When a company is growing as quickly as 3D Systems Corporation (NYSE:DDD), in an industry with tremendous promise, it can be difficult to gauge the importance of earnings. Do you ignore profit while the company builds sales? And if the quality of those earnings is difficult to assess because of recent acquisitions, should you just focus on the company’s valuation versus its peers?

The short answer is that earnings always count, and even in situations where the herd is snapping up shares largely for future potential, understanding a corporation’s current profit or loss can arm you with the confidence to either to jump in or pass on the opportunity. Moreover, it can illuminate which aspects of earnings will be important in the future.

A considerable GAAP

Like many other companies, 3D Systems Corporation (NYSE:DDD) includes non-GAAP earnings and metrics in its earnings releases and SEC filings. GAAP is an acronym for “generally accepted accounting principles,” and publicly traded companies are required to file their financial statements under these guidelines, which seek to ensure that the economic reality of a company is reflected across its financial statements. Corporations are allowed to provide alternative numbers alongside GAAP earnings. According to its most recent SEC filing, 3D Systems asserts that it uses non-GAAP earnings to help investors better understand the impact that numerous acquisitions have had on the company’s results.

In the first six months of 2013, 3D Systems Corporation (NYSE:DDD)’ non-GAAP, or “adjusted,” earnings were roughly 2.5 times greater than GAAP earnings ($0.40 per share and $0.16 per share, respectively). This is an increase over 2012, when non-GAAP earnings were 1.75 times higher than GAAP earnings in the first six months.

How does management arrive at these adjusted numbers? The most prominent item the company strips out on a consistent basis is amortization of intangibles. In the first half of 2013, adding back amortization improved earnings by nearly 40%.management understandably wants to remove amortization to arrive at what it believes to be a more representative portrayal of earnings. After all, it’s a non-cash number — a way to assign expense to intangible items. Does the expensing of items like patents and licenses really have any bearing on the day-to-day operations of the company?

In 3D Systems Corporation (NYSE:DDD)’ case, amortization has everything to do with earnings, and you should read management’s non-GAAP presentations, but not rely on them as the primary view of results. The reason stems from the path the company has taken to grow. If you follow 3D Systems Corporation (NYSE:DDD), you’re probably aware that it’s a serial acquirer of other companies. After sleepily plodding along for most of the 2000s, it began buying up smaller 3-D companies in 2010, and since then, it’s been in a royal hurry to acquire revenue and stay ahead of rivals such as Stratasys, Ltd. (NASDAQ:SSYS). Since 2010, the company has generated $125.3 million in operating cash, yet it has raised almost $590 million through stock and debt issuances, and it’s used up $381.7 million of that cash to fund acquisitions.

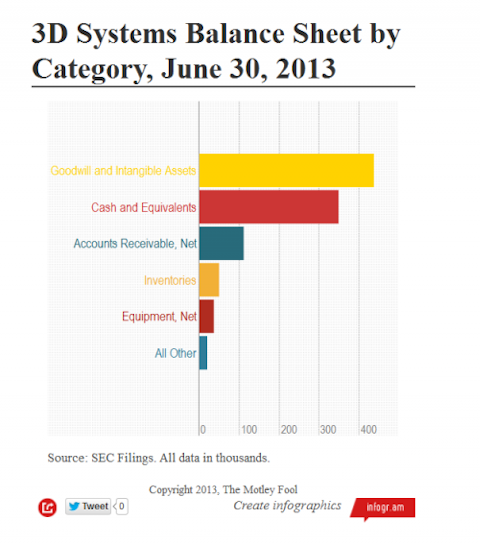

As a result, goodwill and other intangibles are now the largest assets 3D Systems Corporation (NYSE:DDD) owns. The following table and chart give us a sense of the proportion of these assets to tangible assets:

| Balance Sheet Category | Size in Dollars |

|---|---|

| Goodwill and Intangible Assets | $437,567 |

| Cash and Equivalents | $349,255 |

| Accounts Receivable, Net | $111,459 |

| Inventories | $49,771 |

| Equipment, Net | $36,466 |

| All Other | $19,847 |

| Total | $1,004,365 |

Source: company SEC filings. All dollar figures in thousands.

3D Systems Balance Sheet by Category, June 30, 2013 | Infographics

In the case of 3D Systems, which, after raising more than half a billion dollars in cash, has only $36.5 million of property and equipment on its balance sheet, you need to have some measure to gauge how successfully the company is making use of its intangible assets. Amortization sets a reasonable bar to help the average investor determine whether management is effectively employing the patents, licenses, technology, software and trade names of the companies it buys. Is enough income being generated to offset the decay of the intangible assets that drive the earnings power?Here’s a case in point: In its SEC filings, 3D Systems discloses that it has spent $89.6 million cumulatively on the acquisition of customer lists. Accounting for the portion that has already been amortized, that’s still $77.6 million, or nearly 8% of the entire asset base, that’s been attributed to customer acquisition. As a shareholder, you want to follow the amortization of this asset, and you want to see net income on the books even after the amortization is taken into account. In this way you’ll be comfortable that 3D Systems Corporation (NYSE:DDD) is using its customer lists in an efficient and profitable manner. In a global sense, because of the amortization of intangibles, 3D Systems has a much higher cost of sales (both operational and general/administrative) than one might realize from just looking at non-GAAP earnings.

Goodwill: not amortized, but significant

Goodwill presents a slightly different situation. In financial reporting, goodwill is a balance sheet account. When a corporation acquires another company for more than book value, it records the excess in this account. Companies are no longer required to amortize goodwill; rather, they test goodwill each year for “impairment.” Expense is recognized only if management determines that the value of the goodwill has declined.

For 3D Systems, which has grown primarily through acquisition and has a proportionately large goodwill account, reviewing GAAP earnings can help an investor discern whether the company is generating reasonable income from the acquired assets. While there is no recurring amortization bar as with intangible assets, prolonged GAAP losses are a potential flag that a company has overpaid for its acquisitions.

Earnings going forward

So far, 3D Systems Corporation (NYSE:DDD) has credibly delivered earnings on a GAAP basis: It’s shown a profit in each of the past three fiscal years since beginning its acquisition spree. Going forward, look for differences between unadjusted net income and non-GAAP earnings to decrease over time, as organic revenues replace acquired revenues, and net intangible assets decrease because of amortization. Increasing GAAP income will be a decent indicator of 3D Systems’ progress. But decreasing GAAP income in the future will serve as a cautionary flag — a reason to peel back the onion when reading through the company’s quarterly earnings, and reach comfort (or not) with the stock price, given the company’s typically high valuation.

The article The Key to 3D Systems’ Future Earnings originally appeared on Fool.com and is written by Asit Sharma.

Fool contributor Asit Sharma has no position in any stocks mentioned. The Motley Fool recommends and owns shares of 3D Systems and Stratasys and has options on 3D Systems.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.