If there was one company that did not provide any significant shareholder return even in spite of exceptional performance in the last few years, that is Microsoft. As is written in this article:

[…] the Microsoft example provides is how there was such a separation between business results and stock performance. Clearly, Microsoft, the business, performed exceptionally well from 1999 until today. However, because the price was so insanely overvalued, shareholder returns were poor in spite of strong operating results.

As a matter of fact, a company’s performance and its shareholders’ returns are two completely different things. That’s where the term ‘value’ comes in. In this article, I want to research a bit about the present value of Microsoft Corporation (NASDAQ:MSFT) and where the stock price might be heading from here.

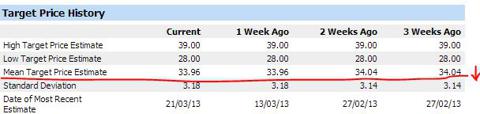

One of the best valuation indicators can be the price estimates by the analysts. According to Investorguide.com, here is a list of price estimates as per popular analysts. And it does not seem too inspiring to me. In fact, the stock’s target price has been revised downward in the last 3 weeks.

Is Microsoft Corporation (NASDAQ:MSFT) really getting overvalued?

If I consider $25 as the average price for the last 5 years, then Microsoft is currently trading above its mean stock price. Can we justify the uptrend? With Windows 8 not doing so good and the PC market going down, we may not have enough valid reasons to justify the current stock price.

It can be noticed though that the non-corporate insider transactions have leaned far too much on the ‘selling’ side. Non-corporate insiders can be expected to be not interested in taking over a company. They are mainly focused on wealth maximization, as are we. And why are they selling more than they are buying? Are the insiders not so confident about the company? Or are they knowledgeable about the imminent stock price decline?

One interesting thing to note is that the institutional investors have not changed their positions much in the last three months. Should we be following the ‘big money’?

| Institutional Holdings: | 65.00% (as of 02/28/13) |

| Bought (Previous 3 Mo): | 422.26 million |

| Sold (Previous 3 Mo): | 425.65 million |

| Total Held: | 5.45 billion |

| Institutions: | 3.29 thousand |

| Non-Corp. Insider Holdings: | 9.20% (as of 01/31/13) |

| Bought (Previous 3 Mo): | 15.13 thousand |

| Sold (Previous 3 Mo): | 5.05 million |

Let us take a look at the various valuation ratios now.

Fundamental valuation

Price-to-earnings ratio: The interesting thing to note about Microsoft Corporation (NASDAQ:MSFT)’s PE ratio and stock price is that while the price has been relatively trading around the average level for the last 5 years, the PE ratio is at its lowest right now since 2010.

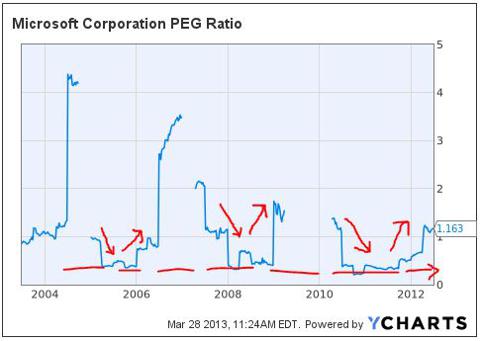

With EPS expected to reach $3.50 by 2015, the price has potential to grow. Right now, the PEG ratio seems to have reached the upper limit. With any positive updates from Microsoft Corporation (NASDAQ:MSFT), the PEG ratio should go down, with PE ratio going up, raising the valuation of the company.

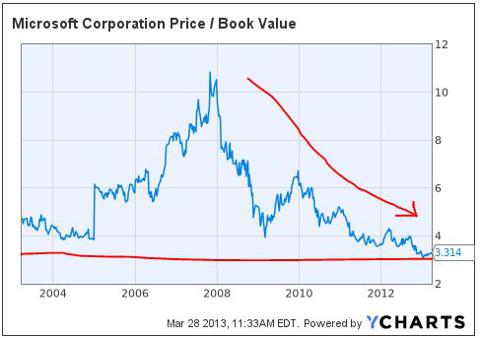

Price-to-book ratio: The P/BV ratio is at its lowest in the last 10 years.

