I firmly believe that The Walt Disney Company (NYSE:DIS) is destined to be one of the great growth stocks of this decade. Yet when you ask most people how Disney makes its money, they’ll tell you theme parks, movies or toys. A lot of people also believe that Disney’s a stodgy old stock for conservative investors.

It’s time to dispel these misconceptions about Disney and let you know what makes this stock shine.

Mickey’s Millions

First, let’s examine how much revenue Disney generated from its six business segments over the past four years.

What makes Disney’s Media Networks business so important is that while it generates 46% of the company’s revenue, it brings in 57% of its total operating income – more than the rest of the Disney empire combined.

Disney’s vast media empire was the brainchild of former CEO Michael Eisner, who oversaw the takeover of Capital Cities/ABC for $19 billion in 1996. Capital Cities was the parent company of ESPN.

Eisner attempted a two-pronged approach to make ESPN profitable – by offering its ESPN branded products at Disney’s theme parks and retail stores, and by expanding ESPN overseas as an international sports channel.

However, things didn’t quite pan out the way Eisner imagined. ESPN integration in theme parks and retail shops is minimal, and its international affiliate fees only account for 11% of the network’s total revenue. However, its overall revenue is still massive – ESPN generates approximately $10.3 billion in annual revenues, more than half of the rest of the Media Networks segment combined.

A research report from Wunderlich found ESPN to be worth $40 billion. The report values the Disney Channel at $10 billion, while ABC Networks, which has declined dramatically over the past fifteen years, is only worth $1.7 billion.

News Corp (NASDAQ:NWS)oration and Comcast Corporation (NASDAQ:CMCSA) – which respectively own Fox and NBC Universal, have stepped up their game in response to ESPN’s growth.

Fox Sports and NBC Sports have emerged as strong competitors, which caused sports broadcast rights fees to soar. Last year, the MLB doubled its annual fees for broadcast rights, raking in a combined $12.4 billion from ESPN, Fox and TBS. In 2011, ESPN paid $15.2 billion for an eight year deal for the rights to broadcast NFL games. Going forward, these rising fees could crimp the profitability of sports networks.

Although they own rival sports networks, neither News Corporation nor Comcast can match the strength of Disney’s brand name and other business segments. While Disney makes movies, toys, cruise ships and theme parks, News Corporation has an extremely fragmented business model spread across dozens of media assets, many of them unprofitable. Meanwhile, Comcast generates the majority of its revenue from its original business – being a cable provider.

Let’s compare the basic fundamentals of these three companies.

From this comparison, we can see that Disney wins out in the most important growth categories, and more importantly, it has far less debt than its rivals. News Corporation’s future growth can’t even be accurately measured by P/E and PEG since it is not currently profitable. Comcast is in better shape than News Corporation, but its debt levels are nearly the same.

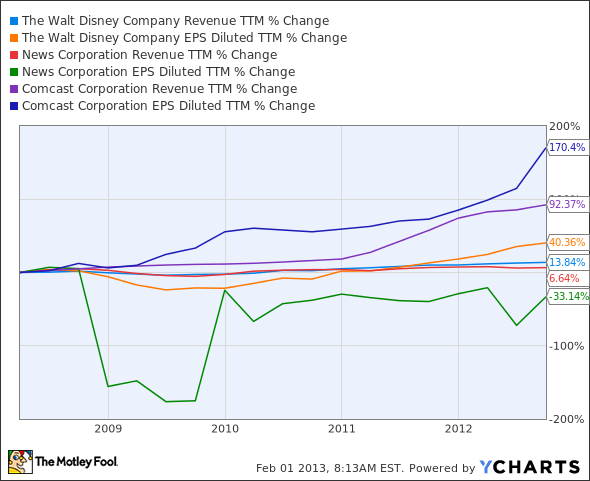

Now let’s check on their revenue and earnings growth over the past five years.

DIS Revenue TTM data by YCharts

Here’s where Comcast has really grown, easily outpacing Disney and News Corp. Both Comcast and Disney are growing profits faster than revenue, an encouraging sign that margins will grow in the future.

In addition to Disney’s booming media business, it’s two other key businesses – theme parks and movies – have been extremely promising.

Disney’s flagship theme parks account for nearly a third of total revenues. This percentage has also slowly risen, despite the global recession. Disney’s upcoming Shanghai Disneyland Park, which opens in 2015, will be the largest in Asia and will capitalize on a rising Chinese middle class. At its existing resorts, Disney has been able to raise ticket and room rates without adversely impacting sales volume.

Disney’s investments and overall revenue from movie franchises at its Studio Entertainment division has steadily declined over the past four years, as the company shifts production over to its subsidiary Marvel (and later on, Lucasfilm).

This is a great strategy, since Disney’s own movie studios have had a notoriously inconsistent track record of blockbusters and bombs.

Mars Needs Moms

and

John Carter

, two of its worst faring films in the past two years, lost a combined $300 million at the box office.

It’s definitely time to let Marvel’s multi-year franchises do the heavy lifting from now on.

The Foolish Bottom Line

In closing, Disney is a stock that has all of these things:

- Globally recognized and loved brands

- Owns the largest sports network in the world

- Stable revenue and earnings growth

- Diverse all-weather portfolio of products

- Low debt compared to its industry

- Proven pricing power at its flagship parks and resorts

While Disney has risen nearly 40% over the past twelve months, its low forward P/E suggests that it still has room to grow. Therefore, the “Happiest Place on Earth” might just be the “Happiest Place” for all your uninvested cash.

The article Still the Most Magical Investment On Earth originally appeared on Fool.com and is written by Leo Sun.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.