Hedge fund managers like David Einhorn, Dan Loeb, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: Silicon Motion Technology Corp. (ADR) (NASDAQ:SIMO).

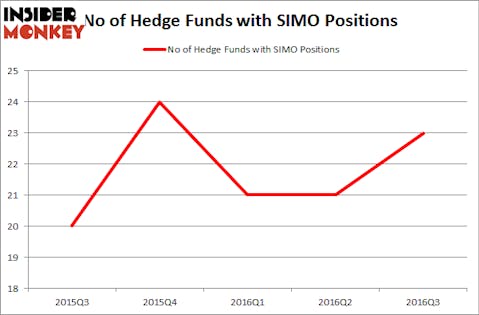

Silicon Motion Technology Corp. (ADR) (NASDAQ:SIMO) has seen an increase in support from the world’s most elite money managers recently. The stock was held in the portfolios of 23 of the hedge funds tracked by Insider Monkey on September 30, up from 21 a quarter earlier. At the end of this article we will also compare SIMO to other stocks including WD-40 Company (NASDAQ:WDFC), IAMGOLD Corporation (USA) (NYSE:IAG), and Trustmark Corp (NASDAQ:TRMK) to get a better sense of its popularity.

Follow Silicon Motion Technology Corp (NASDAQ:SIMO)

Follow Silicon Motion Technology Corp (NASDAQ:SIMO)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Dragon Images/Shutterstock.com

Hedge fund activity in Silicon Motion Technology Corp. (ADR) (NASDAQ:SIMO)

At Q3’s end, a total of 23 of the hedge funds tracked by Insider Monkey were bullish on this stock, up by 10% from one quarter earlier. Hedge fund ownership has been volatile over the last year, though within a narrow range. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of notable hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Ken Griffin’s Citadel Investment Group has the most valuable position in Silicon Motion Technology Corp. (ADR) (NASDAQ:SIMO), worth close to $63.7 million. Coming in second is Cardinal Capital, managed by Amy Minella, which holds a $38.5 million position; the fund has 1.8% of its 13F portfolio invested in the stock. Other peers with similar optimism contain Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Principal Global Investors’ Columbus Circle Investors, and Israel Englander’s Millennium Management.

Consequently, key hedge funds have jumped into Silicon Motion Technology Corp. (ADR) (NASDAQ:SIMO) headfirst. Millennium Management initiated the most valuable position in Silicon Motion Technology Corp. (ADR) (NASDAQ:SIMO). According to regulatory filings, the fund had $24.1 million invested in the company at the end of the quarter. Jim Simons’ Renaissance Technologies also initiated a $5.3 million position during the quarter. The following funds were also among the new SIMO investors: David Costen Haley’s HBK Investments and Ken Hahn’s Quentec Asset Management.

Let’s also examine hedge fund activity in other stocks similar to Silicon Motion Technology Corp. (ADR) (NASDAQ:SIMO). We will take a look at WD-40 Company (NASDAQ:WDFC), IAMGOLD Corporation (USA) (NYSE:IAG), Trustmark Corp (NASDAQ:TRMK), and Intra-Cellular Therapies Inc (NASDAQ:ITCI). This group of stocks’ market caps are similar to SIMO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WDFC | 9 | 74012 | 3 |

| IAG | 17 | 154807 | 7 |

| TRMK | 7 | 33540 | -1 |

| ITCI | 19 | 74738 | -6 |

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $84 million. That figure was $254 million in SIMO’s case. Intra-Cellular Therapies Inc (NASDAQ:ITCI) is the most popular stock in this table. On the other hand Trustmark Corp (NASDAQ:TRMK) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Silicon Motion Technology Corp. (ADR) (NASDAQ:SIMO) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None