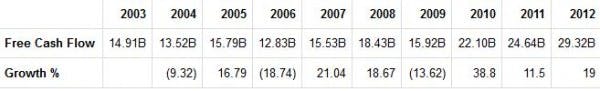

Price-to-cash flow ratio: Looking at the table below, FCF has a CAGR of 7.8%.

With the discount rate being taken as 15%, the current discounted growth price is $38.65. The current stock price seems undervalued by 35.03%.

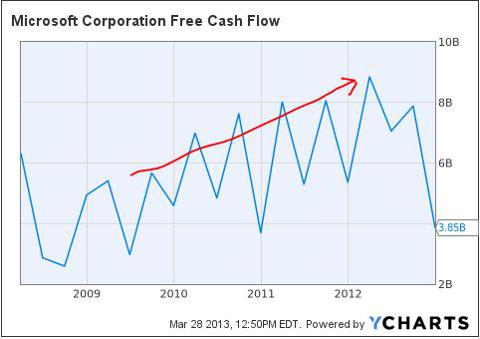

The FCF has grown steadily in the last 5 years, except for 2012. Perhaps, the transition-to-mobile phase is taking its toll on the company, which I hope to get resolved by the end of 2015.

Price-to-sales ratio: When we look at the image below, it is clear that the P/S ratio is also riding at its lowest since 2010. Why? Revenue has been rising steadily since late 2009 to $73 billion by the end of 2012. With the PC market still growing in single digits, I really don’t see any reason why the P/S ratio should go down that drastically. It is as if the market forecasted future decline in revenue without any valid reason, reflecting that in the P/S ratio.

And that is in contrast to analysts’ estimates that sales should reach $92 billion by the end of 2015. It must be noted though that revenue is expected to stall following that. According to me, it is still too far-reaching at the moment. One right acquisition and the whole scenario might change.

Having said that the company might be undervalued in comparison to itself, it is always good to verify the same in comparison with the immediate peers as well. Let us look at the comparative valuation analysis of the company.

| Companies | Price/Earnings Ratio | Price/Book Value Ratio | Price/Sales Ratio |

| Microsoft Corp (NASDAQ:MSFT) | 15.65 | 3.58 | 3.22 |

| Intl. Business Machines | 14.71 | 12.29 | 2.25 |

| Oracle Corp | 14.95 | 3.59 | 4.05 |

| Hewlett-Packard (NYSE:HPQ) Co. | NA | 2.06 | 0.38 |

| Apple (NASDAQ:AAPL) | 10.16 | 3.59 | 2.71 |

Even though Microsoft Corporation (NASDAQ:MSFT) might be fundamentally undervalued, it still seems overvalued when compared to Apple Inc. (NASDAQ:AAPL) and Oracle Corporation (NASDAQ:ORCL). If we consider the growth potential in the mobile market, Apple seems to be better valued than Microsoft. As per recent data, Apple stands second in the global smartphone market, after Google Inc (NASDAQ:GOOG)’s Android. And in terms of profitability margins and financial health, Oracle seems far more investor-friendly than Microsoft. International Business Machines Corp. (NYSE:IBM) with a dividend yield of 1.59% is definitely overvalued and would probably see a downward adjustment in the coming year. Moreover, with the high LT debt-to-equity ratio at 176 times, and below average profitability margins, IBM’s stock price is probably overvalued at the moment.

Conclusion

Looking at the fundamental and technical metrics mentioned above, it can be safely said that Microsoft stock price has the potential to soar in the future. Not to mention the fat dividends that you will probably enjoy alongside. With its sheer size of around $240 billion, this company has the necessary ‘economy moat’ a technology company dreams about. One of the tech giants in the world, Microsoft is a good bet for your investing money.

The article Things Are Pointing Up for Microsoft originally appeared on Fool.com and is written by Suman Chatterjee.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.