A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on MasTec, Inc. (NYSE:MTZ).

MasTec, Inc. (NYSE:MTZ) shares haven’t seen a lot of action during the fourth quarter. Overall, hedge fund sentiment was unchanged. The stock was in 23 hedge funds’ portfolios at the end of September. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Vishay Intertechnology (NYSE:VSH), Intersil Corp (NASDAQ:ISIL), and Penumbra Inc (NYSE:PEN) to gather more data points.

Follow Mastec Inc (NYSE:MTZ)

Follow Mastec Inc (NYSE:MTZ)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

With all of this in mind, let’s analyze the new action regarding MasTec, Inc. (NYSE:MTZ).

What have hedge funds been doing with MasTec, Inc. (NYSE:MTZ)?

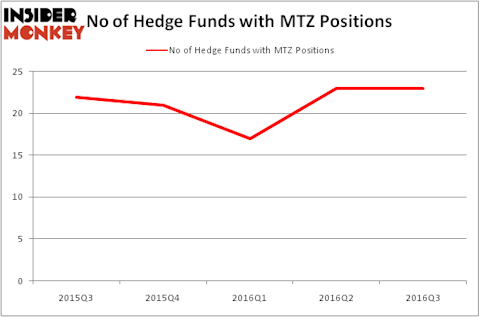

At the end of the third quarter, a total of 23 of the hedge funds tracked by Insider Monkey held long positions in this stock, unchanged from the second quarter of 2016. With hedgies’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Peconic Partners LLC, managed by William Harnisch, holds the most valuable position in MasTec, Inc. (NYSE:MTZ). According to its latest 13F filing, the fund has a $144.3 million position in the stock, comprising 18.3% of its 13F portfolio. The second largest stake is held by Mariko Gordon of Daruma Asset Management, with a $56.8 million position; the fund has 3.5% of its 13F portfolio invested in the stock. Remaining peers that are bullish include Eric F. Billings’s Billings Capital Management, Chuck Royce’s Royce & Associates and Israel Englander’s Millennium Management.

Because MasTec, Inc. (NYSE:MTZ) has witnessed unchanged sentiment from the aggregate hedge fund industry, we ought to look at a sect of funds that decided to sell off their entire stakes last quarter. At the top of the heap, Neil Chriss’s Hutchin Hill Capital sold off the largest stake of the “upper crust” of funds watched by Insider Monkey, worth an estimated $22.4 million in stock, and Doug Gordon, Jon Hilsabeck and Don Jabro’s Shellback Capital was right behind this move, as the fund dumped about $8.6 million worth of MTZ shares. These bearish behaviors are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks similar to MasTec, Inc. (NYSE:MTZ). We will take a look at Vishay Intertechnology (NYSE:VSH), Intersil Corp (NASDAQ:ISIL), Penumbra Inc (NYSE:PEN), and Office Depot Inc (NYSE:ODP). All of these stocks’ market caps are similar to MTZ’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VSH | 17 | 272131 | 3 |

| ISIL | 30 | 318563 | 16 |

| PEN | 17 | 158341 | 4 |

| ODP | 34 | 284342 | -13 |

As you can see these stocks had an average of 25 hedge funds with bullish positions and the average amount invested in these stocks was $258 million. That figure was $294 million in MTZ’s case. Office Depot Inc (NYSE:ODP) is the most popular stock in this table. On the other hand Vishay Intertechnology (NYSE:VSH) and Penumbra Inc (NYSE:PEN) are the least popular ones with only 17 bullish hedge fund positions each. MasTec, Inc. (NYSE:MTZ) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ODP might be a better candidate to consider a long position.

Disclosure: none.