The most common way to determine if stock market returns are overpriced or cheap is to use P/E ratios. The two schools of thought include that of permabulls, who argue that the stock market is cheap because of both the trailing 12-month P/E ratio and 2011 earnings estimates; and Permabears, who argue that the stock market is expensive because of a high Shiller’s P/E Ratio. The Yale economics professor who developed this, Robert Shiller, thought that average real earnings during the past decade is a better indicator of long term earnings. He created the cyclically adjusted P/E ratio (CAPE) to predict long term returns in the stock market. The average historical Shiller P/E ratio is around 16, and right now it’s above 20. That means, according to permabears like David Rosenberg, the stock market is overvalued by at least 20% based on this metric.

Insider Monkey thinks long-term interest rates should also be considered. When combined with long term interest rates, cyclically adjusted price earnings ratio could yield better signals. When long-term interest rates are high, stock prices and Shiller’s CAPE could be low. For instance, in March, 1980 Shiller’s P/E ratio was only 8.1 and the S&P 500 index was at 104.70. Ten years later, the S&P 500 index was 338.46, a 3-fold increase. However, in March, 1980 the 10-year interest rate was 12.75% and $104.7 invested in this would have compounded to $347.63 by March 1990. Clearly the stocks were undervalued by 50% according to Shiller’s P/E in 1980, but they didn’t outperform the bonds by a huge margin over the next 10 years.

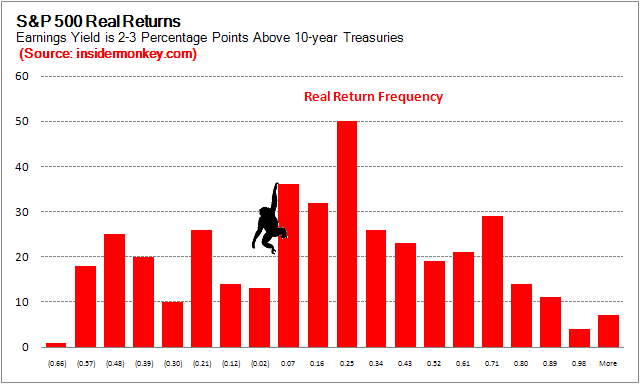

Today, 10 year bonds yield only 2.4% whereas the cyclically adjusted earnings yield is close to 5%. Historically, when the cyclically adjusted earnings yield is 2-3 percentage points above the 10-year treasury yields, the S&P 500 index returns 58% in real terms during the following 10-year period. When the earnings yield –which is the inverse of the P/E ratio – is above the long-term interest rates, companies can borrow at cheaper rates and invest it in themselves and increase profits. The real yield of 10-year bonds right now is below 1%, so these bonds will return about 10% in the next 10 years. If stocks behave the same way they did in the past, they’ll return 58%, and will beat bonds by nearly 50% over the next 10 years.

Do you agree with this article? Before you answer I want to tell you that we wrote this article two years ago (on Oct 12, 2010) when Shiller’s cyclically adjusted PE ratio was around 21. SPDR S&P 500 ETF Trust (NYSEARCA:SPY) returned more than 20% since then. Shiller’s cyclically adjusted PE ratio is also around 21 today and there are a lot of people “warning” us to expect meager returns for a decade.