This week CapitalCube analyzes Sprint Nextel Corporation (NYSE:S). Much smaller than other major telecommunications carriers like AT&T Inc. (NYSE:T) and Verizon Communications Inc. (NYSE:VZ), Sprint Nextel Corporation (NYSE:S) is now providing access to its network to low-cost wireless provider FreedomPop. With a 2GB plan at under $20 a month, FreedomPop offers access to both Clearwire Corporation (NASDAQ:CLWR) and Sprint Nextel Corporation (NYSE:S) networks via wi-fi and could pose a challenge to big carriers like AT&T Inc.

Our fundamental analysis of Sprint Nextel Corporation (NYSE:S) is peer-based. We compare S to its global peers: AT&T Inc. (NYSE:T), Verizon Communications Inc. (NYSE:VZ), Deutsche Telekom AG (PINK:DTEGY), MetroPCS Communications Inc (NYSE:PCS), United States Cellular Corporation (NYSE:USM), and Clearwire Corporation (NASDAQ:CLWR). We also score Sprint Nextel Corporation (NYSE:S) relative to this peer set. For more on CapitalCube’s scoring system click here.

Relative Valuation

Valuation Drivers

Operations Diagnostic

Earnings Leverage

Sustainability of Returns

Drivers of Margin

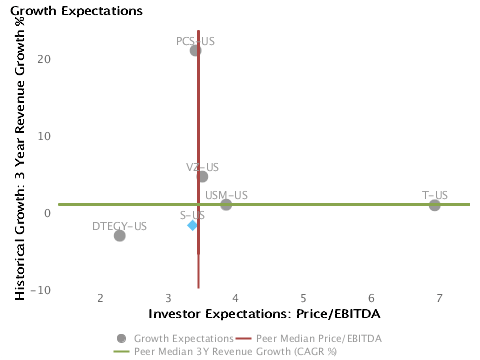

Growth Expectations

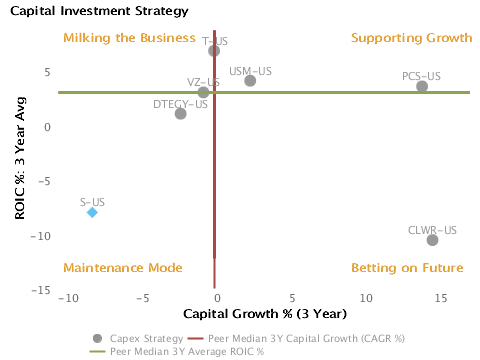

Capital Investment Strategy

Leverage & Liquidity

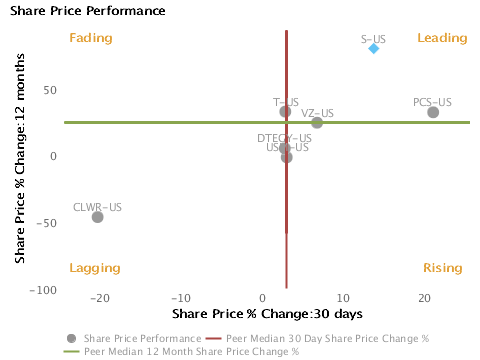

Share Price Performance

Relative outperformance over the last year and the last month suggest a leading position.

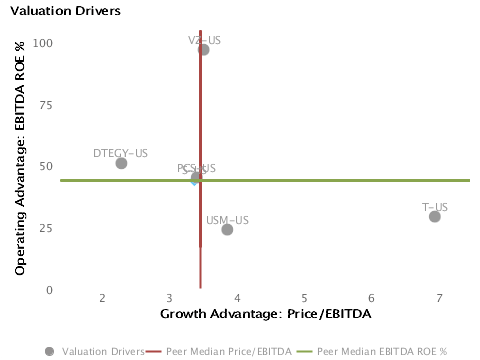

Drivers of Valuation: Operations or Expectations?

Valuation (P/B) = Operating Advantage (ROE) * Growth Expectations (P/E)

The market expects S-US to maintain the median rates of return it generates currently.

Operations Diagnostic

S-US has relatively low net profit margins while its asset efficiency is relatively high.

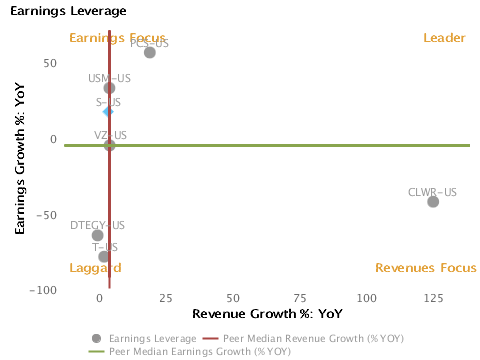

Earnings Leverage

S-US has achieved relatively better changes in earnings than in revenues.

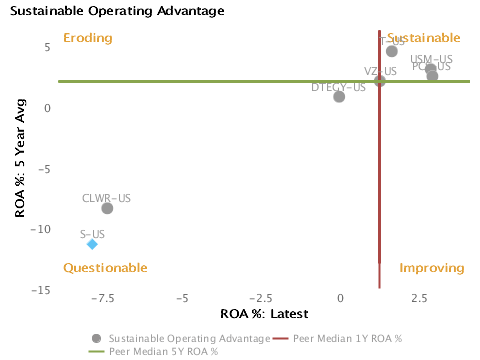

Sustainability of Returns

S-US’s relative returns suggest that the company has operating challenges.

Drivers of Margin

Relatively low margins suggest a non-differentiated product portfolio and not much control on operating costs. S-US has maintained its Commodity/High Cost profile from the recent year-end.

Growth Expectations

The market seems to see the company as a long-term strategic bet.

Capital Investment Strategy

S-US seems to be in maintenance mode.

Leverage & Liquidity

S-US would seem to have a hard time raising additional debt. S-US has maintained its Limited Flexibility profile from the recent year-end. Log-infor detailed report.

Log-infor detailed report.

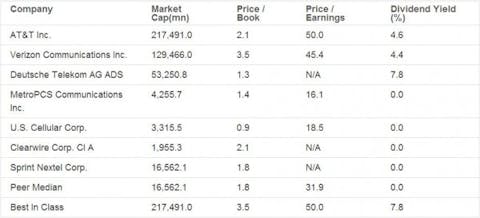

Key Valuation Items

Detailed tables on Revenues & Margins, Key Assets (% of Revenues), Key Working Capital Items, Cash Management Indicators, Key Liquidity Items, Key Cash Flow Items (% of Revenues) are available on logging in.