Even though it can be up to five times as expensive to transport crude by train, a lack of pipeline infrastructure often makes rail the only game in town. Intermodal transportation by rail, which is estimated to account for 20% of railroads’ revenue currently, is also gaining popularity amongst shippers. Rail is more cost effective, especially since rail can be up to 300% more fuel efficient than trucks, according to Zacks Equity Research.

And just to throw in one more reason why rail is a worthy investment, the demand for rail-freight transportation will increase approximately 88% by 2035, according to the Department of Transportation.

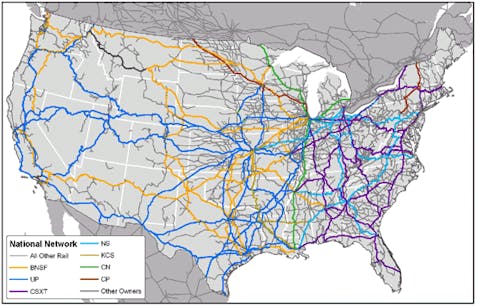

Above are four of the largest publicly traded pure-railroad companies in the United States– Union Pacific Corporation (NYSE:UNP) in dark blue, CSX Corporation (NYSE:CSX) in purple, Norfolk Southern Corp. (NYSE:NSC) in light blue, and Kansas City Southern (NYSE:KSU) in gold.

Burgandy and green are Canadian rail companies, and yellow illustrates rail operated by BNSF Railway, which is owned by Berkshire Hathaway Inc. (NYSE:BRK.A).

The West

Union Pacific Corporation (NYSE:UNP) is the largest railroad in the United States, both by market cap and by sales. Union Pacific operates primarily in the Western U.S., and is ideally placed to benefit from increasing oil production from the Bakken Shale formation in Montana and North Dakota. The company encompasses 23 states in the western two-thirds of the country by rail, and has a diversified business dealing in the transportation of agricultural products, automotive, chemicals, coal, industrial products and intermodal.

Union Pacific Corporation (NYSE:UNP) recently announced that it will also be strengthening infrastructure in Missouri and Illinois, investing more than $20 million in rail lines, without the help of taxpayer dollars. The new project will be one of 1,500 planned this year by the company.

Union pacific currently operates a 32,000-mile network of rail. It is encouraging to see Union Pacific invest in its infrastructure, as it is imperative for its future profitability and ability to meet capacity. This is especially true for Union Pacific Corporation (NYSE:UNP), whose rails cover almost 66% of the nation.

According to the Department of Transportation, close to 90% of the nation’s railway capacity needs to be upgraded to meet the boom in rail transportation demand expected by 2035.

While the U.S. railway industry only comprised a little under 50% of America’s total freight business, railroad companies that aggressively expand their infrastructure will be able to grab larger slices of the freight pie going forward if they can meet capacity– and therefore facilitate and accommodate the increasing demand.

The East

The largest Eastern player is CSX Corporation (NYSE:CSX), followed by Norfolk Southern Corp. (NYSE:NSC). CSX is looking to invest more than $2 billion into its rail infrastructure this year, and the company is also a major stakeholder in the National Gateway. The National Gateway is an $850 million public-private partnership infrastructure initiative intended to allow a more efficient freight transportation connection between ports in the Mid-Atlantic and the Midwest.

A major objective of the initiative is to free up some of the freight bottlenecks in the midwest that tend to cause delays for freight heading west. It plans to do this by building a double-stack cleared corridor for intermodal shipments between the Midwest and mid-Atlantic ports, which should benefit CSX Corporation (NYSE:CSX).

Intermodal is highly lucrative business, and can help offset the company’s dragging coal business. CSX is also optimistic, believing that its businesses (not including coal) can outpace the growth of the sluggish U.S. economy.

Norfolk Southern Corp. (NYSE:NSC) also seems to be optimistic, even with a problematic and challenging coal business, which an executive from the company stated would be a “wild card for the immediate future.” The company realizes that while coal has been a historical staple of the company’s business and may even one day be a staple of its business again in the future, as of now it needs to be offset with another business that is currently more profitable– such as emerging energy markets. These include sand, pipe, and other materials for shale-gas production– and of course crude by rail.

Norfolk Southern Corp. (NYSE:NSC) recently built and opened its Birmingham Regional Intermodal Facility in Alabama, worth around $97.5 million, which was created to allow a more efficient and higher-capacity intermodal freight rail route between the Gulf Coast and the Northeast.

Other opportunities for rail transportation

Besides emerging energy markets, other possibilities for profit are popping up for railroad companies. With auto companies (including both Honda Motor Co Ltd (NYSE:HMC) and Nissan Motor Co., Ltd. (ADR) (OTCMKTS:NSANY)) planning to expand and boost production in Mexico, finished vehicle production in Mexican markets may increase by as much as 35% by 2015, which will provide great opportunities for Kansas City Southern (NYSE:KSU) to capitalize on of the shipping and returning of raw materials to and from Mexico, Canada, and the United States.

Kansas City Southern (NYSE:KSU) is also poised to benefit from oil as well, as its rails connect the Bakken with various refiners on the Gulf of Mexico. This should help it to keep the profits flowing, especially if pipelines are continually delayed.

Valuations

Ok, so how do these companies stack up at their current levels?

| P/E | Forward P/E | Dividend (yield) | Market cap (billions) | |

|---|---|---|---|---|

| UNP | 18.45 | 14.42 | $2.76 (1.70%) | $73.32 |

| CSX | 13.86 | 12.48 | $0.60 (2.40%) | $25.63 |

| NSC | 14.04 | 12.18 | $2.00 (2.60%) | $24.57 |

| KSU | 29.91 | 21.83 | $0.86 (0.80%) | $12.15 |

While Kansas City Southern (NYSE:KSU) looks overvalued at current levels with not much dividend yield supporting it, the other rail companies look more attractively valued going forward. If Union Pacific Corporation (NYSE:UNP) can grow its earnings and meet forward estimates, its current trailing P/E isn’t as expensive as it looks.

The East Coast rail plays look best currently, but they have also been negatively impacted by coal and may continue to see it drag on their profitability. They also offer the better paying dividends, however.

The bottom line

Investing in America’s railroads should be very profitable going forward. The shale oil and gas boom in the U.S. should continue to give these railroads some steam. Intermodal should also give a boost, as it is cheaper with rail than by truck. This could really pickup if trains become powered by natural gas, which only costs around $0.50 per gallon– as opposed to about $4.00 for diesel.

My favorite picks are CSX Corporation (NYSE:CSX), for its cheap valuations and solid dividend yield, and Union Pacific Corporation (NYSE:UNP), for its proximity to the Bakken and enormous size and scope. Both are great rail plays, and investing in both gives an investor exposure to both coasts.

Joseph Harry has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

The article Is It a Good Idea to Invest in U.S. Railroads? originally appeared on Fool.com.

Joseph is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.