This division of the company acquires, explores, develops and produces gas and crude oil for sale in the commodities market. In August, the company sold its interest in shale oil assets in the Williston basin, which accounts for only 15% of its total oil and gas reserves. The $243 million that it got from this sale is to be used for reducing the interest burden paying off debt that is due in 2013. The interest saving amounts to $0.09 per share, which is likely to result in better future earnings and also help in avoiding the need to raise fresh equity capital for funding the planned $1.2 billion capital expenditure till 2016.

This division of the company acquires, explores, develops and produces gas and crude oil for sale in the commodities market. In August, the company sold its interest in shale oil assets in the Williston basin, which accounts for only 15% of its total oil and gas reserves. The $243 million that it got from this sale is to be used for reducing the interest burden paying off debt that is due in 2013. The interest saving amounts to $0.09 per share, which is likely to result in better future earnings and also help in avoiding the need to raise fresh equity capital for funding the planned $1.2 billion capital expenditure till 2016.

Apparently, the market ignored the fact of decline in production in 2013, which is estimated at 6%.

At $40.89, the stock is trading at 1.49 times book value. Considering the potential for profit and reserves of scarce natural resources, the BKH appears to be undervalued.

Zoltek Companies (NASDAQ:ZOLT) is an applied technology and materials company. It operates through wholly owned subsidiaries and is engaged in development, manufacturing and marketing of carbon and technical fibers and in manufacturing of filament winding and pultrusion equipment used in the production composite parts. ZOLT has manufacturing units in Hungary and Mexico and in Abilene (Texas) and St. Charles (Missouri).

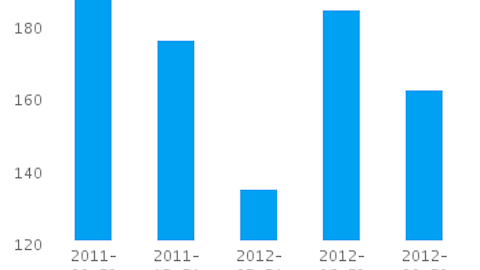

The company reported revenue of $35.9 million and EPS of $0.09 for the quarter ended December 2012. On both counts, it missed analyst forecasts – revenue by $6.1 million and EPS by $0.04.

In this case, ZOLT stock price gained 5.16% in January and settled at $8.15 per share after having touched $8.51 on January 11. On the day quarterly results were to be released, the stock reacted and gained 4.62% in one day.

Pluses for ZOLT

1). ZOLT is expected to grow at an annual average rate of 15% in the long term. However, analyst forecast for the remaining three quarters of the fiscal year 2013 is for a negative growth of 26.77%.

2). The company stands to benefit from the extension of wind Production Tax Credit, which was part of the fiscal cliff package.

3). The stock is trading at a discount to its book value of $8.89 per share. Any dip in share price is a buy signal for holding the stock for long term gain.

Forecasts are supposed to be based on solid facts and figures researched and studied by analysts before making them. Should you invest or trade believing them? Read on.

In an article published in the Wall Street Journal, the writer says, “What goes unsaid, however, is that these positive surprises are becoming so common they are nearly universal. They are predetermined in a cynical tango-clinch between companies and the analysts who cover them. And there is no reliable evidence that the stock market as a whole will earn higher returns after periods with more positive surprises.”

Surprises or missing forecasts are nothing to get excited about. They will keep coming at you every earnings season. The same article goes on to say, “Even in the depths of the financial crisis, from the third quarter of 2008 through the first quarter of 2009, between 59% and 66% of companies beat expectations”.

My humble suggestion to readers, go back to fundamentals. Even more importantly, understand a company, understand its products, its markets, and its management, before buying into it.

The article Notable Earnings Misses and Their Relevance originally appeared on Fool.com and is written by Sujata Dutta.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.