If there was one company that did not provide any significant shareholder return even in spite of exceptional performance in the last few years, that is Microsoft. As is written in this article:

[…] the Microsoft example provides is how there was such a separation between business results and stock performance. Clearly, Microsoft, the business, performed exceptionally well from 1999 until today. However, because the price was so insanely overvalued, shareholder returns were poor in spite of strong operating results.

As a matter of fact, a company’s performance and its shareholders’ returns are two completely different things. That’s where the term ‘value’ comes in. In this article, I want to research a bit about the present value of Microsoft Corporation (NASDAQ:MSFT) and where the stock price might be heading from here.

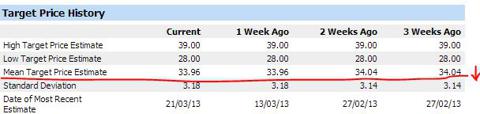

One of the best valuation indicators can be the price estimates by the analysts. According to Investorguide.com, here is a list of price estimates as per popular analysts. And it does not seem too inspiring to me. In fact, the stock’s target price has been revised downward in the last 3 weeks.

Is Microsoft Corporation (NASDAQ:MSFT) really getting overvalued?

If I consider $25 as the average price for the last 5 years, then Microsoft is currently trading above its mean stock price. Can we justify the uptrend? With Windows 8 not doing so good and the PC market going down, we may not have enough valid reasons to justify the current stock price.

It can be noticed though that the non-corporate insider transactions have leaned far too much on the ‘selling’ side. Non-corporate insiders can be expected to be not interested in taking over a company. They are mainly focused on wealth maximization, as are we. And why are they selling more than they are buying? Are the insiders not so confident about the company? Or are they knowledgeable about the imminent stock price decline?

One interesting thing to note is that the institutional investors have not changed their positions much in the last three months. Should we be following the ‘big money’?

| Institutional Holdings: | 65.00% (as of 02/28/13) |

| Bought (Previous 3 Mo): | 422.26 million |

| Sold (Previous 3 Mo): | 425.65 million |

| Total Held: | 5.45 billion |

| Institutions: | 3.29 thousand |

| Non-Corp. Insider Holdings: | 9.20% (as of 01/31/13) |

| Bought (Previous 3 Mo): | 15.13 thousand |

| Sold (Previous 3 Mo): | 5.05 million |

Let us take a look at the various valuation ratios now.

Fundamental valuation

Price-to-earnings ratio: The interesting thing to note about Microsoft Corporation (NASDAQ:MSFT)’s PE ratio and stock price is that while the price has been relatively trading around the average level for the last 5 years, the PE ratio is at its lowest right now since 2010.

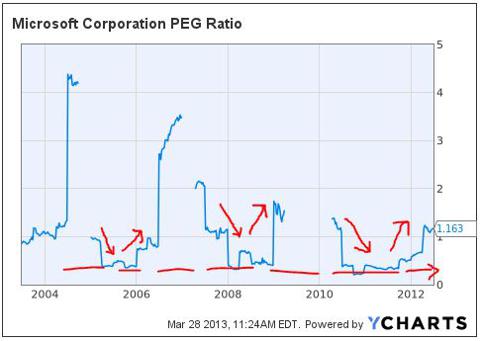

With EPS expected to reach $3.50 by 2015, the price has potential to grow. Right now, the PEG ratio seems to have reached the upper limit. With any positive updates from Microsoft Corporation (NASDAQ:MSFT), the PEG ratio should go down, with PE ratio going up, raising the valuation of the company.

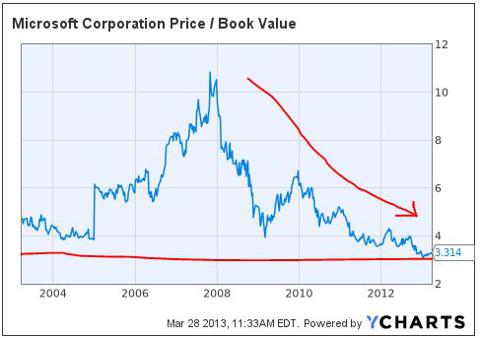

Price-to-book ratio: The P/BV ratio is at its lowest in the last 10 years.

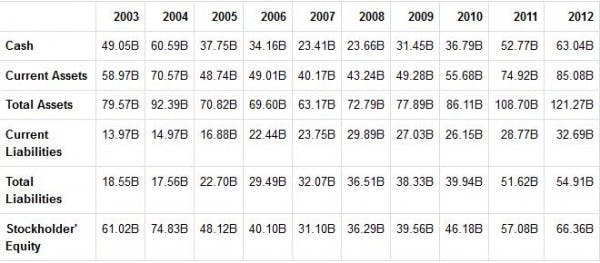

If you look at the table below though, shareholders’ equity has gone up exponentially since 2010. With $63 billion in short-term investments and $10.7 billion in long-term debt (only $1.23 billion of that counted as current) as of December, 2012, the company seems to be in a healthy financial position.

Needless to say, the book value per share should go up in the coming few years. $2.31 billion worth of investment in fixed assets in 2012 is not going to go to waste, I am sure. And that’s when the P/BV ratio is going to rise to the normal level. In fact, the current book price is $40.52, the price at which the stock should trade to achieve the average P/BV level of the last 10 years.