Although the broader markets are in the green today as a wave of M&A activity and a number of solid earnings reports have improved market sentiment, several stocks are not on the receiving end of that sentiment today.

In this article, we’ll analyze why traders are selling Tidewater Inc. (NYSE:TDW), Inovio Pharmaceuticals Inc (NASDAQ:INO), Genworth Financial Inc (NYSE:GNW), Ariad Pharmaceuticals, Inc. (NASDAQ:ARIA), and Syngenta AG (ADR) (NYSE:SYT) today, and check in with the smart money to determine how they have been trading these equities.

Our research determined that following the small-cap stocks that hedge funds are collectively bullish on can help a smaller investor to beat the S&P 500 by around 95 basis points per month (see the details).

Tidewater Inc. (NYSE:TDW) has plunged by 43% after it disclosed the following in a PR statement concerning its discussions with principal lenders and note-holders in regards to amending its debt arrangements to obtain relief from certain covenants:

“While the company will continue to work toward amendments to its various debt arrangements that will be acceptable to all parties, there is a possibility that the lenders, noteholders and the company will not be able to negotiate new debt terms that are acceptable to all parties, in which case the company will have to consider other options, including a possible reorganization under Chapter 11 of the federal bankruptcy laws.”

In addition, the company also reported that it received extensions for limited waivers from certain covenants until November 11, 2016. Jim Simons‘ Renaissance Technologies cut its stake in Tidewater Inc. (NYSE:TDW) by 18% in the second quarter to 1.57 million shares at the end of June.

Follow Tidewater Inc (NYSE:TDW)

Follow Tidewater Inc (NYSE:TDW)

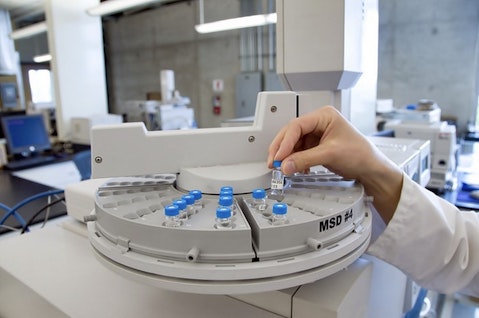

Receive real-time insider trading and news alerts

Inovio Pharmaceuticals Inc (NASDAQ:INO) shares are down by almost 14% after the company announced that the FDA has placed a clinical hold on its Phase 3 clinical trial for VGX-3100. In the FDA’s initial communication, the agency requested additional information to support the shelf-life of the disposable parts of the CELLECTRA 5PSP immunotherapy delivery device. Inovio is working to address the FDA’s concerns and anticipates that the requested data will be available before the end of 2016. The company also now estimates that the start of the phase III clinical program will be delayed until the first-half of 2017, pending resolution of the FDA’s requests. Of the 749 hedge funds that we track which filed 13Fs for the June quarter, eight funds owned $2.15 million worth of Inovio Pharmaceuticals Inc (NASDAQ:INO) shares on June 30, compared to six funds with $4.66 million worth of Inovio holdings on March 31.

Follow Inovio Pharmaceuticals Inc. (NASDAQ:INO)

Follow Inovio Pharmaceuticals Inc. (NASDAQ:INO)

Receive real-time insider trading and news alerts

On the next page we’ll see why traders are selling Genworth Financial, Ariad Pharmaceuticals, and Syngenta.