The successful funds run by legendary investors such as Dan Loeb and David Tepper make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentive to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at MGP Ingredients Inc (NASDAQ:MGPI) from the perspective of those successful funds.

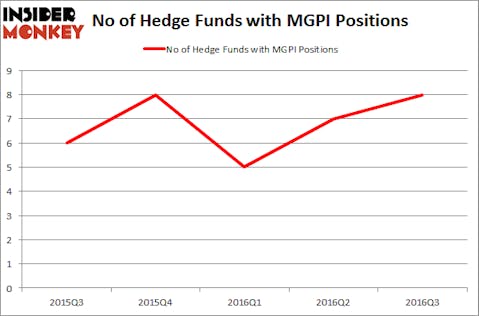

MGP Ingredients Inc (NASDAQ:MGPI) investors should be aware of an increase in hedge fund sentiment lately. MGPI was in 8 hedge funds’ portfolios at the end of September. There were 7 hedge funds in our database with MGPI holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Echo Global Logistics, Inc. (NASDAQ:ECHO), CommerceHub Inc (NASDAQ:CHUBA), and Heron Therapeutics Inc (NASDAQ:HRTX) to gather more data points.

Follow Mgp Ingredients Inc (NASDAQ:MGPI)

Follow Mgp Ingredients Inc (NASDAQ:MGPI)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Igor Normann/Shutterstock.com

Now, let’s take a look at the fresh action surrounding MGP Ingredients Inc (NASDAQ:MGPI).

How have hedgies been trading MGP Ingredients Inc (NASDAQ:MGPI)?

Heading into the fourth quarter of 2016, a total of 8 of the hedge funds tracked by Insider Monkey were bullish on this stock, up 14% from one quarter earlier. On the other hand, there were a total of 8 hedge funds with a bullish position in MGPI at the beginning of this year. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Amy Minella’s Cardinal Capital has the largest position in MGP Ingredients Inc (NASDAQ:MGPI), worth close to $32.4 million, corresponding to 1.5% of its total 13F portfolio. Sitting at the No. 2 spot is Mark Broach of Manatuck Hill Partners, with a $8.5 million position; the fund has 3.4% of its 13F portfolio invested in the stock. Remaining members of the smart money that are bullish include Richard Driehaus’s Driehaus Capital, Cliff Asness’s AQR Capital Management and Dmitry Balyasny’s Balyasny Asset Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now, specific money managers have jumped into MGP Ingredients Inc (NASDAQ:MGPI) headfirst. Cardinal Capital, led by Amy Minella, established the most outsized position in MGP Ingredients Inc (NASDAQ:MGPI), followed by Dmitry Balyasny’s Balyasny Asset Management, which initiated a $2 million position during the quarter. The other funds with brand new MGPI positions are Ed Bosek’s BeaconLight Capital, Charles Paquelet’s Skylands Capital, and Ken Griffin’s Citadel Investment Group.

Let’s now take a look at hedge fund activity in other stocks similar to MGP Ingredients Inc (NASDAQ:MGPI). We will take a look at Echo Global Logistics, Inc. (NASDAQ:ECHO), CommerceHub Inc (NASDAQ:CHUBA), Heron Therapeutics Inc (NASDAQ:HRTX), and Rent-A-Center Inc (NASDAQ:RCII). This group of stocks’ market valuations are similar to MGPI’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ECHO | 9 | 38125 | -1 |

| CHUBA | 18 | 39195 | 18 |

| HRTX | 12 | 379923 | 2 |

| RCII | 18 | 73846 | -1 |

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $133 million. That figure was $53 million in MGPI’s case. CommerceHub Inc (NASDAQ:CHUBA) is the most popular stock in this table. On the other hand Echo Global Logistics, Inc. (NASDAQ:ECHO) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks MGP Ingredients Inc (NASDAQ:MGPI) is even less popular than ECHO. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None