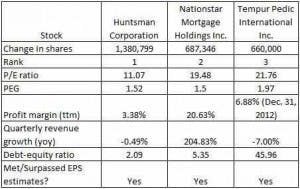

Mr. Bass’ Hayman Capital Management had a total of $160 million assets under management as of the end of December 2012. It had sold 3 stocks out and bought 10 new ones. The biggest buys were Huntsman Corporation (NYSE:HUN), Nationstar Mortgage Holdings Inc. (NYSE: NSM), and Tempur-Pedic International Inc. (NYSE:TPX). Although this article does not show the actual performance of the stocks when Hayman made the purchase, because we do not know for sure when that happened, we can still get an idea by analyzing its current performance. By looking at how the stock has done so far since the quarter of purchase, it provides a strong basis for whether the fund manager had picked the right stock or not.

Huntsman

Hayman Capital had just put chemicals-maker Huntsman Corporation (NYSE:HUN) on top of its portfolio with a new position of over 1.380 million shares, representing 13.68% of its total portfolio. Despite the recent negative growth in its revenues, Huntsman Corporation (NYSE:HUN) has either met or exceeded consensus estimates in terms of earnings in all quarters of 2012; the company boasts an ROE of 20.55%. Indicators of its valuation can easily lure investors. Its P/E ratio is 11.07, while its forward P/E is only 7.08. On the other hand, its high debt-equity ratio, at 1.955, can become a concern if the revenue continues to plummet. On a positive note, however, the quarterly debt-equity ratio is on a declining trend. Meanwhile, Huntsman Corporation (NYSE:HUN) maintains a good record of paying stable dividend income; it recently increased the quarterly amount from $0.10 to $0.125 per share in the first quarter of 2013. The company had just moved up in market cap rank, with $4.04 billion, passing Patterson Companies, which has a current market cap of $4.02 billion.

Nationstar Mortgage Holdings

The asset management firm initiated a position in Nationstar Mortgage worth over $21.293 million, which is equivalent to 13.26% of its portfolio. The company exhibits high profitability with its net margin (ttm) of 20.63% and ROE of 32.72%. The current margin is way above the historical rate of below 10%. In fact, the company has consistently performed a positive earnings surprise in the last 3 consecutive quarters. Furthermore, NSM has a P/E ratio of 19.76 and a forward ratio of only 9.45. Meanwhile, quarterly revenue has expanded enormously by 204.83% year-over-year. In terms of debt, the company heavily relies on borrowings, with its debt-equity ratio of 5.35. But I must say that Mr. Bass had correctly picked NSM based on the fact that the stock price has been slowly moving above the $35 mark since the year started.