In any long-term portfolio, a certain amount of one’s holdings should be allocated to investments in “safe” stocks. I define that term as large, stable companies with great records of returns and dividend increases, which also are able to weather recessions well. One of the best sectors to find companies like this is consumer products companies, and my favorite play in this sector right now is The Procter & Gamble Company (NYSE:PG). As you will see, sometimes the “safe” and “boring” stocks like this one can turn out to be the best thing you can do for your portfolio over the long run.

About Proctor & Gamble

The Procter & Gamble Company (NYSE:PG) sells a wide array of products that it classifies into five segments, including beauty products, grooming, health care, fabric/home care, and baby/family care. The company produces such well-known brands as Olay, Pantene, Gillette, Crest, Vicks, Duracell, Tide, Charmin, and Pampers, just to name a few.

The Procter & Gamble Company (NYSE:PG) is truly an international company, selling its products in over 180 countries around the world. 39% of the company’s revenues come from the U.S. and Canada, with the rest coming from Western Europe (19%), Asia (18%), and Latin America (10%). Their largest customer is Wal-Mart, which accounts for 14% of the company’s total revenues.

Growth Plans

The Procter & Gamble Company (NYSE:PG) is one year into a five year, $10 billion cost cutting plan. A significant amount of these savings is expected to come from a restructuring of their operations, which unfortunately includes the downsizing of over 5,000 employees; however it should allow the company to operate more efficiently going forward. The company also plans to shift the priority of its resources toward its most profitable businesses.

Valuation

The Procter & Gamble Company (NYSE:PG)’s valuation may seem a bit pricey at 17.3 times TTM earnings, but I believe that this is pretty reasonable. First, analysts project an 8.6% forward growth rate for the company, which is very good for a company of this size. Secondly, companies with the best track records of returns and dividend raises often command a premium, and such is the case here.

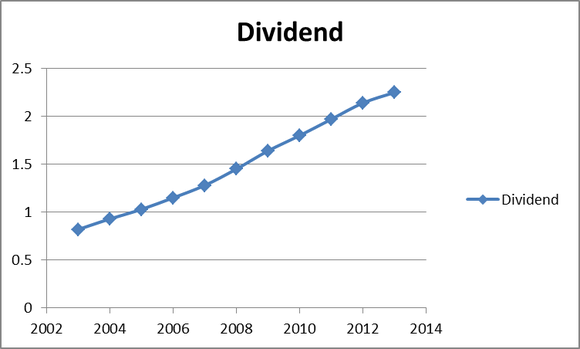

With a dividend yield of just under 3%, Proctor & Gamble is one of the higher yielders in the sector (compare to the 2.4% yield of rival Colgate-Palmolive Company (NYSE:CL)). Plus, they have raised their dividend amount each and every year in recent history, including and especially during the recent recession (see chart below). In fact, a more linear dividend increase over time is hard to come by.

The second thing you should look for when considering a stock for the long haul is share buybacks as a form of increasing the intrinsic value of a company’s shares. Over the past four years alone, Proctor & Gamble has reduced the amount of shares outstanding from 3.15 billion to 2.73 billion, a reduction of 13.3% in a relatively short timeframe.

Alternatives

The logical alternative options are other diversified consumer products companies, such as the aforementioned Colgate-Palmolive Company (NYSE:CL), and companies such as Kimberly Clark Corp (NYSE:KMB).

Colgate-Palmolive Company (NYSE:CL) is primarily known for its namesake oral care products; however the company also produces other personal care brands such as Irish Spring, Speed Stick, Palmolive, and Softsoap. At 22.3 times TTM earnings, it seems a bit expensive compared with P&G, not to mention that they have a lower dividend yield. There is also some comfort in the size of The Procter & Gamble Company (NYSE:PG), as larger companies are generally (but not always) more stable and predictable.

Kimberly-Clark makes various products from natural or synthetic fibers, and they have an array of well-known brands including Kleenex, Scott, Huggies, Pull-Ups, Kotex, and Depends. Kimberly-Clark pays a higher dividend yield than P&G at 3.4% but is a bit pricier at 21.6 times TTM earnings. The consensus calls for just a 6% forward growth rate, making their valuation way too high in my opinion.

Conclusion

The Procter & Gamble Company (NYSE:PG) is precisely the kind of stock that investors should get excited about buying. While some investors may think that these big, stable companies make boring investments, consider this: $100,000 invested in Proctor & Gamble exactly 20 years ago, assuming reinvestment of dividends, would be worth $1,072,000 today! All of the sudden, it doesn’t seem so boring anymore.

The article Buy This Personal Product Maker for Years of Great Returns originally appeared on Fool.com and is written by Matthew Frankel.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.