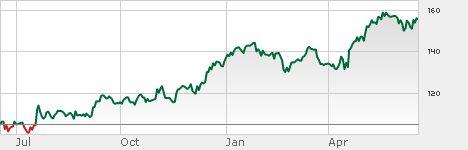

PPG Industries, Inc. (NYSE:PPG) is one of the leading chemical companies in the market, with a diverse product portfolio that includes coatings and glass products for a variety of applications. The company has done very well for itself, with shares up over 55% in the past year, currently just under their all-time highs. After a gain like this, and with a seemingly high valuation, is PPG still attractive enough to invest in, or would one of its rival chemical companies like E I Du Pont De Nemours And Co (NYSE:DD) or The Dow Chemical Company (NYSE:DOW) be a better addition to our portfolios?

About PPG Industries

PPG Industries, Inc. (NYSE:PPG) makes most of its money from coatings, and about 15% from its glass products. The business is divided into five segments, three for the coatings and two for the glass business.

As far as coatings go, the largest segment by revenue is the Performance segment, which produces aerospace, protective, marine, and automotive coatings. Industrial coatings consist of packaging coatings and other coatings meant for various industrial equipment. Finally, Architectural coatings produces coatings for use by painting professionals that are sold through PPG Industries, Inc. (NYSE:PPG)’s company-owned stores and other retail channels.

The company’s glass business is divided into two segments. The first, simply called the glass segment, consists of PPG Industries, Inc. (NYSE:PPG)’s flat glass business, which is one of the largest in North America. The company produces flat glass for construction, aircraft, furniture, and other uses. The other segment is called Optical and Specialty materials, and includes Transitions lenses, sun lenses, and many other optical products.

A busy year so far…

In addition to the business segments listed above, PPG was involved in the commodity chemicals business until this year, producing chlor-alkali and various derivatives. At the end of January, the company merged its commodities chemicals business with Georgia Gulf, now Axiall Corp (NYSE:AXLL). As a result of the transaction, $900 million in cash was paid to PPG directly and about $1 billion of Axiall shares was paid to PPG’s shareholders. Commodity chemicals is a rather volatile business that tend to carry with it lower profit margins, so this transaction helps PPG reach its goal of more consistent and predictable growth. On an investment note, Axiall could end up producing great returns if raw material and energy costs continue to work in their favor.

Also earlier this year in April, PPG Industries, Inc. (NYSE:PPG) acquired the North American architectural coatings business of Akzo Nobel for $1.05 billion. The business has annual revenues of around $1.5 billion and significantly expands PPG’s architectural coatings footprint. The acquisition should also result in some cost savings due to the efficiency that is to be expected one the new business becomes fully integrated with PPG’s existing infrastructure.

The numbers

PPG Industries, Inc. (NYSE:PPG) trades for 19.7 times the current fiscal year’s estimated earnings, which seems a bit high to me. While the company is projected to grow its earnings at a relatively high rate going forward, the company does have an above-average debt level, and its profit margins are very dependent on raw materials costs, which can fluctuate significantly. The consensus of analysts covering the company project a 3-year average forward earnings growth rate of 8.5%, which doesn’t justify the current pricing in my opinion. Additionally, PPG’s dividend yield of just 1.6% is sub-par, especially for those who view income as a priority when investing.

Other chemical giants: Dow and DuPont

There are many choices in the chemical business, but let’s take a look at two of the leaders in the sector to see if we can find a better deal, or if all chemical companies are a bit on the expensive side.

Dow Chemical is the largest U.S. chemical company with an extremely diverse assortment of coatings, plastics, agricultural products, and energy products. In my opinion, Dow is a tremendous bargain right now at just 14.6 times current year earnings, and the company is projected to grow its earnings by 23% and 19.5% during the next two years. While Dow does have a debt issue as well, the valuation still looks extremely attractive, as does Dow’s 3.8% dividend yield which is sure to attract income-seekers.

DuPont is the second largest U.S. chemical company and is just as diversified in its product offerings as Dow. DuPont is the “cheapest” of the three companies mentioned at 13.9 times current year earnings, which are projected to grow at 12% annually going forward. DuPont is also a good income stock, with a 3.42% yield that has never been cut, something Dow can’t claim.

Buy, Sell, or Hold?

So, it looks like the expensive valuation is not widespread across the chemical sector. PPG Industries, Inc. (NYSE:PPG) is a bit overpriced at the current level, and I would need either a significant pullback or some upside surprise in their next quarterly report before I would be a buyer. In the meantime, either of the other two companies mentioned would make an excellent long-term play on the chemical sector, with my preference going to Dow due to its dividend and impressive growth rate.

Matthew Frankel has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

The article There Are Better Ways to Play the Chemical Sector originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.