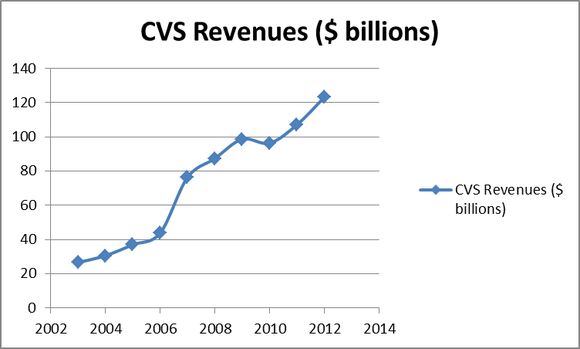

If you take a closer look at the chart above, you’ll notice a slight drop-off in revenue after 2011 after almost linear growth before this point. On Jan 1, 2012, Walgreen’s contract with Express Scripts Holding Company (NASDAQ:ESRX), the largest pharmacy benefit management company in the U.S., expired. Once the contract expired, Walgreen Company (NYSE:WAG) was no longer a part of Express Scripts’ network, and customers covered under Express Scripts-administered health plans were forced to seek alternatives to fill their prescriptions.

Express Scripts Holding Company (NASDAQ:ESRX) has grown tremendously since first entering into the original contract with Walgreen and in fact has increased its revenues by over 600% during the past decade. Express Scripts Holding Company (NASDAQ:ESRX) provides pharmacy benefit management for such huge clients as Wellpoint, the U.S. Department of Defense, and UnitedHealth Group Inc. (NYSE:UNH). It is easy to see that Walgreen could not afford to lose all of this business forever.

The companies eventually settled their battle over payment issues and agreed to a new multi-year agreement which began on Sept 15 of last year; however, the company estimates that they lost up to $4 billion in sales as a result of this mess. If you look at the chart and follow the growth pattern, one would have predicted about $75 billion in revenue for 2012, which is about what the company would have produced if this mess had never happened.

CVS: The Better Deal Now?

Bear in mind that just because Walgreen Company (NYSE:WAG) and Express Scripts worked out their differences doesn’t mean that all of the former Walgreen customers will immediately flock back to their old pharmacies. Studies done by both companies indicate that most of the lost prescription customers moved to CVS Caremark Corporation (NYSE:CVS), and it may not be such an easy task to lure that business back.

On that note, CVS Caremark Corporation (NYSE:CVS) may be the better investment right now. Completely opposite of what we saw in Walgreen’s chart, CVS experienced a revenue spike in 2012, which confirms the theory that most of Walgreen’s fleeing customers wound up at CVS Caremark Corporation (NYSE:CVS).