A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on Regal Beloit Corp (NYSE:RBC).

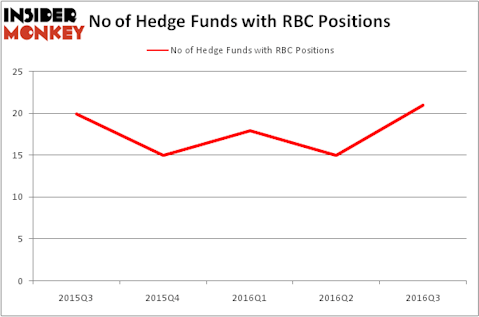

Regal Beloit Corp (NYSE:RBC) investors should pay attention to an increase in hedge fund interest recently. RBC was in 21 hedge funds’ portfolios at the end of September. There were 15 hedge funds in our database with RBC holdings at the end of the previous quarter. At the end of this article we will also compare RBC to other stocks including Companhia Paranaense de Energia (ADR) (NYSE:ELP), Kite Pharma Inc (NASDAQ:KITE), and Cree, Inc. (NASDAQ:CREE) to get a better sense of its popularity.

Follow Regal Rexnord Corp (NYSE:RRX)

Follow Regal Rexnord Corp (NYSE:RRX)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

chungking/Shutterstock.com

How have hedgies been trading Regal Beloit Corp (NYSE:RBC)?

At the end of the third quarter, a total of 21 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 40% jump from one quarter earlier, pushing hedge fund ownership to a yearly high. With the smart money’s sentiment swirling, there exists a select group of notable hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Adage Capital Management, managed by Phill Gross and Robert Atchinson, holds the number one position in Regal Beloit Corp (NYSE:RBC). Adage Capital Management has a $35.7 million position in the stock. On Adage Capital Management’s heels is Fisher Asset Management, managed by Ken Fisher, which holds a $34.7 million position. Other members of the smart money with similar optimism include Cliff Asness’ AQR Capital Management, D E Shaw, and Glenn Russell Dubin’s Highbridge Capital Management.

As one would reasonably expect, specific money managers were leading the bulls’ herd. Millennium Management, managed by Israel Englander, initiated the biggest position in Regal Beloit Corp (NYSE:RBC). Millennium Management had $5 million invested in the company at the end of the quarter. Mark Coe’s Coe Capital Management also initiated a $1.7 million position during the quarter. The following funds were also among the new RBC investors: Matthew Tewksbury’s Stevens Capital Management, Joshua Packwood and Schuster Tanger’s Radix Partners, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Regal Beloit Corp (NYSE:RBC) but similarly valued. These stocks are Companhia Paranaense de Energia (ADR) (NYSE:ELP), Kite Pharma Inc (NASDAQ:KITE), Cree, Inc. (NASDAQ:CREE), and Darling International Inc. (NYSE:DAR). This group of stocks’ market valuations are closest to RBC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ELP | 10 | 24205 | 0 |

| KITE | 27 | 293694 | 8 |

| CREE | 12 | 45363 | 1 |

| DAR | 24 | 291374 | -6 |

As you can see these stocks had an average of 18.25 hedge funds with bullish positions and the average amount invested in these stocks was $164 million. That figure was $159 million in RBC’s case. Kite Pharma Inc (NASDAQ:KITE) is the most popular stock in this table. On the other hand Companhia Paranaense de Energia (ADR) (NYSE:ELP) is the least popular one with only 10 bullish hedge fund positions. Regal Beloit Corp (NYSE:RBC) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard KITE might be a better candidate to consider a long position in.

Disclosure: None