Mellanox Technologies, Ltd. (NASDAQ:MLNX) has announced earlier today that it will acquire EZchip Semiconductor Ltd (NASDAQ:EZCH) in a transaction valued at $811 million, driving the shares of both companies in opposite directions. EZchip surged by over 14% in the intraday trading on Wednesday, while Mellanox lost over 6%. However, hedge funds have been bullish on Mellanox, and not so thrilled regarding EZchip, according to our data.

An everyday investor does not have the time or the required skill-set to carry out an in-depth analysis of equities and identify companies with the best future prospects like a fund with the knowledge and resources can. Our research has shown that a portfolio based on hedge funds’ top stock picks (which are invariably comprised entirely of large-cap companies) falls considerably short of a portfolio based on their best small-cap stock picks. The most popular large-cap stocks among hedge funds underperformed the market by an average of seven basis points per month in our back tests whereas the 15 most popular small-cap stock picks among hedge funds outperformed the market by nearly a percentage point per month over the same period between 1999 and 2012. Since officially launching our small-cap strategy in August 2012 it has performed just as predicted, beating the market by over 60 percentage points and returning 118%, while hedge funds have collectively underperformed the market (read more details here).

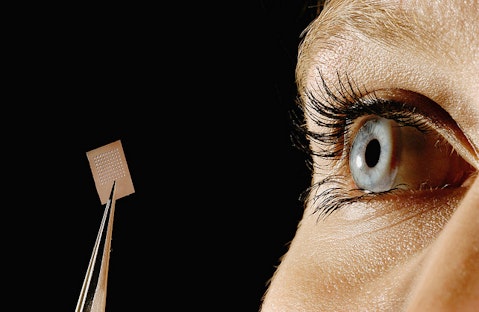

The all-cash transaction between Mellanox and EZchip, will be covered with cash on hand and $300 million in fully committed financing. Mellanox will acquire each share of EZchip for $25.50, which represents a 16% premium to the stock’s close on Tuesday. Mellanox, which sells solutions that enable servers, computers and databases to interconnect, expects the deal to be immediately accretive to adjusted earnings.

Follow Mellanox Technologies Ltd. (NASDAQ:MLNX)

Follow Mellanox Technologies Ltd. (NASDAQ:MLNX)

Receive real-time insider trading and news alerts

In a conference call about the deal, Eyal Waldman, CEO of Mellanox, said that EZchip, which makes data communications chips for the carrier, cloud and data center network market, will boost the combined company’s addressable market by $2.2 billion to $14.5 billion in 2017, according to Reuters. According to Nomura analyst Sanjay Chaurasia in a research note, Mellanox and EZchip have little overlap in terms of customers, which presents an opportunity for the combined company to grow over the next few years. Waldman is quoted mentioning Huawei, ZTE, Ericsson and Avaya as EZchip customers that have the potential to become Mellanox customers after the deal is completed.

Follow Ezchip Semiconductor Ltd (NASDAQ:EZCH)

Follow Ezchip Semiconductor Ltd (NASDAQ:EZCH)

Receive real-time insider trading and news alerts