Since the article is focusing on a Canadian sector I chose to show stock information from the Toronto Stock Exchange instead of the NYSE. Dollar amounts and stock information are in Canadian dollars.

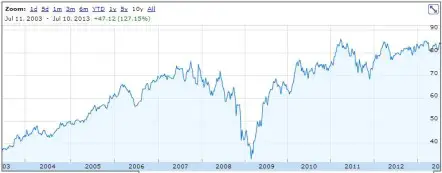

10 year stock chart

The 10 year annual average return is 8.6%. If we include the dividend payments over the past 10 fiscal years (total dividends paid of $20.73) then the total average annual return would be 11.0% with the average return from dividends representing 2.4%.

Out of the big six Canadian banks, Toronto-Dominion Bank (USA) (NYSE:TD)’s 10 year capital gain has been the best.

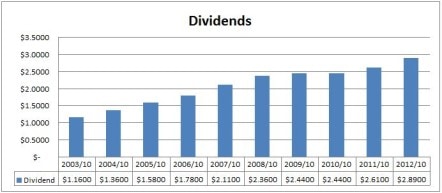

Dividends

Toronto-Dominion Bank (USA) (NYSE:TD) has increased its dividend for 2 consecutive years in a row. Prior to this, it had a 16 year dividend streak from 1994 to 2009. The most recent increase occurred with the dividend recorded in April, when management increased the quarterly dividend by 5.2% from $0.77 to $0.81. This was the company’s second increase in the past year. Prior to the 5.2% increase it raised the quarterly dividend from $0.72 to $0.77. This would make the most recent annual increase from $0.72 to $0.81 which is a 12.5% increase.

In the chart, you can see where dividend growth slowed around 2008-2010. The overall trend is good, and it looks like dividend growth has started to improve since the global financial crisis.

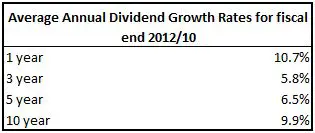

Dividend growth

You can see the affects of the global financial crisis on the 3 and 5 year average annual dividend growth rates. The 10 year rate is good, and it looks like dividend growth has improved recently with the 1 year rate above 10%.

Estimated future dividend growth

Toronto-Dominion Bank (USA) (NYSE:TD) stated in a recent quarterly earnings presentation that it is targeting a payout ratio of 40-50% in the medium term. In the past few years, the payout ratio has been around 40-50%, and other banks like Canadian Imperial Bank of Commerce (USA) (NYSE:CM) and Bank of Montreal (USA) (NYSE:BMO) have stated that they are targeting a payout ratio of 40-50%. Based on these factors I think it is reasonable to assume that Toronto-Dominion Bank (USA) (NYSE:TD) is also targeting 40-50%.

Analysts expect annual EPS growth to be 7.8% for the next 5 years. Accepting this EPS growth rate and using a payout ratio of 40-50% would result in dividend growth of 6.4% to 11.2%. The company’s most recent annual dividend increase of 12.5% leads me to think that future dividend growth will be at the higher end of this range, likely around 10%.

Competitive advantage & return on equity (ROE)

Looking at the table below, it looks like Toronto-Dominion Bank (USA) (NYSE:TD)’s ROE has been below the industry average.

The Canadian banking industry is dominated by the big six banks. The big six are all very competitive so while there are not a lot of big players in the Canadian market, it is still very competitive. Overall I would say that Toronto-Dominion Bank has a narrow economic moat.