If you look at the table below though, shareholders’ equity has gone up exponentially since 2010. With $63 billion in short-term investments and $10.7 billion in long-term debt (only $1.23 billion of that counted as current) as of December, 2012, the company seems to be in a healthy financial position.

Needless to say, the book value per share should go up in the coming few years. $2.31 billion worth of investment in fixed assets in 2012 is not going to go to waste, I am sure. And that’s when the P/BV ratio is going to rise to the normal level. In fact, the current book price is $40.52, the price at which the stock should trade to achieve the average P/BV level of the last 10 years.

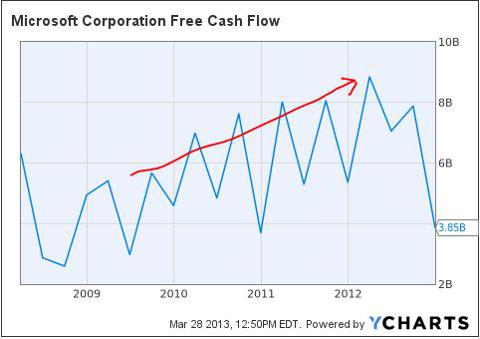

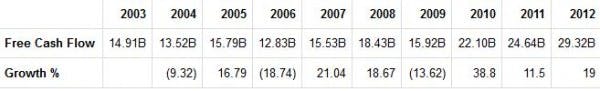

Price-to-cash flow ratio: Looking at the table below, FCF has a CAGR of 7.8%.

With the discount rate being taken as 15%, the current discounted growth price is $38.65. The current stock price seems undervalued by 35.03%.

The FCF has grown steadily in the last 5 years, except for 2012. Perhaps, the transition-to-mobile phase is taking its toll on the company, which I hope to get resolved by the end of 2015.

Price-to-sales ratio: When we look at the image below, it is clear that the P/S ratio is also riding at its lowest since 2010. Why? Revenue has been rising steadily since late 2009 to $73 billion by the end of 2012. With the PC market still growing in single digits, I really don’t see any reason why the P/S ratio should go down that drastically. It is as if the market forecasted future decline in revenue without any valid reason, reflecting that in the P/S ratio.

And that is in contrast to analysts’ estimates that sales should reach $92 billion by the end of 2015. It must be noted though that revenue is expected to stall following that. According to me, it is still too far-reaching at the moment. One right acquisition and the whole scenario might change.

Having said that the company might be undervalued in comparison to itself, it is always good to verify the same in comparison with the immediate peers as well. Let us look at the comparative valuation analysis of the company.

| Companies | Price/Earnings Ratio | Price/Book Value Ratio | Price/Sales Ratio |

| Microsoft Corp (NASDAQ:MSFT) | 15.65 | 3.58 | 3.22 |

| Intl. Business Machines | 14.71 | 12.29 | 2.25 |

| Oracle Corp | 14.95 | 3.59 | 4.05 |

| Hewlett-Packard (NYSE:HPQ) Co. | NA | 2.06 | 0.38 |

| Apple (NASDAQ:AAPL) | 10.16 | 3.59 | 2.71 |

Even though Microsoft Corporation (NASDAQ:MSFT) might be fundamentally undervalued, it still seems overvalued when compared to Apple Inc. (NASDAQ:AAPL) and Oracle Corporation (NASDAQ:ORCL). If we consider the growth potential in the mobile market, Apple seems to be better valued than Microsoft. As per recent data, Apple stands second in the global smartphone market, after Google Inc (NASDAQ:GOOG)’s Android. And in terms of profitability margins and financial health, Oracle seems far more investor-friendly than Microsoft. International Business Machines Corp. (NYSE:IBM) with a dividend yield of 1.59% is definitely overvalued and would probably see a downward adjustment in the coming year. Moreover, with the high LT debt-to-equity ratio at 176 times, and below average profitability margins, IBM’s stock price is probably overvalued at the moment.

Conclusion

Looking at the fundamental and technical metrics mentioned above, it can be safely said that Microsoft stock price has the potential to soar in the future. Not to mention the fat dividends that you will probably enjoy alongside. With its sheer size of around $240 billion, this company has the necessary ‘economy moat’ a technology company dreams about. One of the tech giants in the world, Microsoft is a good bet for your investing money.

The article Things Are Pointing Up for Microsoft originally appeared on Fool.com and is written by Suman Chatterjee.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.