Apple Inc. (NASDAQ:AAPL) has had a wild ride over the past couple of weeks. On Wednesday, September 12th, the tech giant finally announced the iPhone 5. To say there was hype surrounding Apple’s newest iteration of its über-popular smartphone would be an understatement.

It appears the markets agree.

Over the following two days of trading activity, shares of the company rose nearly 5% to flirt with the $700 mark for the first time in their storied history. In the week since, the stock has risen above this psychological barrier, and currently rests at $700.09 a share.

Now, the news surrounding Apple Inc. (NASDAQ:AAPL) has not been all positive, as fanboys have had to “deal with” early reports that the iPhone 5’s new mapping application is nothing more than a pretty face. Moreover, the device has been criticized by many tech bloggers for failing to live up to their lofty expectations, which included day dreams of features like HD radio and 128GB storage.

While these concerns are justified, it hasn’t slowed down Apple’s party-train one bit. As we reported last week, the company received a record 2 million preorders for the iPhone 5 in its first 24 hours, a level of demand more than twice the size the iPhone 4S had last year. To put these numbers into perspective, recall that Apple sold 37 million units of its newest smartphone in the fourth quarter of 2011 (technically its fiscal Q1), which was also a record total. At the end of this same period, the company reported all-time highs in quarterly revenue ($46.3B) and quarterly EPS ($13.87). In the three months following the public release of its holiday 2011 earnings, shares of Apple rose 31.1%, above the $600 mark for the first time.

Judging by its booming preorder numbers, it’s very likely that these records could be broken once again. Early estimates by Shaw Wu of Sterne Agee place iPhone 5 sales in this year’s holiday quarter at 46.5 million units, and its quite possible that opening weekend sales can eclipse 10 million alone. If these even a fraction of these estimates hold, and the remaining segments of Apple’s revenue remain in-step with historical levels of growth, the company can generate earnings in excess of $15 a share over its next quarter.

At the moment, official EPS forecasts of nearly 40 Wall Street analysts average $15.64 a share, with a range between $14.08 and $18.47. In other words, an EPS on the absolute lowest end of consensus estimates will still be record-setting. Considering the effect that generally positive earnings reports have had on Apple’s stock in the past, its difficult to find any reason not to be bullish on this situation.

Well, here’s one more.

At it’s current market price a shave above $700 a share, Apple Inc. (NASDAQ:AAPL) is undervalued. Yep, you read that right. Despite all of the hubbub surrounding the company at all times, not to mention during the release of arguably its most anticipated product ever, Apple’s shares are cheap.

We can see this by looking at the stock’s Price-to-Earnings ratio (16.5X), which is below Google Inc. (NASDAQ:GOOG) at 21.8X, and Apple’s own 5-year historical average of 21.9X. More importantly, when forward-looking estimates are used, Apple also trades at a lower earnings multiple (13.3X) than the forward P/E of Google (14.9X). Interestingly, Microsoft Corporation (NASDAQ:MSFT) is trading at cheaper trailing (15.6X) and forward (9.5X) P/Es than the Cupertino-based company, but the true light of Apple’s undervaluation can be seen when earnings growth is factored into the equation.

The PEG ratio, which indicates how investors are valuing a company’s expected EPS growth, is particularly low when looking at Apple. With a PEG of 0.76, it is trading at nearly a 25% discount to what is considered to be a “fair” valuation, and this metric is also below Google (1.29) and Microsoft (1.78), and lower than more loosely associated peers like Dell Inc. (NASDAQ:DELL) at 1.25, and International Business Machines Corp. (NYSE:IBM) at 1.41.

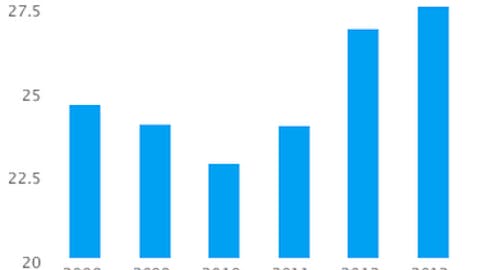

As Apple Inc. (NASDAQ:AAPL) continues its maturity into even more of an omnipresent force in the technological world, its growth will undoubtedly slow, and long-range estimates are already predicting such an event. Though the company’s EPS growth has averaged 65.0% annually over the past five years, early consensus places this growth to average 21.5% a year over the next half-decade. Though this estimated growth is below historical levels, it is still above the likes of Google (16.8%), Microsoft (8.8%), Dell (4.9%), and IBM (10.6%). It appears that the markets are over-discounting Apple’s slowing growth, and even if its holiday sales remain flat from 2011 totals, investors can still expect solid appreciation over the next 6-12 months.

Fortunately for the millions of Apple Inc. (NASDAQ:AAPL) bulls out there, it is reasonable to expect the iPhone 5 to outsell the 4GS over the remainder of 2012. If this occurs, and more sales records are broken, it’s a strong possibility that the stock could crack the quadruple digits. As mentioned in “Apple (AAPL) Can Get Past $1,000,” a successful deal with China Mobile Ltd. (NYSE:CHL) will give the company access to nearly 700 million untapped mobile phone users, or 70% of Chinese market.

If Apple can reach an agreement with China Mobile while selling 40 million-plus iPhone 5 units over the next quarter, investors can expect a very merry Christmas.

The hedge fund industry is definitely in agreement with this outlook, as 140 funds held shares of Apple in their 13F portfolios at the end of Q2. This total compares very favorably to its tech competitors like Google (113), Microsoft (97), Dell (35), and IBM (43). Some of the most notable Apple bulls are Chase Coleman of Tiger Global Management, David Einhorn of Greenlight Capital, and Philippe Laffont of Coatue Management. For a complete look at hedge funds’ sentiment toward Apple Inc. (NASDAQ:AAPL), continue reading here.